-

Purchases of new single-family homes increased 1% to a 708,000 annualized pace following an upwardly revised 701,000 in June, government data showed Tuesday.

August 24 -

The company is divesting itself of another piece of Xome after previously peddling Title365 to Blend Labs.

August 23 -

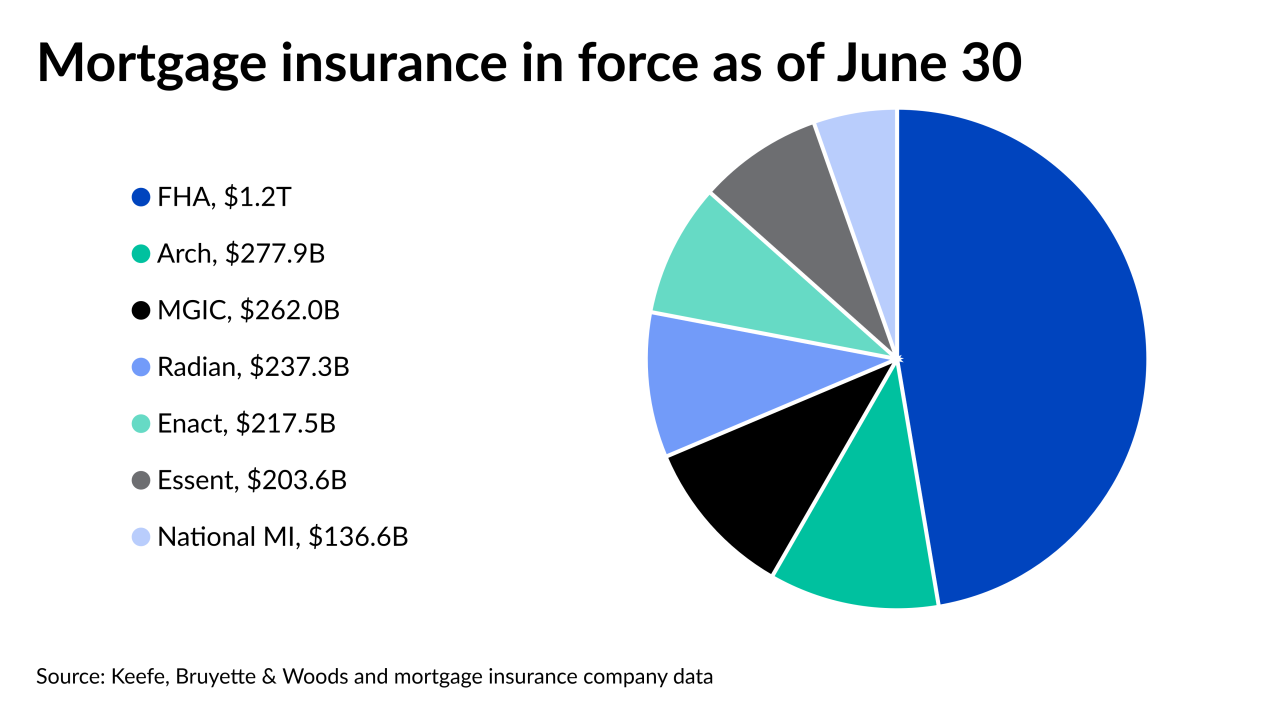

However, the pace of growth at the six active underwriters should moderate over the next two years, Keefe, Bruyette & Woods said.

August 23 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

Meanwhile, investors await word from the central bank regarding monetary policy, as limited housing supply continues to drive prices upward.

August 19 -

Lower rates and higher home prices will boost dollar volume although few home sales will cut into purchase volume growth.

