-

Mortgage applications for new home purchases rose 2% year over year in December, the Mortgage Bankers Association reported.

January 12 -

Mortgage rates moved lower for the second consecutive week on the market's reaction to November's employment numbers, according to Freddie Mac.

January 12 -

Mortgage application volume started off 2017 on a good note as activity increased 5.8% from one week earlier, according to the Mortgage Bankers Association.

January 11 -

The Federal Housing Administration said it would cut the annual premium by 25 basis points starting on Jan. 27, giving President-elect Donald Trump a limited window to delay or scrap the cut.

January 9 -

New approaches to credit scoring lower the standard of the criteria required to receive a mortgage loan, at greater risk to the industry.

January 9 FICO

FICO -

Some single-family lenders are ideally trying to move purchase loans from application to funding within 21 days at a time when average timeline is twice as long. Here's why.

January 9 -

The Federal Housing Administration is cutting its annual mortgage insurance premium by 25 basis points, lowering it to 60 basis points starting Jan. 27, the agency said Monday.

January 9 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

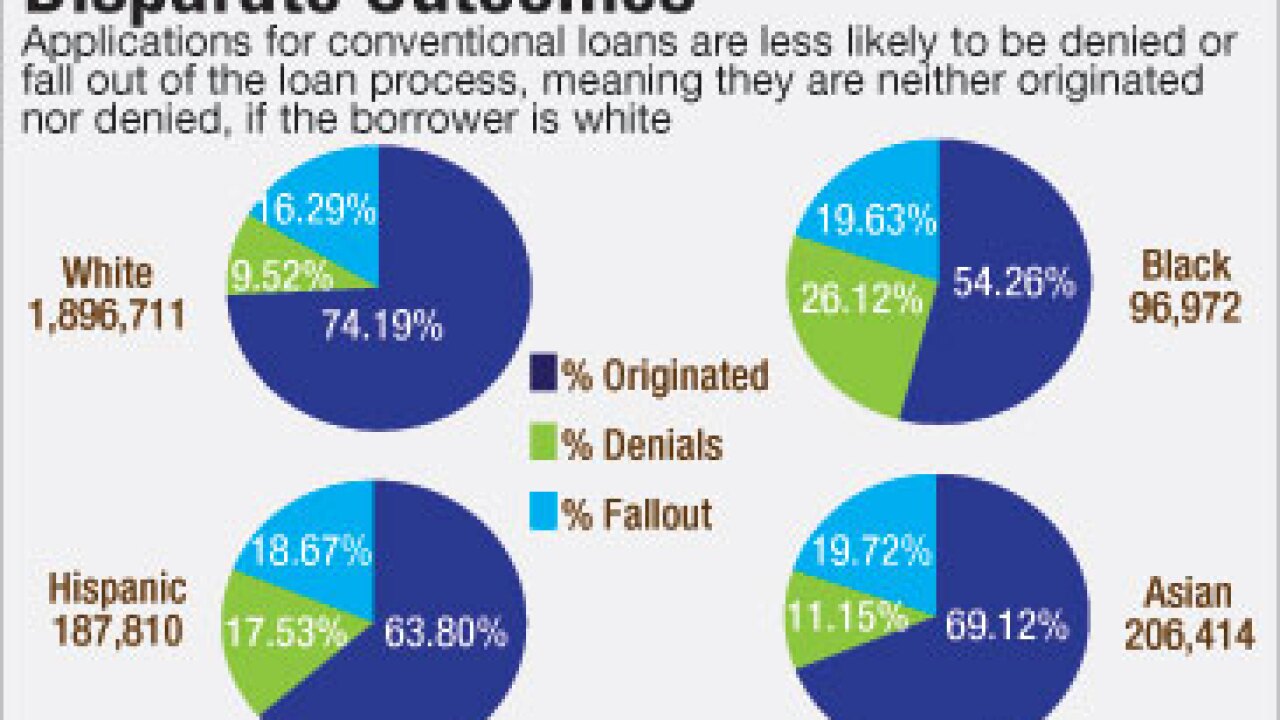

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Mortgage credit availability grew for the fourth consecutive month in December, the Mortgage Bankers Association reported.

January 5 -

Now that it has completed the purchase of its rival private mortgage insurer United Guaranty from AIG, Arch Capital Group plans to trim the sales force while avoiding service disruptions.

January 4 -

Walter Investment Management Corp. has agreed to sell Green Tree Insurance Agency to a wholly owned subsidiary of insurance company Assurant.

January 4 -

F&M Bank Corp. in Timberville, Va., has acquired Valley Southern Title in Harrisonburg, Va.

January 4 -

Residential loan application activity continued its post-election slump, declining for the sixth time in the eight weeks, according to the Mortgage Bankers Association.

January 4 -

In an enforcement action totaling more than $23 million in fines and restitution, the Consumer Financial Protection Bureau found that TransUnion and Equifax two of the largest consumer credit reporting agencies had misled consumers on the value of the data they marketed.

January 3 -

This was a year of shocks and surprises, including a multimillion-dollar verdict after one lender sued another, regulations putting a lender out of business, Brexit driving rates down and Donald Trump's election pushing them back up. Here are 10 events and trends from 2016 that changed the industry.

December 30 -

The Rural Housing Service is expanding its manufactured housing loan guarantee program to include more refinancings of used or existing manufactured homes.

December 30 -

Mortgage rates moved higher, closing the year with nine consecutive weeks of increases, according to Freddie Mac.

December 29 -

The Department of Justice has agreed to a settlement with a pair of Cincinnati banks accused of redlining African-American neighborhoods in four cities in Ohio and Indiana.

December 28 -

Fannie Mae's Day 1 Certainty initiative and automated verification tools at Freddie Mac are set to improve mortgage loan application defect and misrepresentation risk in 2017, according to a report from First American Financial Corp.

December 28