Fannie Mae to include rent payments in underwriting

The rental history incorporation can only weigh positively in a consumer’s credit assessment, said Malloy Evans, executive vice president and head of single-family at Fannie Mae. If a prospective borrower has missed payments it would not be counted against them.

Read the

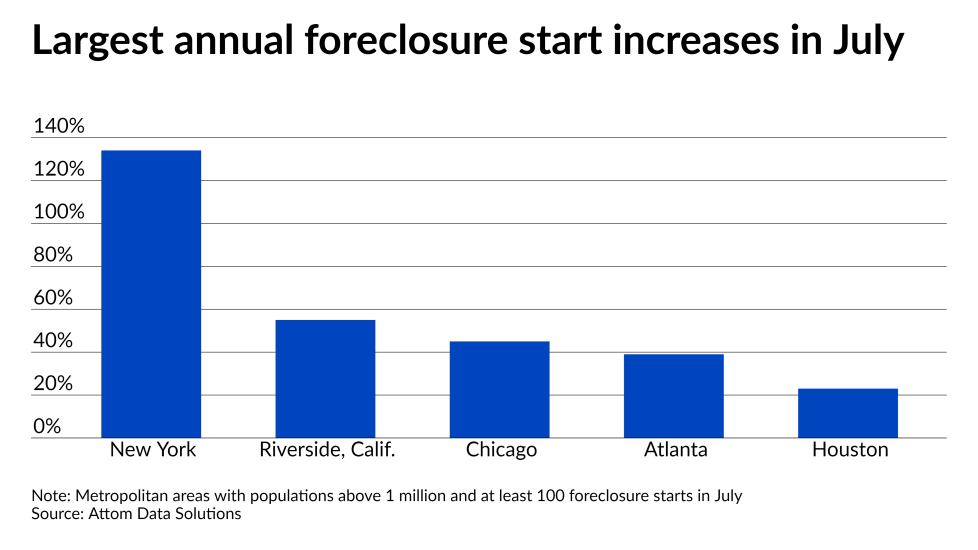

July foreclosures increase 40% year-over-year

Foreclosure filings accounted for 12,483 properties in July, down 4% from June but a 40% increase

While foreclosure proceedings will continue increasing with the government’s moratorium expired,

Read the

Waters calls for more FHA mortgage foreclosure protections

“Providing clear guidance to mortgage servicers and enhancing supervision and enforcement during this period is critical to ensure homeowners do not face unnecessary foreclosures during the month of August and before housing counseling funds and homeowner assistance funds provided through the American Rescue Plan Act have reached communities and households,” Waters wrote.

Read the

Judge rules Biden’s ban on evictions can remain in place

U.S. District Judge Dabney Friedrich rejected a plea to block a moratorium by the Centers for Disease Control and Prevention that was set to last until Oct. 3. The decision extends protections against eviction that expired July 31 and were in doubt after the Supreme Court indicated in June that only Congress could continue the policy.

Read the

Buyers and sellers have gloomy outlook on July housing market

The share of borrowers who thought July was a good time to buy a home dropped to a new all-time low of 28% from

Read the

Ginnie Mae extends comment period on nonbank capital plan

Ginnie, an arm of the Department of Housing and Urban Development, said late Thursday that it will extend the comment period by 60 days to Oct. 8 on its request for input. The guarantee agency had

