-

Interest rates fell in August to the lowest level recorded all year for millennials, which could mean expanded buying power for this segment, according to Ellie Mae.

October 7 -

Xerox Mortgage Services will change its name as it becomes a part of Conduent, the company that will incorporate Xerox's business process outsourcing division.

October 6 -

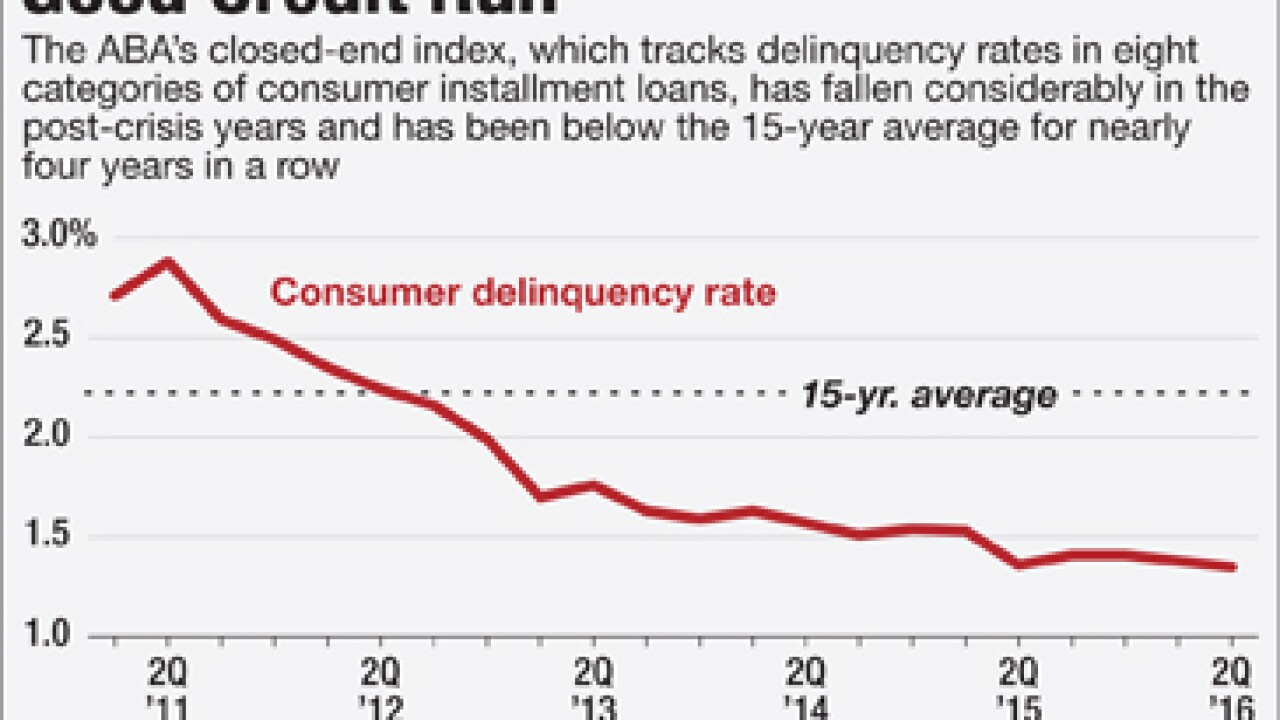

The 1.35% delinquency rate was the lowest since at least 2001, and it marked nearly four years of delinquencies below the 15-year average of 2.21%.

October 6 -

M&T Bank is offering mortgage subsidies through a new program to qualified consumers in New Jersey and nearby states.

October 5 -

Mortgage applications increased 2.9% from one week earlier, according to the Mortgage Bankers Association, as the conforming interest rate fell to its lowest level since July.

October 5 -

More than $200 billion of the most poorly underwritten commercial mortgages originated before the financial crisis come due this year and next, many of them still underwater.

October 4 -

Multichannel loan origination system provider OpenClose has added a rate sheet generator to its product and pricing engine.

September 30 -

Though they have a reputation for being precarious, Federal Housing Administration loans are leading the decline in mortgage application defect risk, according to First American Financial Corp.

September 30 -

Deutsche Bank jumped in Frankfurt trading after a media report that the lender is nearing a $5.4 billion settlement with the U.S. Department of Justice in a probe tied to residential mortgage-backed securities, less than half an initial request.

September 30 -

Strong home sales are boosting originations of Federal Housing Administration loans and opening the door for first-time buyers developments that could portend the mortgage insurance agency receiving a positive report from auditors this fall.

September 30 -

An FHA lender was cited for violating Department of Housing and Urban Development rules by allowing repayment provisions in second mortgages.

September 30 -

Community bankers are showing renewed interest in consumer lending but admit they may be losing ground to more tech-savvy players, according to a survey released Thursday.

September 29 -

BB&T Corp. has agreed to pay $83 million to settle a Department of Justice investigation over loans that failed quality control tests but were still insured by the Federal Housing Administration.

September 29 -

Low interest rates are keeping the housing market strong even as affordability keeps declining, according to Freddie Mac.

September 28 -

Sperlonga Data & Analytics has begun reporting homeowner and condominium association payments and account statuses to Equifax.

September 27 -

Now that Fannie Mae requires trended data credit reports for its automated underwriting system, will other secondary market players follow suit? If so, how soon?

September 26 -

The Consumer Financial Protection Bureau filed a lawsuit against a Van Nuys, Calif., credit repair company for deceptively marketing its services and charging consumers illegal fees.

September 23 -

Fannie Mae employees will be working this weekend to update the agency's automated underwriting machine to process trended data for the first time.

September 23 -

The average sales price of a new mobile home was $67,800 in April, compared with an average sales price of $380,000 for a site-built home.

September 23 -

The granular data and quick decisions that can help field a winning fantasy football team have a lot in common with the analytics tools that mortgage lenders use to monitor and evaluate their operations.

September 23