-

From insights about borrower payment preferences to new automation assisting with natural disaster recovery efforts, here's a roundup of news coming out of the Mortgage Bankers Association Servicing Conference.

February 7 -

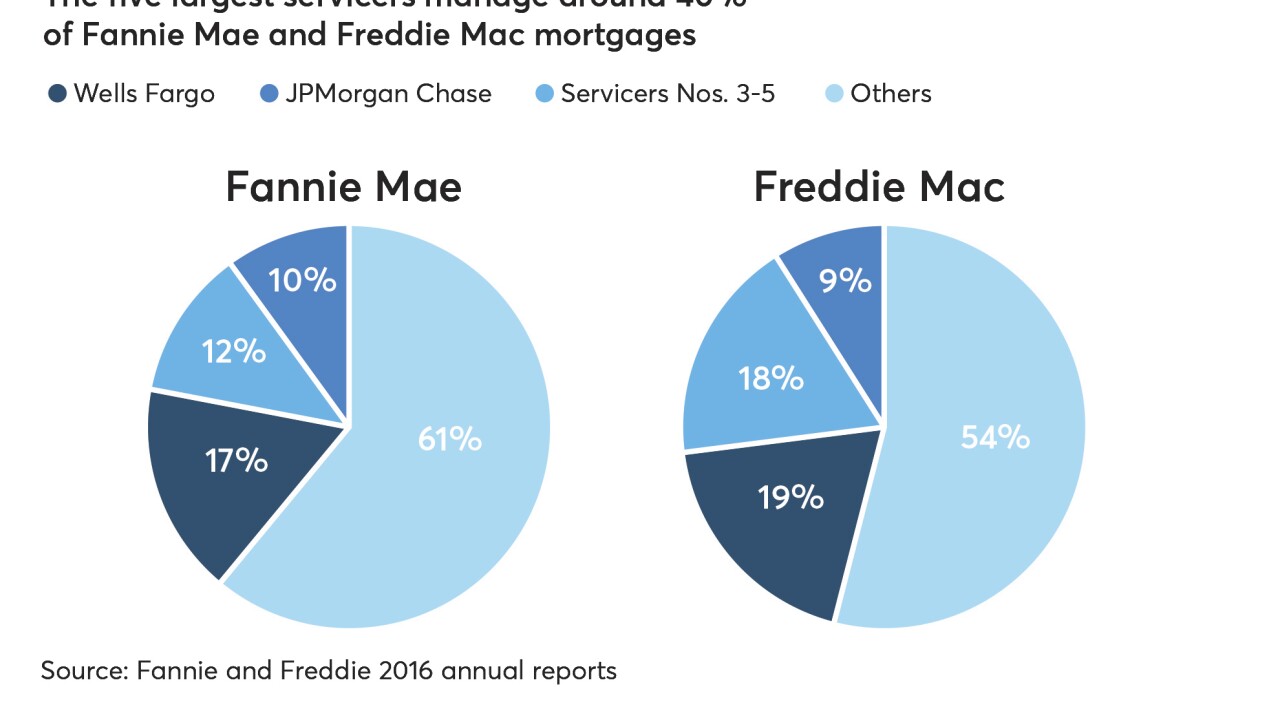

Wary of concentration risk, secondary market participants are backing initiatives to give more players a piece of the action.

February 6 -

From responding to natural disasters to emerging technology strategies, here's a look at six top trends on the agenda for the 2018 MBA Servicing Conference.

February 2 -

QuestSoft is buying data verification and audit services firm Investors Mortgage Asset Recovery Co. at a time when lenders are more widely using technology to verify information.

February 1 -

Compliance is a significant cost center for mortgage lenders. But with bulk rates, technology and better process management, some lenders have found new ways to reduce the burden.

January 29 -

Roostify has integrated its mortgage transaction technology into LendingTree's lead generation system, creating a seamless path from product search through closing.

January 26 -

LoanDepot Inc., a mortgage lender basing its growth around digital applications, isn't giving up on humans' role in the home-buying process just yet.

January 23 -

A group of big financial institutions wants to use the blockchain to make it easier and less costly to track home mortgages packaged into securities.

January 18 -

Startups that have developed the technology for real estate finance are starting to conduct a broader array of transactions, including property sales.

January 2 -

With recommended reads from Chase Mortgage's Mike Weinbach, New American Funding's Patty Arvielo and more, check out these 13 books every mortgage pro should have on their winter reading list.

