-

Mortgage interest rates fell slightly for the second consecutive week, according to Freddie Mac.

February 16 -

Freddie Mac's net income increased to $4.8 billion in the fourth quarter, more than double what it earned a quarter earlier, the government-sponsored enterprise announced Thursday.

February 16 -

The Consumer Financial Protection Bureau is seeking feedback on the benefits and risks of using alternative data sources, such as rent or utility payments, that would allow lenders to build a credit history for unbanked consumers.

February 16 -

Wintrust Financial in Rosemont, Ill., has bought certain assets of American Homestead Mortgage in Montana.

February 16 -

Builders started work on more homes than forecast in January after an upward revision to starts in the prior month, a sign construction was on a steady path entering 2017.

February 16 -

Black Knight Financial Services has launched a new tool that identifies potential liabilities to reduce title insurers' claims.

February 15 -

Loan applications for new home purchases increased 9.2% year over year in January, according to the Mortgage Bankers Association.

February 15 -

Senate Banking Committee Chairman Mike Crapo said Wednesday that although he plans to begin working on housing finance reform and changes to the Dodd-Frank Act, the poor relationship between Democrats and Republicans will slow any progress.

February 15 -

Zeus Mortgage in Houston is positioning its new online crowdfunding platform as an alternative to traditional mortgages for property buyers and others having trouble borrowing to remodel homes or fund construction projects.

February 15 -

The refinance share of mortgage activity decreased to 46.9% of total applications, its lowest level since June 2009, from 47.9% the previous week.

February 15 -

American International Group posted its fourth loss in six quarters, burned again by higher-than-expected claims costs as Chief Executive Officer Peter Hancock struggles to sustain profitability.

February 14 -

Changes in the housing market are creating new opportunities and challenges for credit unions, including how they market themselves to potential borrowers.

February 14 -

Federal Reserve Chair Janet Yellen appeared Tuesday before an uncommonly collegial hearing of the Senate Banking Committee, but the lack of outward drama masked the fact that lawmakers from both parties were using her testimony to lay the groundwork for a broader battle over the future of regulatory reform.

February 14 -

Fairly or not, the millennial generation has a reputation as footloose and fancy-free. Or, to put it less kindly, slow to launch slower to get married, buy a house, and have kids than the young people of previous generations.

February 14 -

Federal Reserve Chair Janet Yellen said more interest-rate increases will be appropriate if the economy meets the central bank's outlook of gradually rising inflation and tightening labor markets.

February 14 -

While Arch Capital had a slight increase in year-over-year net income to $64 million, the total was affected by $25 million of costs related to the purchase of United Guaranty.

