-

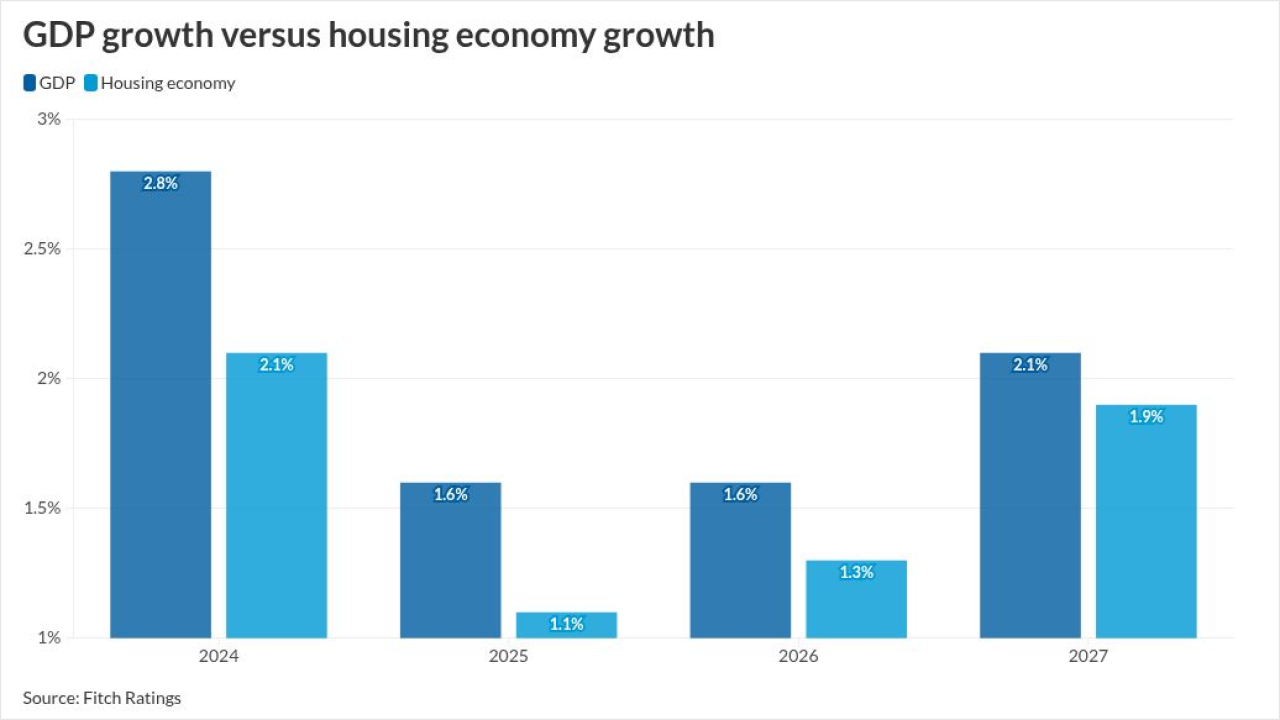

The home purchase market, which competes for consumers with rentals, should remain subdued in 2026 because of high mortgage rates and low affordability.