December 29 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

As digital mortgage technology helps consumers take a more hands-on approach to the mortgage process, lenders are stepping up their adoption of automation and machine learning through artificial intelligence capabilities.

December 26 -

Fannie Mae and Freddie Mac have new technology-driven initiatives planned for 2018 that are expected to help lenders improve the borrowing experience for home buyers and make full use of the government-sponsored enterprises' credit box.

December 26 -

Updated dynamic and interactive versions of Fannie Mae and Freddie Mac's redesigned Uniform Residential Loan Application are out.

December 20 -

To succeed in an era of increasingly narrow margins and broad competition, mortgage lenders must be methodical about loan fulfillment and take a "less is more" approach to designing workflows.

December 18 cloudvirga

cloudvirga -

Supply constraints tempered real estate and title professionals' outlook for the home purchase market over the next year, according to First American Financial Corp.'s fourth quarter Real Estate Sentiment Index.

December 13 -

From Ellie Mae to Remax, here's a look at seven publicly traded companies in the mortgage and real estate industries expecting accelerated growth in 2018.

December 12 -

Maxwell Financial Labs, a provider of a digital cloud-based platform used by the mortgage industry, is getting a new $3 million round of funding led by Anthemis Group's investment arm.

December 6 -

Block One Capital has signed a binding term sheet to acquire 40% of the equity of Finzat, a private entity aiming to develop a blockchain system to create a safer, more compliant digital mortgage process.

December 6 -

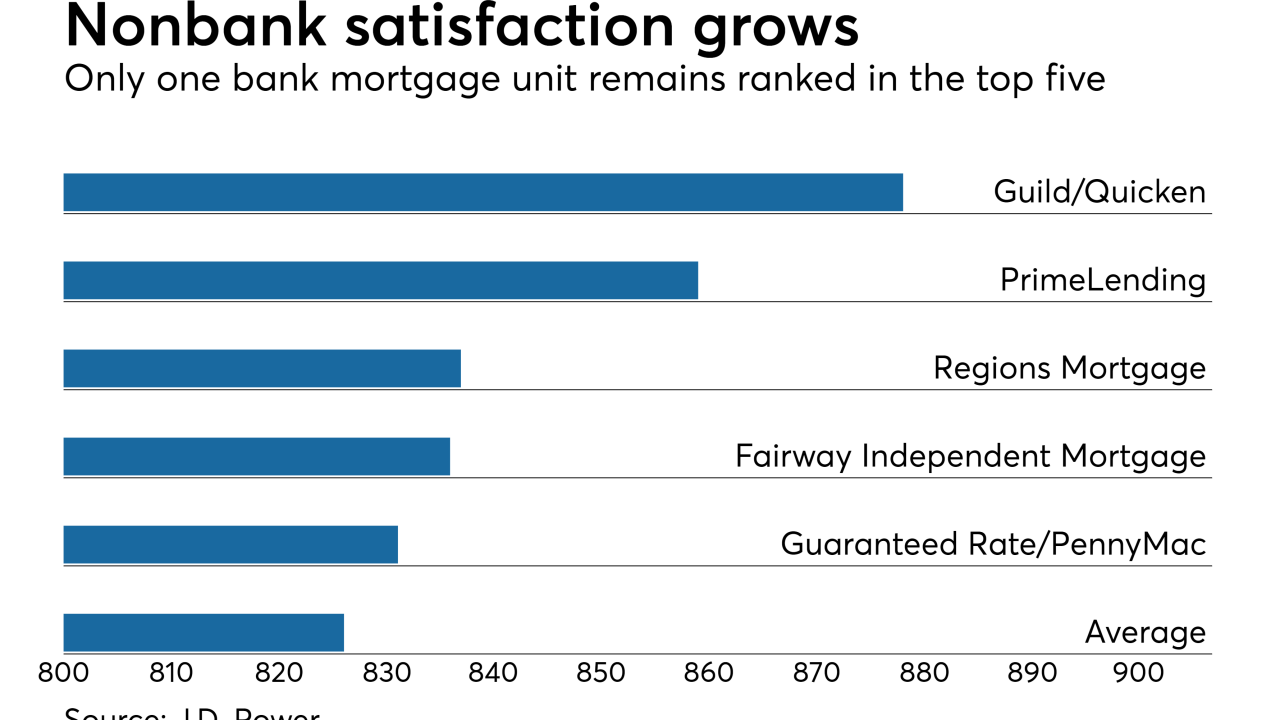

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9