Read the

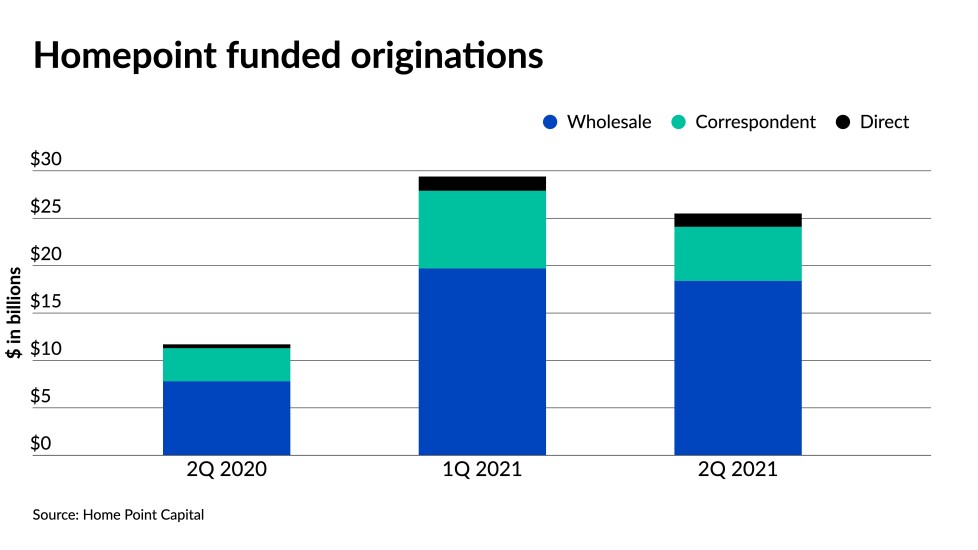

Home Point considers selloff of Ginnie Mae servicing rights

For the second quarter, Home Point Capital, parent company of mortgage lender and servicer Homepoint Financial, posted a net loss of $73.2 million, compared to net income of $149 million

“We entered the second quarter faced with an historic pricing dislocation in our primary origination channel — wholesale. Revenue had compressed to levels not seen in at least the past eight years,” Willie Newman, Home Point Capital’s CEO and president, said during the company’s earnings call on Tuesday.

Read the

CFPB servicing rule aims to prevent foreclosure crisis

Federally sponsored forbearance plans begin expiring in September after a temporary foreclosure moratorium ended July 31. Many analysts believe foreclosures will soon be inevitable for hundreds of thousands of borrowers who were delinquent as soon as the pandemic began last year.

A CFPB rule taking effect Aug. 31 enables lenders to process quick foreclosures for loans beyond repair, so they can focus on working with other borrowers and thereby mitigate cumulative foreclosures from COVID-19.

Read the

HUD to team with Fannie, Freddie regulator on fair housing oversight

Under the agreement the two agencies will share information and coordinate investigations and compliance reviews. HUD is primarily tasked with enforcing the Fair Housing Act, and the FHFA regulates the government-sponsored enterprises.

"FHFA oversees entities that have significant control over a large share of the mortgage market. Stepping up our collective fair housing oversight of their activities will make an enormous impact,” HUD Secretary Marcia Fudge said in a press release.

Read the

Redfin reports record rise in market share in Q2

The losses in the second quarter of this year were largely attributed to

Read the

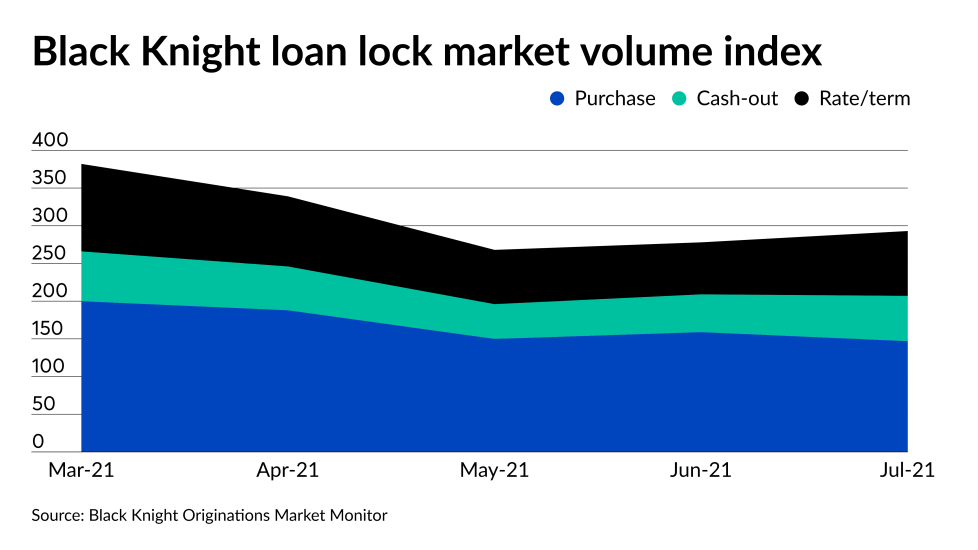

Low mortgage rates blunt shift to purchase market — for now

The 50/50 split was a change from the June Origination Market Monitor report's heavy weighting to purchase, with a 57% share versus 43% in refinances. And a separate report from ICE Mortgage Technology found that in June, for the first time in 18 months, more purchase loans were closed than refinances.

