-

An expanded data set based on the third quarter annual price changes is what the Federal Housing Finance Agency uses to calculate next year's conforming loan limits.

November 25 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

While some international purchasers are reluctant to buy in the U.S. right now, interest in investment properties still abounds, the CEO of Waltz said.

November 21 -

Non-QM's rapid rise is reshaping how lenders underwrite and manage risk, setting a model the rest of the industry will follow, writes the founder of Prudent AI.

November 20 Prudent AI

Prudent AI -

Rocket enters the crowded DSCR market with a product for experienced investors, joining rivals as non-QM lending grows and demand for single-family rentals stays strong.

November 19 -

While Redfin argues the housing market is stuck and First American was cautious, Remax and Zillow had positive observations about the month's sales activity.

November 19 -

Independent mortgage bankers were in the black for each loan originated during the third quarter, as low rates brought an application surge in September.

November 18 -

Application error findings rose over 15%, the second quarter in a row they have moved higher, the post-closing file review from Aces Quality Management found.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

With the increase in investor-owned properties, the risk of undisclosed real estate fraud, including occupancy misrepresentation, rose 9% in the third quarter.

November 14 -

The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

November 13 -

These attempts to remove legit items from credit files are made with the aim of at least temporarily boosting the credit score in order to get a loan.

November 13 -

While Rocket increased 15 points, it slipped to 11th overall as other mortgage lenders had higher customer service score growth, J.D, Power said.

November 12 -

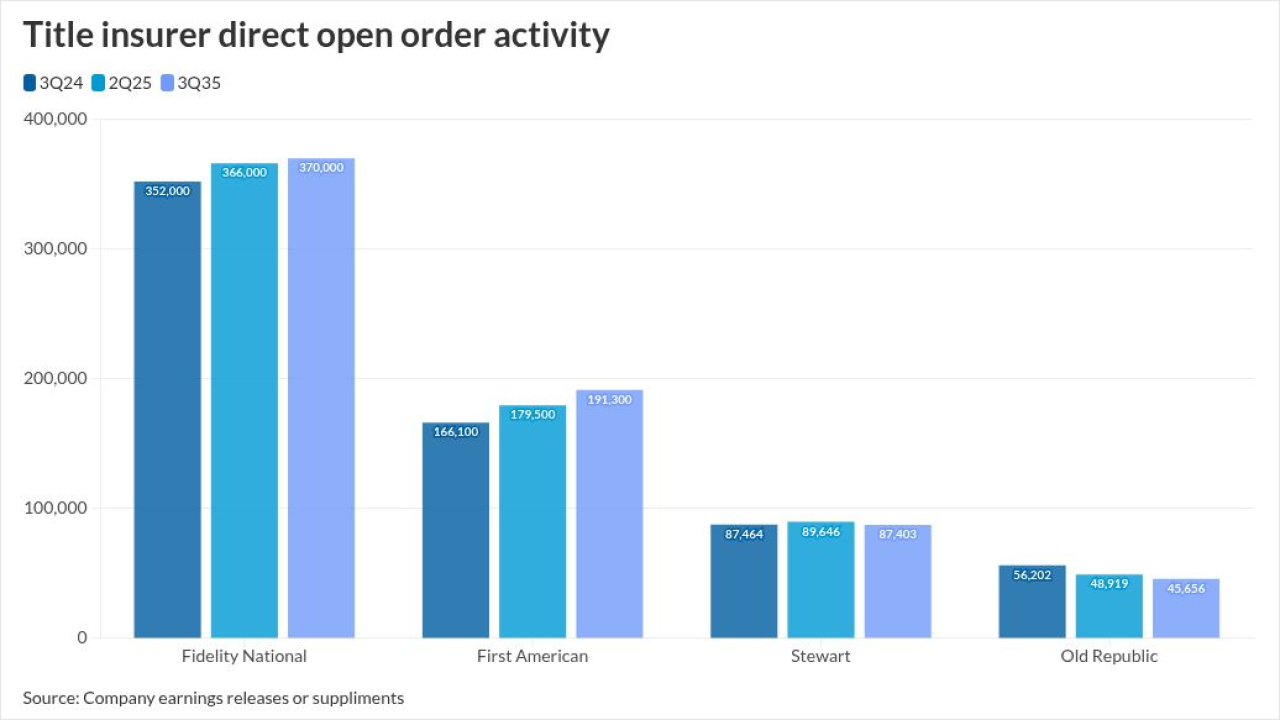

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Bill Pulte's X post has the industry excited that loan level price adjustments could change, but the impact would not be as beneficial as some think, KBW said.

October 27 -

Several claims in a recent Loan Think column misrepresented how credit scores and resellers work in mortgage lending, according to the president of the National Consumer Reporting Association.

October 24 National Consumer Reporting Association

National Consumer Reporting Association -

The NRMLA/Riskspan Reverse Mortgage Market Index set a new high of 502.42, with the dollar amount of home equity for those 62 or over reaching $14.4 trillion.

October 21