-

The surge in mortgage rates since the November election is expected to offset the increase to lenders' short-term funding costs following the Federal Open Markets Committee's 25-basis-point increase to the federal funds rate.

December 14 -

The Federal Open Market Committee agreed unanimously Wednesday to raise the federal funds rate by 25 basis points, a move that was widely anticipated by markets. The committee's expectations for interest rates in 2017, however, were more varied.

December 14 -

Higher rates and lower consumer confidence are expected to put a damper on existing home sales in 2017, according to the National Association of Realtors.

December 14 -

The mortgage interest deduction has been a pillar of U.S. housing policy for more than a century, but Congress appears ready to consider significant changes to it that some industry players worry could effectively render it moot.

December 14 -

The inventory of starter homes is shrinking at an increasingly faster pace, leaving first-time homebuyers with fewer and more expensive options, according to Trulia.

December 14 -

Credit Suisse Group must face New York Attorney General Eric Schneiderman's $10 billion lawsuit accusing the bank of fraud in the sale of mortgage-backed securities prior to the 2008 financial crisis, a state appeals court ruled Tuesday in a split decision.

December 14 -

Mortgage application volume decreased 4% from one week earlier as interest rates on 30-year loans continued to rise, according to the Mortgage Bankers Association.

December 14 -

Interest rates may climb to 3% on 10-year Treasuries by next year as deficits and inflation rise under a Donald Trump presidency and that would hurt the housing market, said Jeffrey Gundlach, chief investment officer of DoubleLine Capital.

December 14 -

Southern National Bancorp of Virginia in McLean has agreed to buy Eastern Virginia Bankshares in Glen Allen.

December 14 -

It is going take some time before it comes to fruition, but the Federal Housing Finance Agency got the ball rolling Tuesday on pushing Fannie Mae and Freddie Mac to begin purchasing manufactured housing loans.

December 13 -

Stanford Kurland will step down from his role as CEO of PennyMac Financial Services and its affiliate PennyMac Mortgage Investment Trust and assume the role of executive chairman of both as part of a broader executive reorganization.

December 13 -

One step the government can take to strengthening housing is to create a unified office dedicated to housing finance and policy, streamlining and making more efficient existing agencies and programs.

December 13 The Collingwood Group

The Collingwood Group -

Of the five banks that failed their living will tests earlier this year and were forced to resubmit plans, only Wells Fargo failed again, resulting in immediate regulatory action that will restrict its growth, including its ability to expand internationally and buy nonbank subsidiaries.

December 13 -

Millennials are the most optimistic about the state of the U.S. real estate market, while most American express favorable opinions about housing, according to Berkshire Hathaway HomeServices.

December 13 -

The Federal Housing Finance Agency finalized a rule Tuesday that will create a "duty to serve" for Fannie Mae and Freddie Mac to help low- and moderate- income consumers, including encouraging a secondary market for manufactured housing loans.

December 13 -

Mortgage applications for new home purchases rose 12% year over year in November, according to the Mortgage Bankers Association.

December 13 -

SoFi Lending Corp.'s securitization of its student loan refis for high net worth individuals is now a model for its recent expansion into super prime jumbo mortgages.

December 13 -

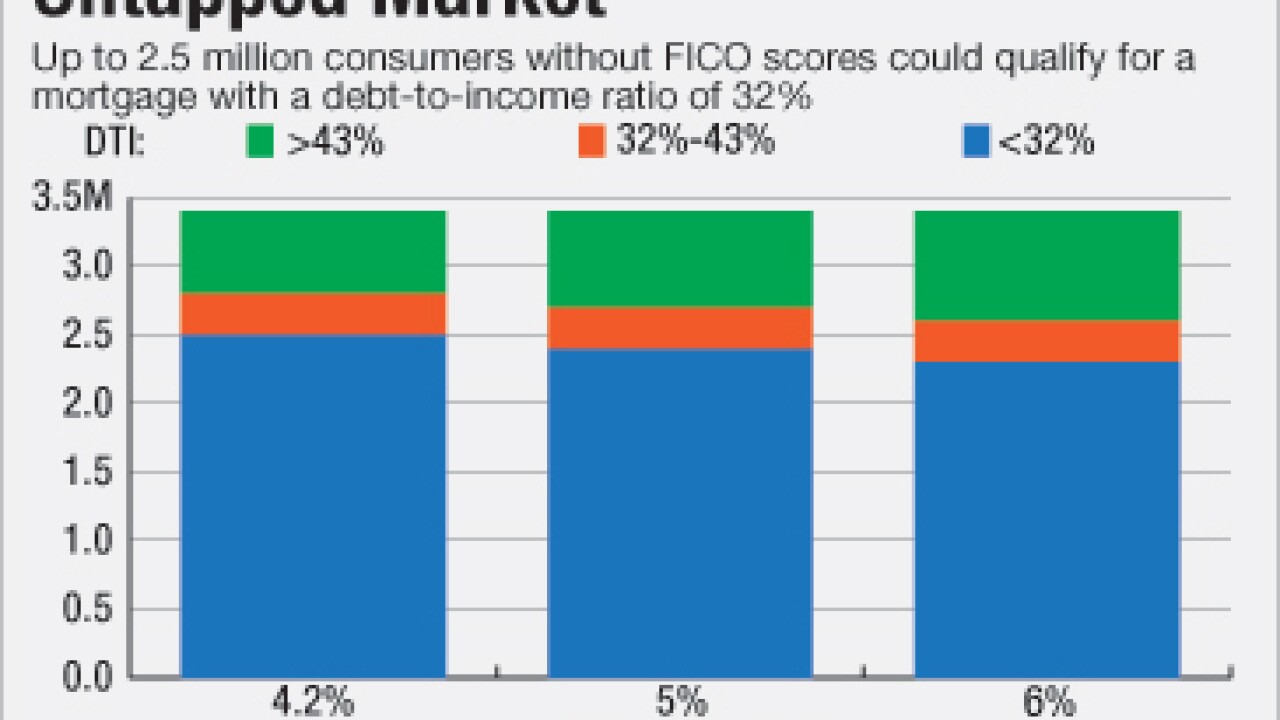

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Rising mortgage interest rates affect the volume of refinance and purchase originations, but don't necessarily spell bad news for home prices, explains Fannie Mae Chief Economist Doug Duncan.

December 12 -

Fairway Independent Mortgage Corp. is rolling out a new mobile application that allows consumers to apply for a loan, scan documents and get updates on their loan status through real-time push notifications.

December 12