August 19 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18 -

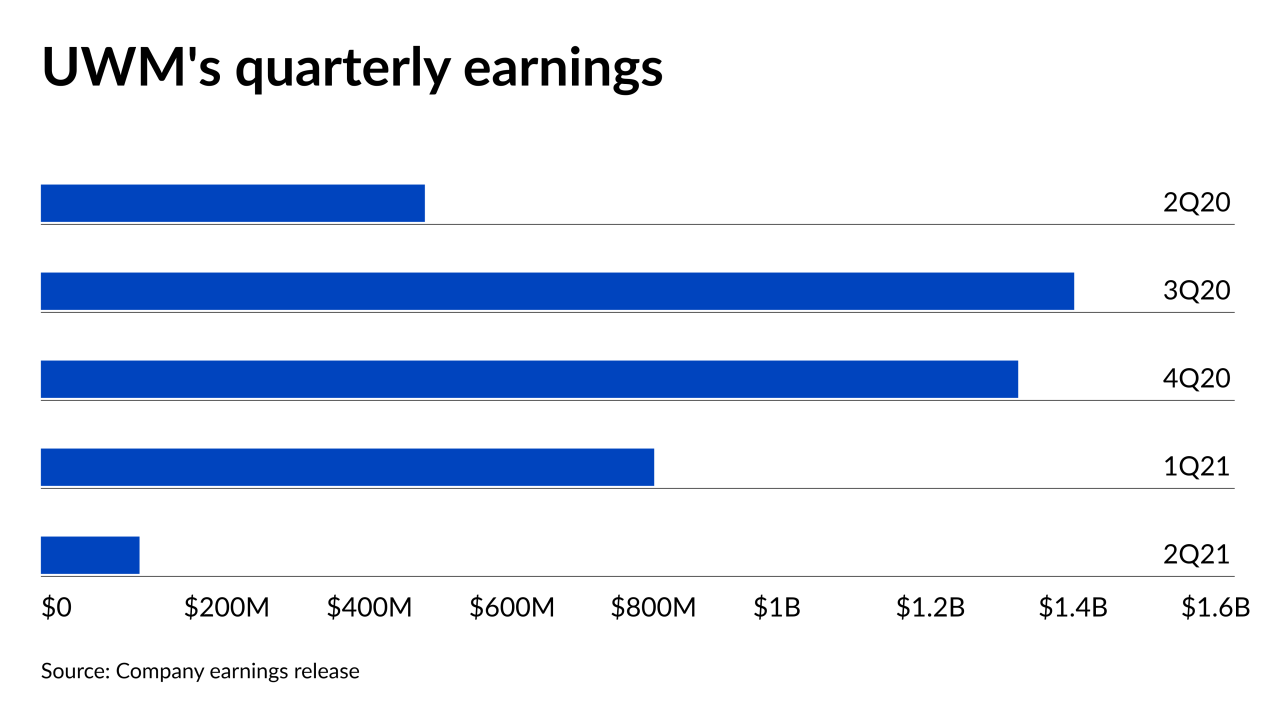

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

The share of home sales that were competitive remained above year-ago levels in July, but only by a few percentage points.

August 16 -

Depressed margins and a $219 million hit to its servicing rights fair value translated to a lower bottom line at the wholesaler.

August 16 -

Also: Rocket announces expansion and Ginnie Mae extends comment period on nonbank capital plan

August 13 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

But median prices still rose 17% year-over-year, the company found.

August 13 -

Second quarter open orders were 37% higher than one year prior, while closed orders grew by 43%.

August 13 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

The Department of Housing and Urban Development and Federal Housing Finance Agency, which supervises Fannie Mae and Freddie Mac, formed a pact to share information and coordinate investigations of potential fair-lending violations.

August 12 -

The companies are investing more in government-insured equity withdrawal products for borrowers ages 62 and up, which offer higher returns.

August 12 -

Shrinking gain-on-sale margins also ate into earnings, with growth expected to slow for the rest of 2021.

August 12 -

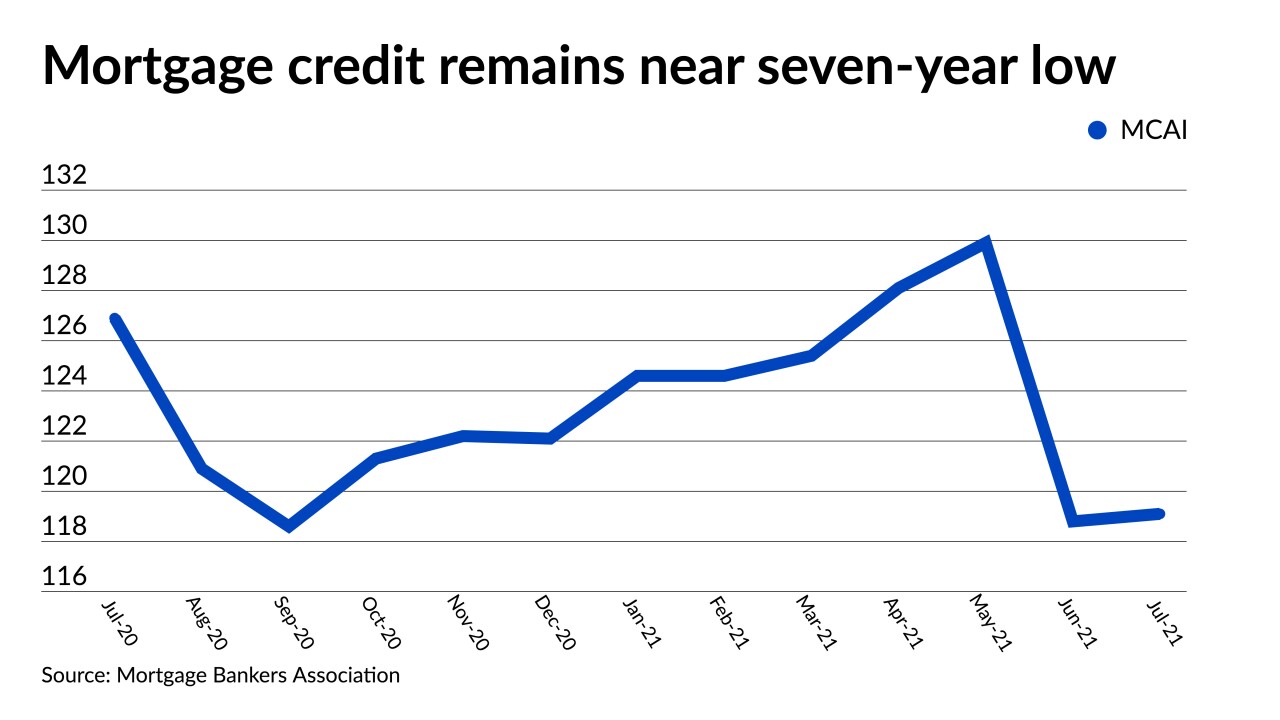

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

The average was up from 2.77% last week and the highest since July 15, Freddie Mac said Thursday.

August 12