-

Driven by investor uncertainty, mortgage interest rates have moved by two basis points or less for four consecutive weeks, according to Freddie Mac.

February 23 -

Nationstar Mortgage Holdings reported significantly higher net income for the fourth quarter, due to improved revenue in its servicing segment.

February 22 -

The market share of mortgage applications submitted for refinancings hit an eight-year low as total activity decreased 2% from one week earlier, according to the Mortgage Bankers Association.

February 22 -

The developers of new loan-modification programs need to streamline application processes and stop making borrowers chase down useless documents.

February 16 -

Mortgage interest rates fell slightly for the second consecutive week, according to Freddie Mac.

February 16 -

Zeus Mortgage in Houston is positioning its new online crowdfunding platform as an alternative to traditional mortgages for property buyers and others having trouble borrowing to remodel homes or fund construction projects.

February 15 -

American International Group posted its fourth loss in six quarters, burned again by higher-than-expected claims costs as Chief Executive Officer Peter Hancock struggles to sustain profitability.

February 14 -

While Arch Capital had a slight increase in year-over-year net income to $64 million, the total was affected by $25 million of costs related to the purchase of United Guaranty.

February 13 -

JPMorgan Chase is known to eschew selling conforming mortgage loans to Fannie Mae and Freddie Mac, preferring to securitize them in the private-label market.

February 13 -

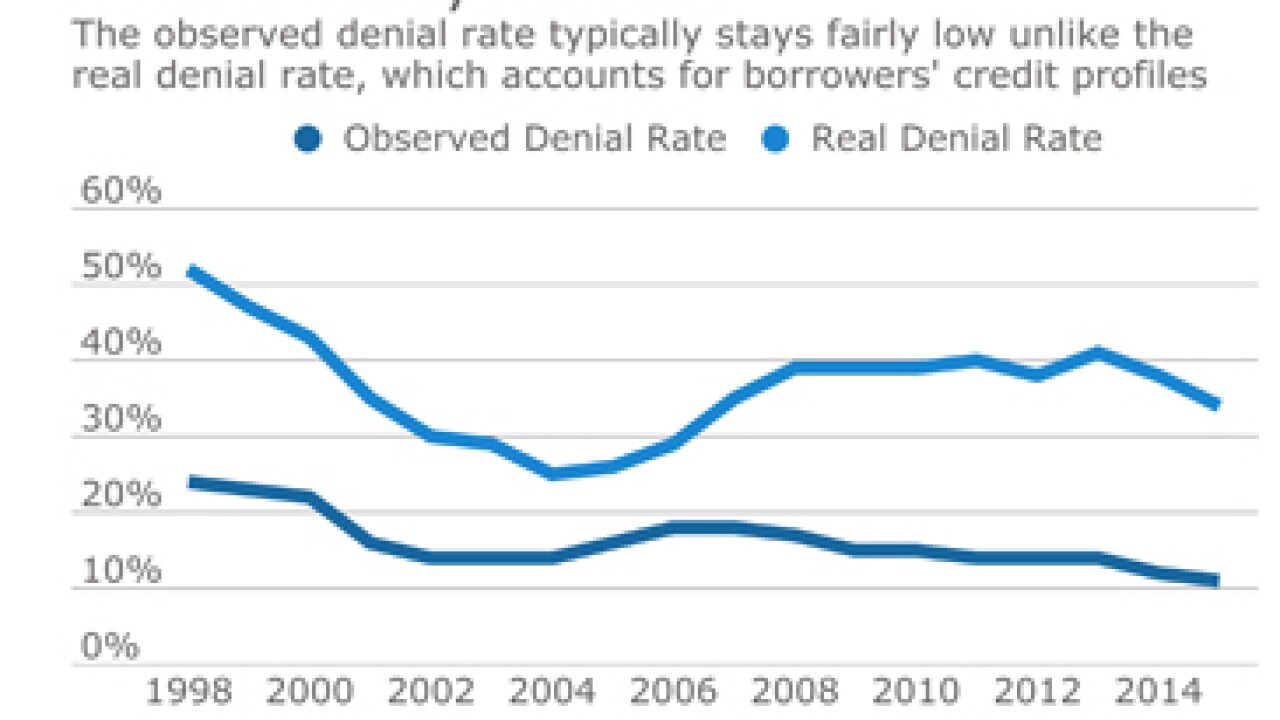

The denial rate traditionally used by the mortgage industry is hiding the fact that fewer borrowers with lower credit are applying for loans, according to the Urban Institute.

February 13 -

Nonbank mortgage company Cornerstone Home Lending has launched a new mortgage company as a joint venture with homebuilder Oakwood Homes.

February 10 -

Invictus Capital Partners, a nonprime mortgage lender based in Washington, D.C., is making its debut in the securitization market.

February 10 -

The rise in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but some consumer groups fear it could lead to a new wave of loan defaults.

February 9 -

Federal Reserve Bank of St. Louis President James Bullard said the central bank ought not rush to raising interest rates next month because uncertainty over the fiscal policies of the Trump administration clouds the U.S. economic outlook.

February 9 -

Uncertainty about the economy caused mortgage interest rates to stay within a 2-basis-point range for the third straight week, according to Freddie Mac.

February 9 -

Analysts at Deutsche Bank, one of the biggest underwriters of bonds tied to U.S. commercial real estate, say now it's time to short indexes of the securities.

February 9 -

Thomas Pahl has been appointed acting director of the Federal Trade Commission's consumer protection bureau, the agency said Wednesday.

February 8 -

The share of refinance applications is at its lowest level in over seven and a half years, according to the Mortgage Bankers Association.

February 8 -

Corporate borrowers aren't ready just yet to pull the trigger on multimillion-dollar loans to buy fleets of trucks or scads of new inventory despite excitement about a more business-friendly Washington, lenders cautioned.

February 7 -

Mortgage credit availability increased in January amidst wider access to jumbo loans, according to the Mortgage Bankers Association.

February 7