-

National home prices grew monthly and annually in October, but considerably less than last year, according to S&P Dow Jones Indices.

December 30 -

The professionals can't originate loans in their local cities for various stretches, following a federal judge's ruling granting most of the lender's wishes.

December 30 -

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

December 29 -

The latest announcement comes two months after an initial round of staff reductions following approval of Rocket's acquisition of the company.

December 29 -

Here are the most-read stories from National Mortgage News over the past year.

December 29 -

This year it took a homebuyer seven years to save for a typical down payment on a house, compared with 12, according to Realtor.com.

December 29 -

Home prices rose 0.2% nationally month-over-month in November, but there were an estimated 37.2% more sellers than buyers in the market, Redfin said.

December 26 -

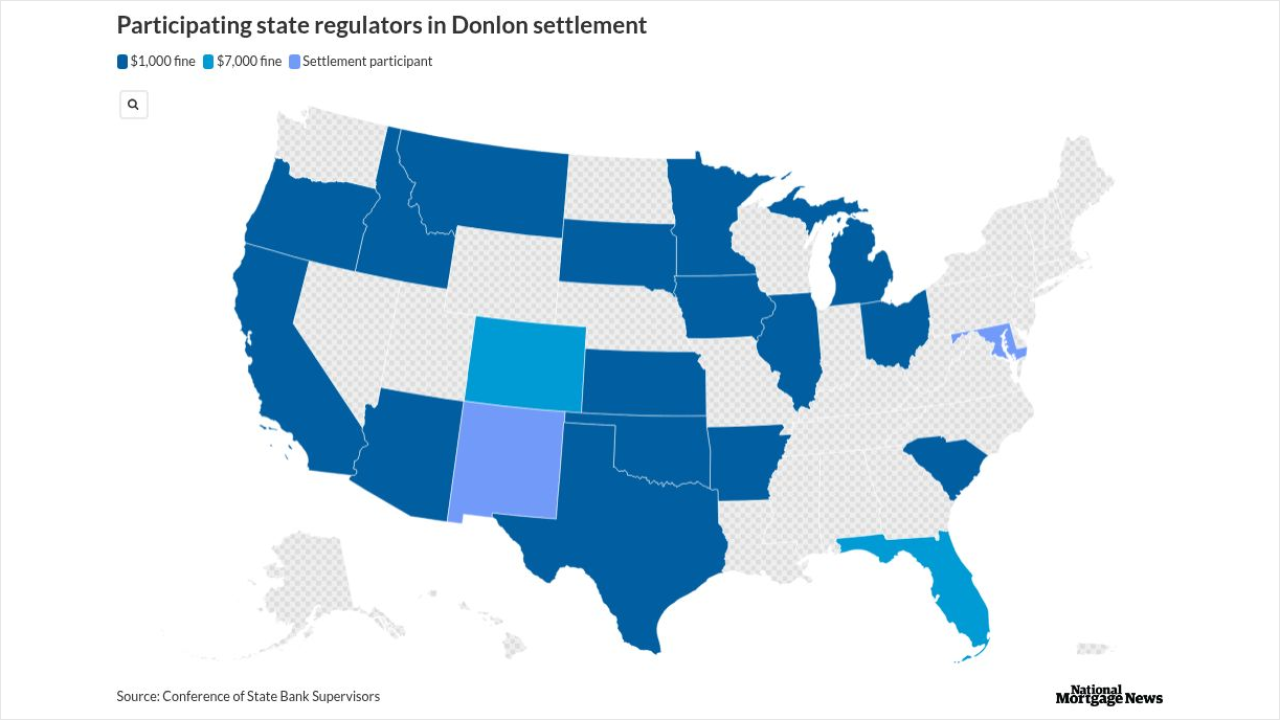

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

December 26 -

Mortgage lenders test crypto-backed mortgages as Fannie Mae and Freddie Mac review digital assets in underwriting, weighing risk, non-QM loans and access for nontraditional homebuyers.

