-

Fears about repurchase requests made by Fannie Mae and Freddie Mac persisted beyond the crisis, but those fears don't match actual repurchase numbers.

June 15

-

Mortgage applications decreased 2.4% from one week earlier even though interest rates for conforming loans are at their lowest point in 18 months, according to the Mortgage Bankers Association.

June 15 -

Delinquencies on non-owner-occupied commercial real estate loans ticked up in the first quarter after years of steady declines. Some are shrugging off the increase, saying it was expected given the strong demand for CRE loans, but others say there's good reason to be concerned.

June 14 -

There's been plenty of speculation about insurance companies crowding out commercial mortgage bond investors this year.

June 14 -

Down payment assistance programs can save homebuyers an average of $17,766 during the life of a loan, according to a joint report from RealtyTrac and Down Payment Resource.

June 9 -

Mortgage rates were lower this week after the May employment report came in well below expectations, according to Freddie Mac.

June 9 -

The Department of Housing and Urban Development has reached an agreement with First-Citizens Bank & Trust Co. in Raleigh, N.C., to settle alleged fair lending violations.

June 8 -

JPMorgan Chase's next residential mortgage securitization looks a lot like the six deals it completed in 2015: it is backed by jumbo loans to high-quality borrowers that the bank acquired from other originators.

June 8 -

Mortgage applications increased 9.3% from one week earlier as rates were basically flat for the period, according to the Mortgage Bankers Association.

June 8 -

TRID wasn't as hard on the wholesale channel as was once feared, but some parties involved in the process still either do not fully understand the rule or haven't perfected their operations to handle it.

June 8 -

Independent mortgage banks and mortgage subsidiaries of chartered banks managed to grow profits from the fourth quarter despite lower interest rates and production volume, according to the the Mortgage Bankers Association.

June 7 -

Arjun Sirrah takes great pride in his company's national-level success as a community bank in Connecticut competing against digital lending startups in student loan refinancing. Now, his Darien Rowayton Bank plans to bring its tech-based approach to the mortgage market.

June 6 -

There's not enough origination volume to sustain seven private mortgage insurers and the number of underwriters may need to shrink, warns MGIC CEO Patrick Sinks.

June 3 -

Mortgage rates were up slightly from last week in continued anticipation of a possible move by the Federal Reserve, but still near three-year lows, according to Freddie Mac.

June 2 -

LenderLive has reorganized its various business divisions under two new units LenderLive Network and LenderLive Services.

June 1 -

Mortgage applications decreased 4.1% from one week earlier, according to the Mortgage Bankers Association.

June 1 -

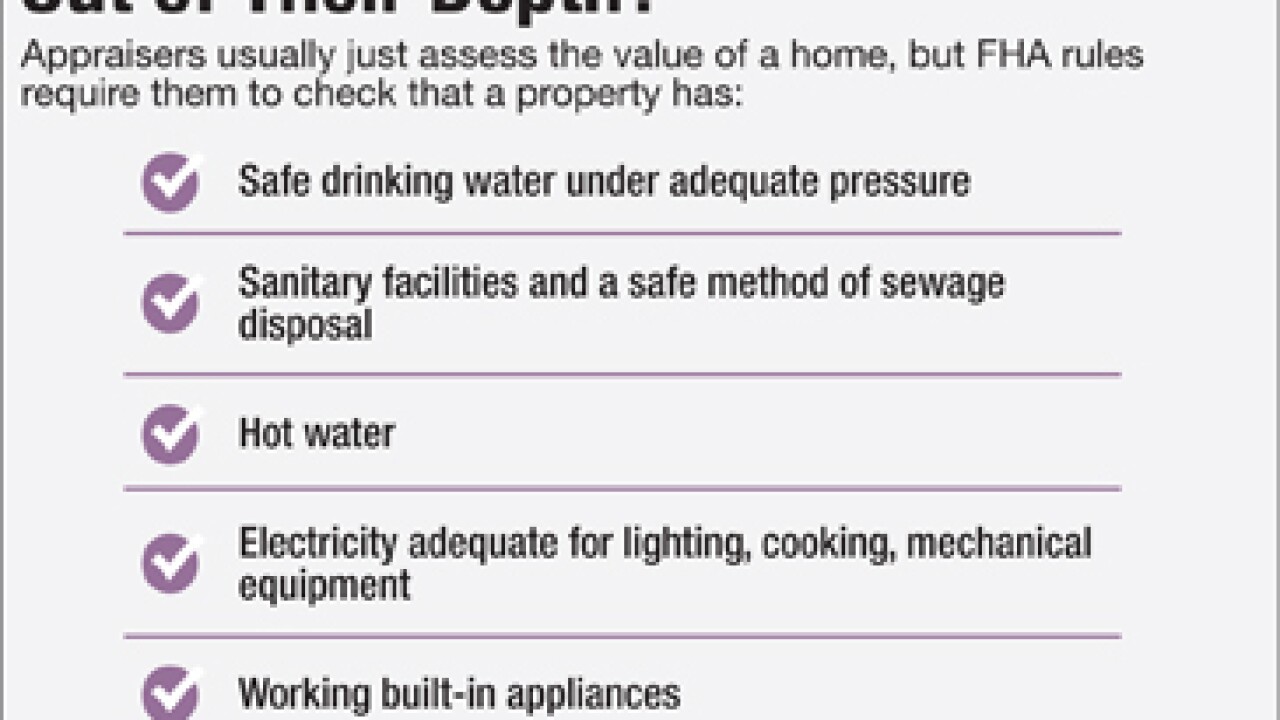

Many appraisers are charging more or simply refusing to do FHA work, which to their minds now comes close to, if not crossing into, the remit of the home inspector.

May 27 -

The CFPB alleges that David Eghbali, a loan officer for a Wells Fargo branch in Beverly Hills, Calif., developed a scheme to manipulate escrow fees in order to close more mortgages and boost his bonus. Eghbali says he was forced to sign a settlement because he couldn't afford to fight the CFPB in court.

May 26 -

The Inspector General for the Department of Housing and Urban Development is not backing down on his concerns about premium pricing associated with the down payment assistance programs by the Federal Housing Administration.

May 26 -

The bank's new low-down-payment mortgage, an alternative to FHA loans, dispenses with the complex qualification requirements that have hampered recent efforts with low down payments by Fannie and Freddie.

May 26