December 15 -

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

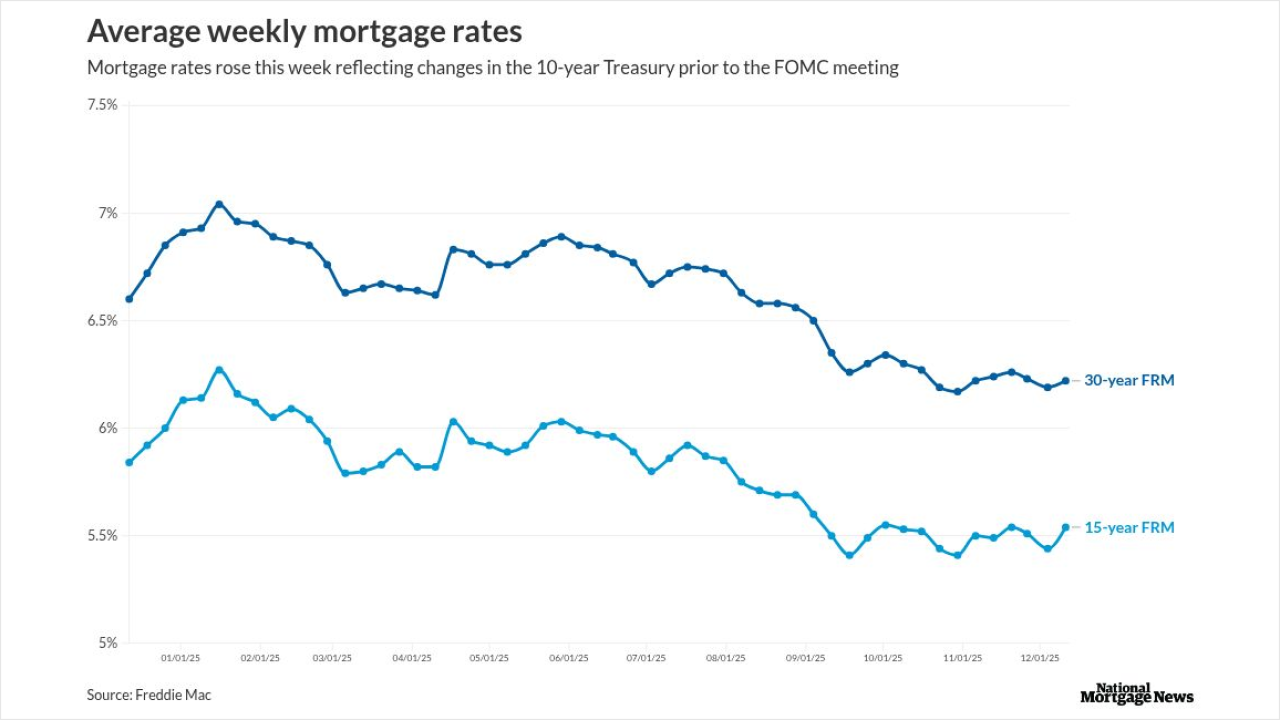

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11 -

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

December 10 -

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

An influx of adjustable-rate and cash-out refinance mortgage programs during the month pushed the Mortgage Credit Availability Index 0.7% higher in November.

December 9 -

Treasury yields climbed to the highest in more than two months, following losses in most global government-bond markets, ahead of a Federal Reserve interest-rate decision that may alter expectations for monetary policy in 2026.

December 8 -

Refinance retention hit 28% last quarter, the highest percentage in three and a half years, according to ICE Mortgage Technology.

December 8 -

The drop in mortgage rates as measured by Freddie Mac, came about even as the 10-year Treasury yield used to price loans moved higher since Thanksgiving.

December 4 -

The contract rate on a 30-year mortgage dropped 8 basis points to 6.32% in the week ended Nov. 28, which included the Thanksgiving holiday, according to Mortgage Bankers Association data released Wednesday.

December 3 -

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

December 3 -

Planet Home Lending, helped by growing recapture and distributed retail volume, did 64% more originations in the third quarter than one year prior.

December 1 -

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

November 26 -

The administration has previously said the finalists are Fed Governors Christopher Waller and Michelle Bowman, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett and BlackRock Inc. executive Rick Rieder.

November 25 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

Even with this week's increase, mortgage rates have remained within a 13 basis point band since mid-September, with industry pundits saying that's where they will stay.

November 20 -

Trump's remarks — made in a joking tone — come amid increased pressure on the administration from voters to lower the cost of living.

November 20 -

Even to the detriment of greater profits, the sector is offering ultra-low terms via temporary buydowns combined with larger forward commitments.

November 20 -

Consecutive weeks of mortgage rate increases resulted in a 5.2% decrease in mortgage loan application volume, according to the Mortgage Bankers Association.

November 19 -

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14