Read the

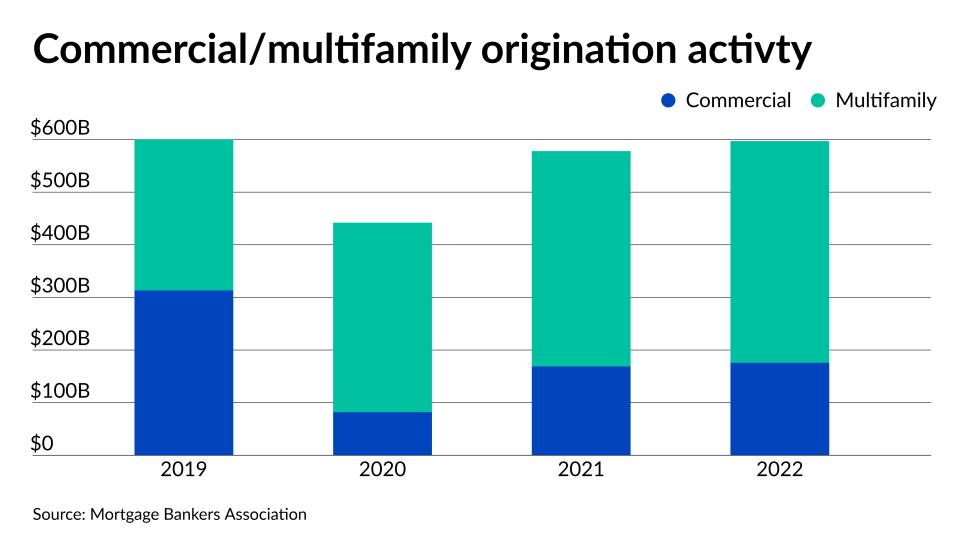

Multifamily originations expected to set a record in 2021

Multifamily originations are expected to increase to $409 billion, a 13% year-over-year increase and a new record, topping last year's $360 billion in multifamily volume. Mortgages secured by income producing properties to be originated this year are expected to increase to $578 billion, compared with $442 billion in pandemic-affected 2020.

Back

Read the

Guild Mortgage Q2 earnings show lower profits, shrinking margins

In the second quarter, the parent of

The company posted net revenue of $294.1 million, down 32.4% from $435.1 million in the second quarter last year, and $526.2 million last quarter.

Read the

What the CFPB’s servicing report says about COVID forbearance requests

“For private loans, the rates of delinquent loans for borrowers who never requested COVID-19 hardship forbearances during the pandemic were higher — exceeding 50% for some servicers,” the bureau’s report on pandemic response metrics said.

Borrowers with private loans don’t have the same right to long-term forbearance federally-backed loans have and if their mortgages are in securitizations, their options may be limited by loan pooling and servicing agreements governing those transactions.

Read the

Sagent, Figure team up to bring blockchain to mortgage servicing

"We're partnering with Figure to bring our deep mortgage servicing expertise together with their modern tech stack and their Provenance Blockchain to essentially create new technology,” said Sagent CEO and President Dan Sogorka.

As part of the deal, Figure's mortgage servicing portfolio will move onto

Read the

Rocket Cos. launches home buying and selling platform

The site will incorporate a property searching function, a network of real estate agents and partners across the country, credit reporting, by-owner sales listings and closing and settlement services

“There are very few organizations, if any, that have our reach,” Rocket Homes CEO Doug Seabolt said in an interview. “Buying or selling a home is stressful, it can be confusing and I honestly think it’s too complicated. We are always trying to eliminate that.”

Read the