-

Independent mortgage banks and mortgage subsidiaries of chartered banks managed to grow profits from the fourth quarter despite lower interest rates and production volume, according to the the Mortgage Bankers Association.

June 7 -

Arjun Sirrah takes great pride in his company's national-level success as a community bank in Connecticut competing against digital lending startups in student loan refinancing. Now, his Darien Rowayton Bank plans to bring its tech-based approach to the mortgage market.

June 6 -

There's not enough origination volume to sustain seven private mortgage insurers and the number of underwriters may need to shrink, warns MGIC CEO Patrick Sinks.

June 3 -

Mortgage rates were up slightly from last week in continued anticipation of a possible move by the Federal Reserve, but still near three-year lows, according to Freddie Mac.

June 2 -

LenderLive has reorganized its various business divisions under two new units LenderLive Network and LenderLive Services.

June 1 -

Mortgage applications decreased 4.1% from one week earlier, according to the Mortgage Bankers Association.

June 1 -

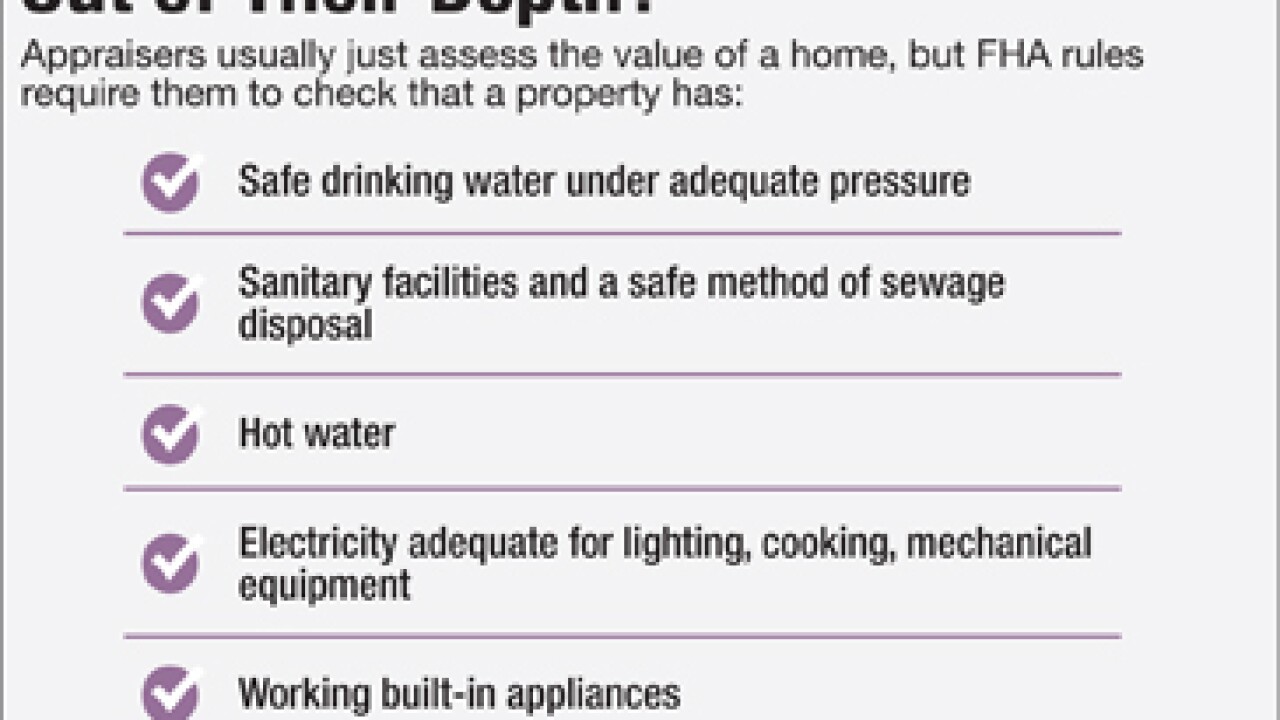

Many appraisers are charging more or simply refusing to do FHA work, which to their minds now comes close to, if not crossing into, the remit of the home inspector.

May 27 -

The CFPB alleges that David Eghbali, a loan officer for a Wells Fargo branch in Beverly Hills, Calif., developed a scheme to manipulate escrow fees in order to close more mortgages and boost his bonus. Eghbali says he was forced to sign a settlement because he couldn't afford to fight the CFPB in court.

May 26 -

The Inspector General for the Department of Housing and Urban Development is not backing down on his concerns about premium pricing associated with the down payment assistance programs by the Federal Housing Administration.

May 26 -

The bank's new low-down-payment mortgage, an alternative to FHA loans, dispenses with the complex qualification requirements that have hampered recent efforts with low down payments by Fannie and Freddie.

May 26 -

New research findings challenge common assumptions about borrower behavior, illustrating how trended data something mortgage lenders will soon be required to collect could be a game-changer.

May 26 -

The Department of Housing and Urban Development is telling lenders that down payment assistance programs still qualify for FHA backing despite concerns raised last year by HUDs inspector general.

May 25 -

FHFA Director Mel Watt also reiterated concerns regarding insurance companies and large bank members, saying that some Home Loan Banks have large exposures to a few individual members.

May 24 -

Increased mortgage borrowing was behind a 1.1% rise in U.S. household debt in the first quarter, with slowdowns in other areas such as credit-card balances and auto loans, according to the Federal Reserve Bank of New York

May 24 -

New York luxury-condo builder Extell Development Co. says its taking longer than expected to obtain construction financing for its One Manhattan Square project as lenders pull back from the market.

May 20 -

From the Common Security Platform and Freddie Mac loan sales to new accounting rules and what direction mortgage rates are headed, there was plenty to debate during this week's MBA Secondary Conference in New York.

May 19 -

The Justice Department filed suit Thursday against Guild Mortgage, arguing the firm violated the False Claims Act by improperly originating and underwriting Federal Housing Administration loans.

May 19 -

Mortgage rates held near 2016 lows as a result of minimal action in the 10-year Treasury yield over the past week, according to Freddie Mac.

May 19 -

The percentage of loan applications which become closed loans slipped from March's high last month, according to Ellie Mae.

May 19 -

Rep. Maxine Waters, the top Democrat on the House Financial Services Committee, introduced legislation Thursday to reform consumer credit reporting.

May 19