-

The trade group's letter to FHFA Director Bill Pulte pointed out that lenders were facing credit report price hikes for four straight years.

December 16 -

New-home purchase activity rose 3.1% year over year, but dropped 7% from October, the Mortgage Bankers Association said.

December 16 -

Remote work helped fuel migration and erased the loss of rural residents that occurred in the decade prior to the arrival of Covid, Harvard researchers found.

December 15 -

The threshold regards loans where the annual percentage rate is at least 1.5 percentage points higher than the average prime offer rate on first liens.

December 15 -

The partnership also includes a $50 million equity investment in Finance of America, securing long-term alignment between the companies.

December 15 -

The Department of Housing and Urban Development announced the FHA-insured loan caps for low- and high-cost areas, which are set based on conforming loan limits.

December 12 -

ETHZilla partnered with Zippy to bring manufactured home chattel loans on-chain as tokenized real-world assets.

December 11 -

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

The lowest-priced properties purchased by investors typically left them in the red when sold, according to the latest home flipping report from Attom.

December 11 -

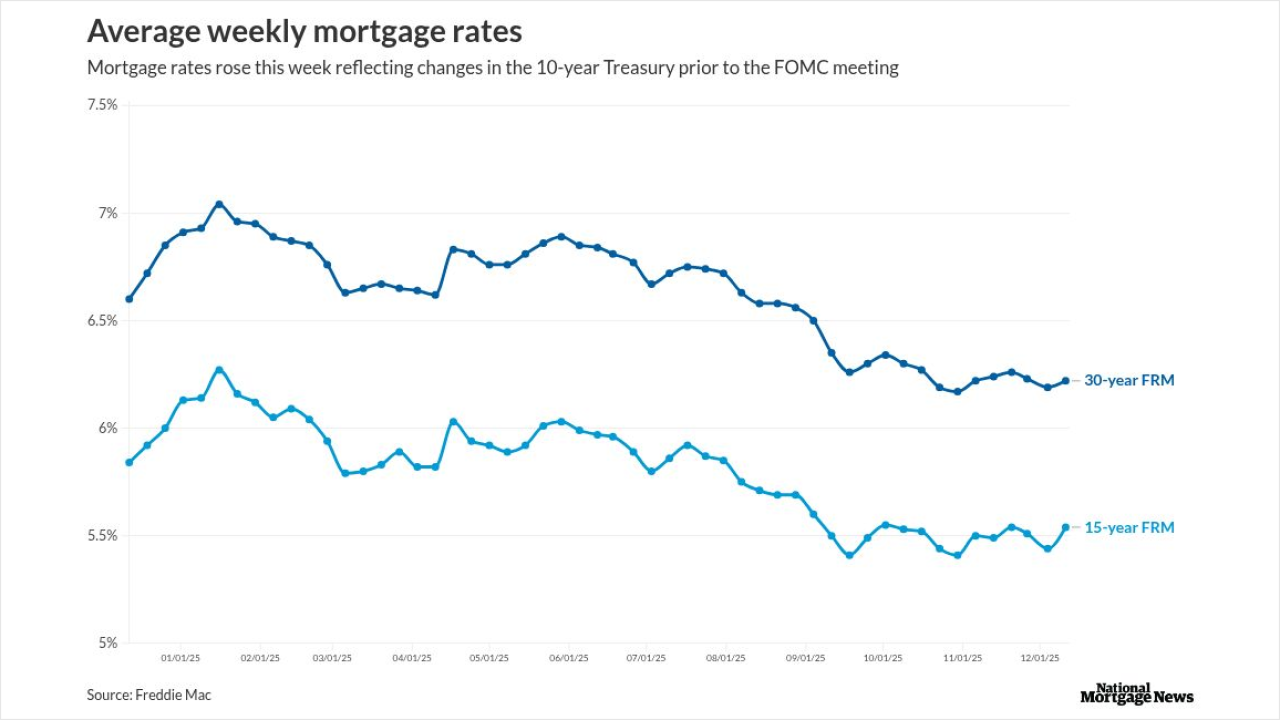

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11 -

Hartford, Connecticut, Rochester, New York, and Worcester, Massachusetts, headed the list of the 100 largest metro areas in the country, according to Realtor.com.

December 10 -

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Sen. Hassan sent letters to corporate owners of manufactured housing communities, looking for answers on affordability and living conditions for their residents.

December 10 -

An influx of adjustable-rate and cash-out refinance mortgage programs during the month pushed the Mortgage Credit Availability Index 0.7% higher in November.

December 9 -

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

December 9 -

Refinance retention hit 28% last quarter, the highest percentage in three and a half years, according to ICE Mortgage Technology.

December 8 -

BTIG is waiting with "baited breath" for Fannie Mae and Freddie Mac to relist their common stocks, but if spreads widen, it could derail it from happening.

December 5 -

Manufactured housing could see eased lending rules if the defense bill removes the "permanent chassis" requirement, expanding FHA mortgage eligibility.

December 5 -

A recent Remax survey found 88% of respondents said they are "very" or "somewhat likely" to purchase a home next year.

December 5 -

The drop in mortgage rates as measured by Freddie Mac, came about even as the 10-year Treasury yield used to price loans moved higher since Thanksgiving.

December 4