-

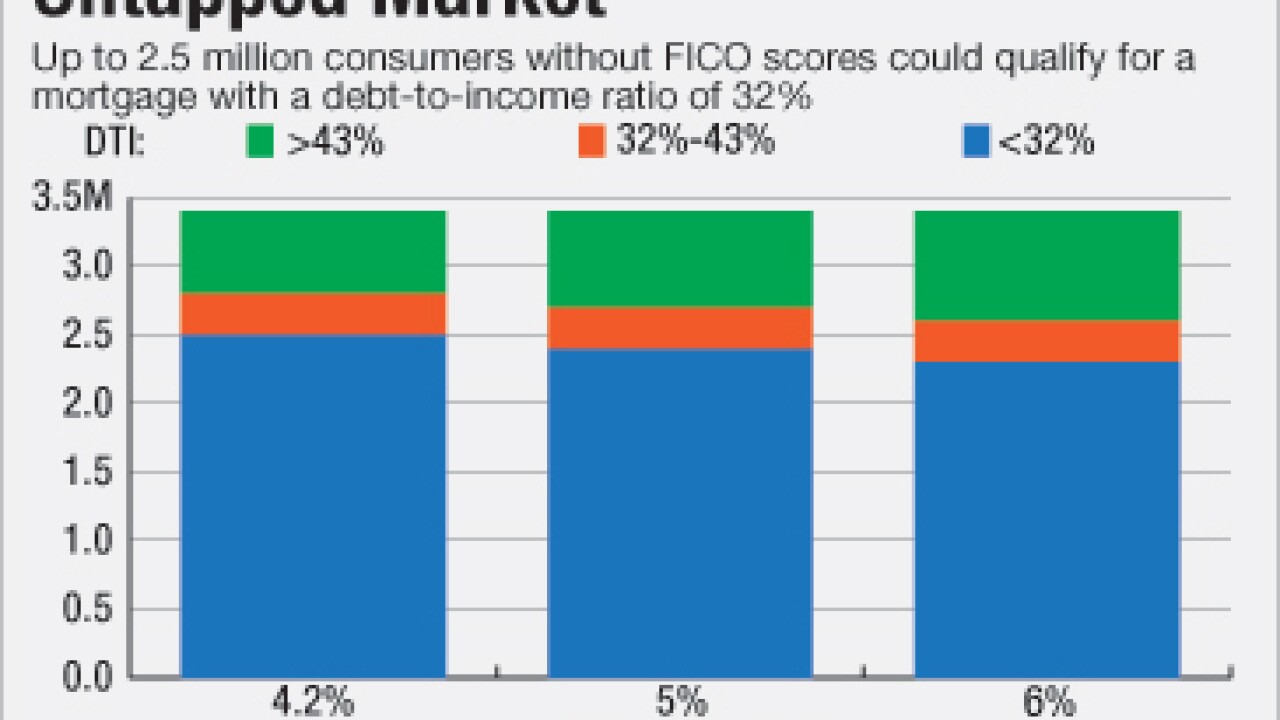

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Fairway Independent Mortgage Corp. is rolling out a new mobile application that allows consumers to apply for a loan, scan documents and get updates on their loan status through real-time push notifications.

December 12 -

Ally Financial is now making home loans.

December 12 -

Data aggregation and analytics platform provider Envestnet-Yodlee has created a new automated mortgage asset verification product.

December 9 -

The Mortgage Industry Standards Maintenance Organization is proposing a standard for the maintenance and sharing of commercial and multifamily real estate rent-roll information.

December 9 -

Moves by lenders to adapt their processes with the TILA-RESPA integrated disclosure rule in mind appear to have staunched the increase in loan application defects, according to ACES Risk Management.

December 9 -

A flood of fintech companies are promising to create a better experience for mortgage borrowers, forcing lenders to contemplate buying a vendor's software, building applications in-house or even outright acquiring a company with digital expertise.

December 9 -

SAN FRANCISCO Want to improve the customer experience? Start by making the employees' tools better.

December 8 -

Fidelity National Financial plans to distribute the stock it owns in Black Knight Financial Services to its shareholders as part of a plan to simplify the corporate structure of the two companies and increase Black Knight's liquidity.

December 8 -

Digital mortgages are not an idea for the future; they are here to stay, and the mortgage industry must put aside its misplaced fear of technology and change and embrace them.

December 8 Pavaso

Pavaso -

The rise of digital mortgages and increasing lender consolidation are just two reasons mortgage brokers should make the transition to mortgage banking sooner rather than later.

December 7 Click N' Close

Click N' Close -

Construction loans are a big source of interest income for community banks but also carry a lot of risk. A few fintech firms say their platforms can reduce the risk and improve the lending process.

December 6 -

Freddie Mac has published a list of companies that meet its requirements regarding the creation, signing and storage of electronic promissory notes.

November 29 -

The election results will only intensify factors making competition with bank lenders more difficult, including the effect of interest rates as well as the regulatory environment.

November 28

-

Personal information for roughly 480,000 people was exposed in two separate privacy incidents earlier this year involving the U.S. Department of Housing and Urban Development's website.

November 21 -

While nonbank servicers are expected to continue to gain greater market share in 2017, much of that growth will come from their own loan origination activity rather than mortgage servicing rights purchases and subservicing, according to a report from Fitch Ratings.

November 21 -

The Federal Communications Commission has denied a request to exempt servicers from getting consent before robo-calling borrowers' mobile phones, rejecting arguments that the waiver would enable the mortgage industry to better help delinquent borrowers.

November 18 -

Experian, like fellow credit bureaus TransUnion and Equifax, is now offering trended credit reports to lenders that originate single-family loans.

November 14 -

Facebook has disabled so-called ethnic affinity filters from housing, credit and employment advertising following mounting criticism that the practice allowed marketers to discriminate against minorities in violation of fair housing and civil rights laws.

November 11 -

Banks have been waiting on Justice Department guidelines on how to make their websites compliant with the Americans with Disabilities Act, but many are being advised to take action now or face lawsuits from disabled customers.

November 10