-

Mortgage applications increased 0.6% from one week earlier as rates rose 5 basis points on 30-year conforming and jumbo loans, according to the Mortgage Bankers Association.

October 19 -

MGIC Investment Corp. posted the biggest intraday gain in 11 weeks as third-quarter operating profit advanced on lower costs tied to soured home loans.

October 18 -

Fluctuations in home price and wage gains have created a volatile outlook for housing affordability across the country. By better deciphering market data, mortgage companies can hone their strategies to respond to prevailing economic trends.

October 18 -

Recently launched low-down-payment mortgage programs are presenting new opportunities for fraud. But new data and monitoring tools can help lenders mitigate those risks.

October 18 -

Regions Financial in Birmingham, Ala., has bought a business that manages low-income housing tax credits.

October 17 -

West Town Bancorp in Illinois has revved up its government-backed lending to small businesses, making it a good example of how community banks can outhustle big lenders in the quest for new sources of fee income.

October 13 -

Tricon American Homes is prepping its second securitization of single-family rental homes, according to ratings agency reports.

October 12 -

Mortgage applications decreased 6% from one week earlier, according to the Mortgage Bankers Association.

October 12 -

It's tougher out there for New York's commercial real estate developers seeking cash for their latest projects.

October 11 -

Companies in the path of the storm have battened down the hatches, as others have prepared for the impact the hurricane could have on home sales and loan servicing in the weeks to come.

October 7 -

Interest rates fell in August to the lowest level recorded all year for millennials, which could mean expanded buying power for this segment, according to Ellie Mae.

October 7 -

Xerox Mortgage Services will change its name as it becomes a part of Conduent, the company that will incorporate Xerox's business process outsourcing division.

October 6 -

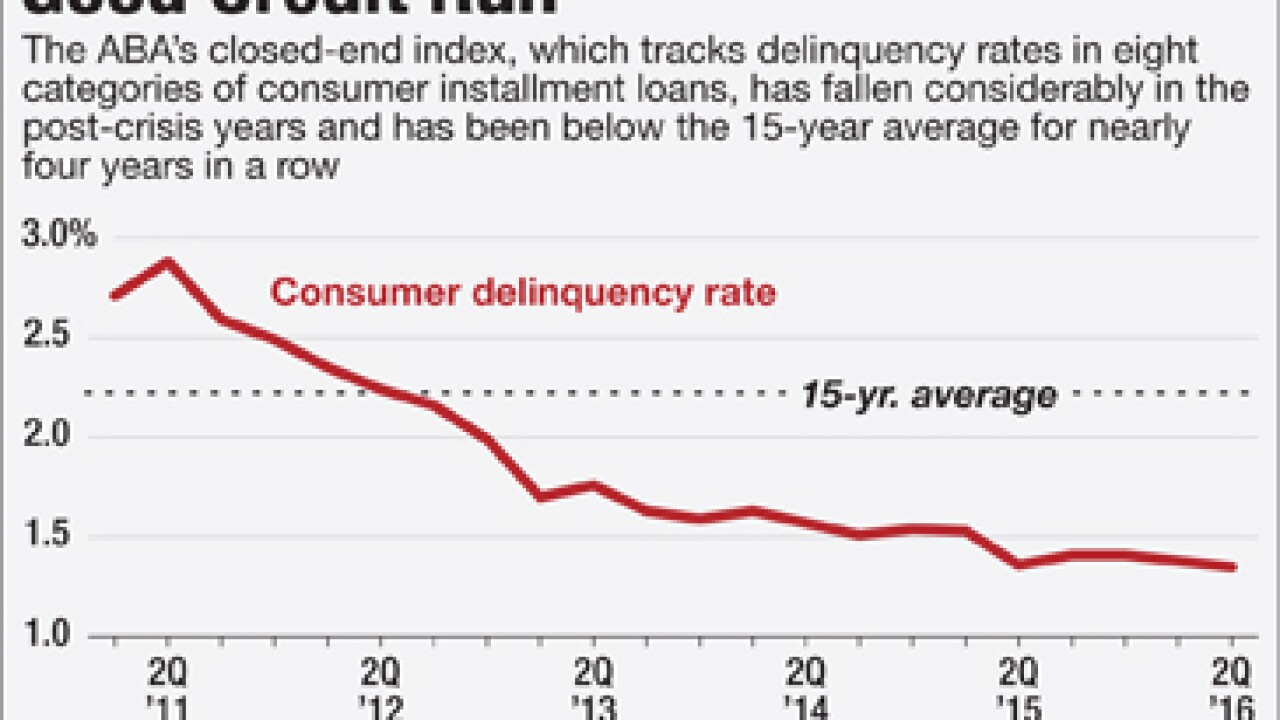

The 1.35% delinquency rate was the lowest since at least 2001, and it marked nearly four years of delinquencies below the 15-year average of 2.21%.

October 6 -

M&T Bank is offering mortgage subsidies through a new program to qualified consumers in New Jersey and nearby states.

October 5 -

Mortgage applications increased 2.9% from one week earlier, according to the Mortgage Bankers Association, as the conforming interest rate fell to its lowest level since July.

October 5 -

More than $200 billion of the most poorly underwritten commercial mortgages originated before the financial crisis come due this year and next, many of them still underwater.

October 4 -

Multichannel loan origination system provider OpenClose has added a rate sheet generator to its product and pricing engine.

September 30 -

Though they have a reputation for being precarious, Federal Housing Administration loans are leading the decline in mortgage application defect risk, according to First American Financial Corp.

September 30 -

Deutsche Bank jumped in Frankfurt trading after a media report that the lender is nearing a $5.4 billion settlement with the U.S. Department of Justice in a probe tied to residential mortgage-backed securities, less than half an initial request.

September 30 -

Strong home sales are boosting originations of Federal Housing Administration loans and opening the door for first-time buyers developments that could portend the mortgage insurance agency receiving a positive report from auditors this fall.

September 30