February 13 -

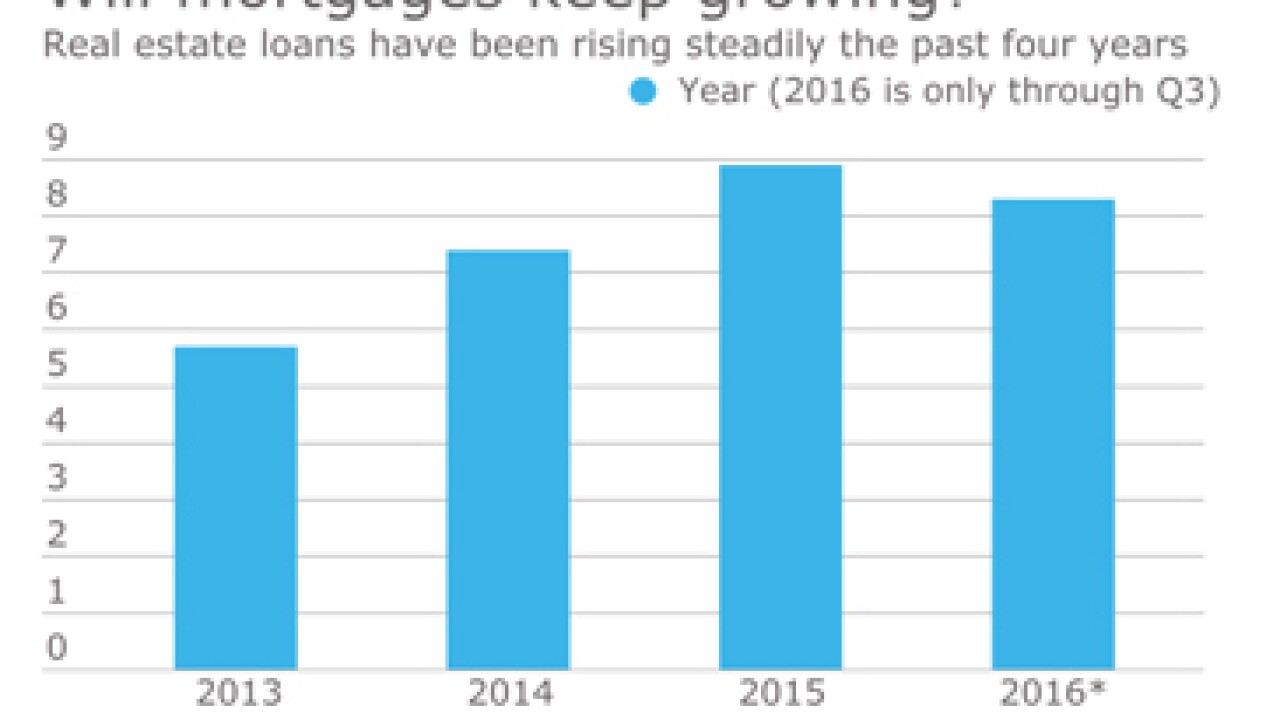

Real estate loans have been growing over the last few years despite a number of headwinds, but can credit unions build on that trend as interest rates rise?

February 13 -

JPMorgan Chase is known to eschew selling conforming mortgage loans to Fannie Mae and Freddie Mac, preferring to securitize them in the private-label market.

February 13 -

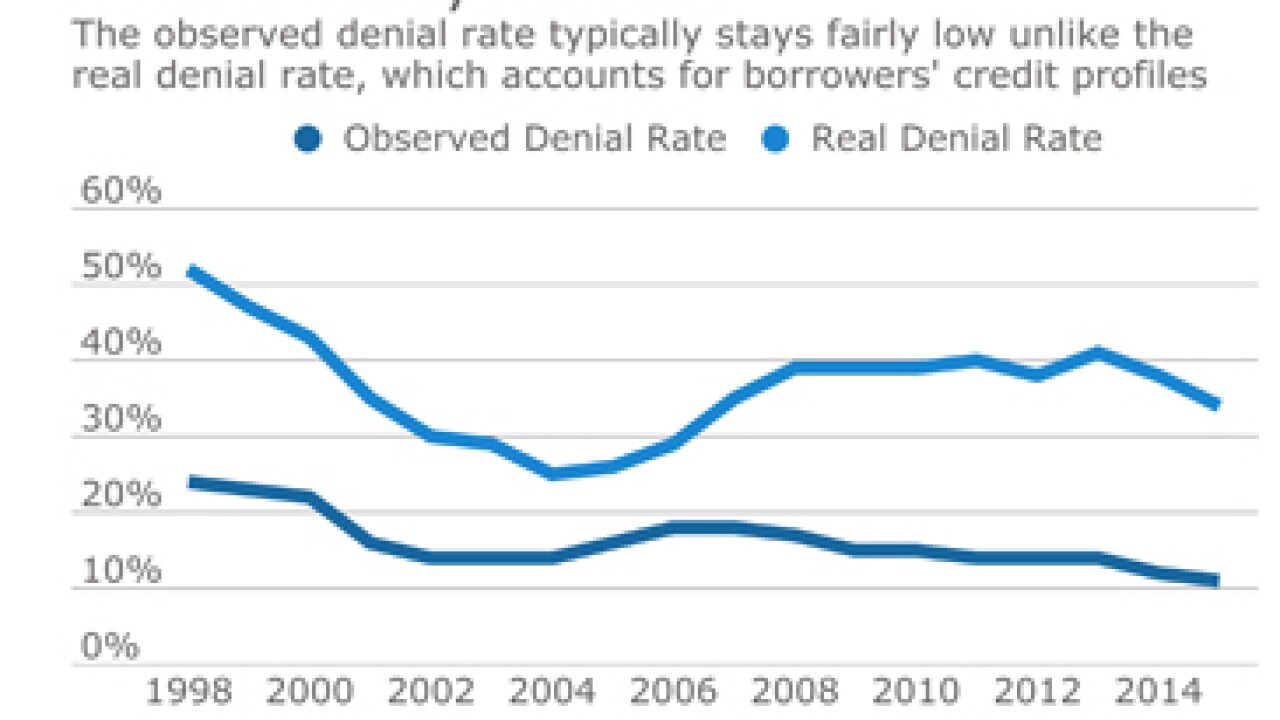

The denial rate traditionally used by the mortgage industry is hiding the fact that fewer borrowers with lower credit are applying for loans, according to the Urban Institute.

February 13 -

Mortgage lenders afraid to enter into any kind of marketing services agreement should look not to what the Consumer Financial Protection Bureau has laid as guidance, but what it has left unsaid.

February 13 Offit | Kurman

Offit | Kurman