December 26 -

The MBA's Market Composite Index, a measure of mortgage loan application volume, dropped 5% on a seasonally-adjusted basis and 6% on an unadjusted basis.

December 24 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

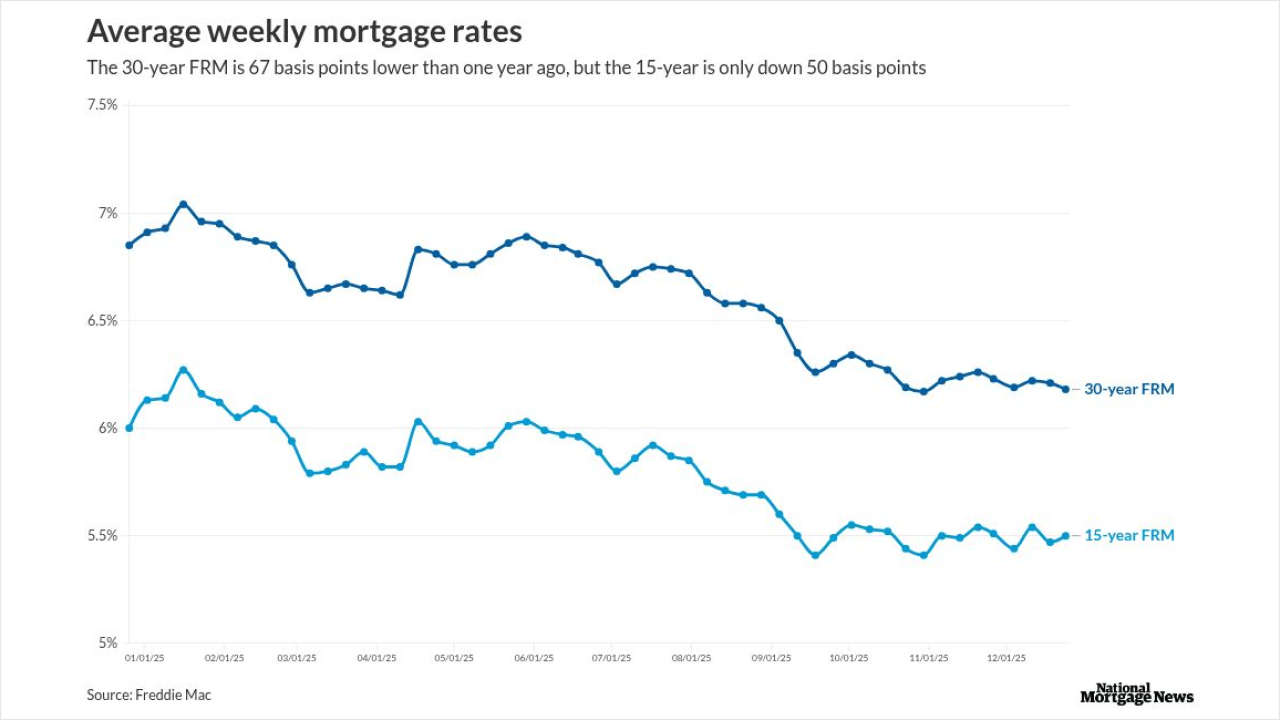

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

The regulator lowered benchmarks for acquisitions of certain single-family loans including low-income refinances, and left multifamily targets intact.

December 23 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

The inventory slowdown came as properties sold for 1.6% below asking prices, with some sellers opting to remove their listings altogether, according to Redfin.

December 22 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

Existing-home sales in the US barely rose in November, as a recent moderation in price growth and mortgage rates motivated buyers at the margin.

December 19 -

More than 80% of mortgage brokers expect business to grow in 2026, mainly through the strengthening of referral networks and the expansion of non-QM offerings.

December 19 -

While the 30-year average has hovered near the same level for weeks, the past year brought with it promising trends that may ease affordability in 2026.

December 18 -

Mortgage activity fell 3.8% from one week prior for the week ending Dec. 12, led by a 4% drop in refinance applications, the Mortgage Bankers Association said.

December 17