-

The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

November 13 -

These attempts to remove legit items from credit files are made with the aim of at least temporarily boosting the credit score in order to get a loan.

November 13 -

While Rocket increased 15 points, it slipped to 11th overall as other mortgage lenders had higher customer service score growth, J.D, Power said.

November 12 -

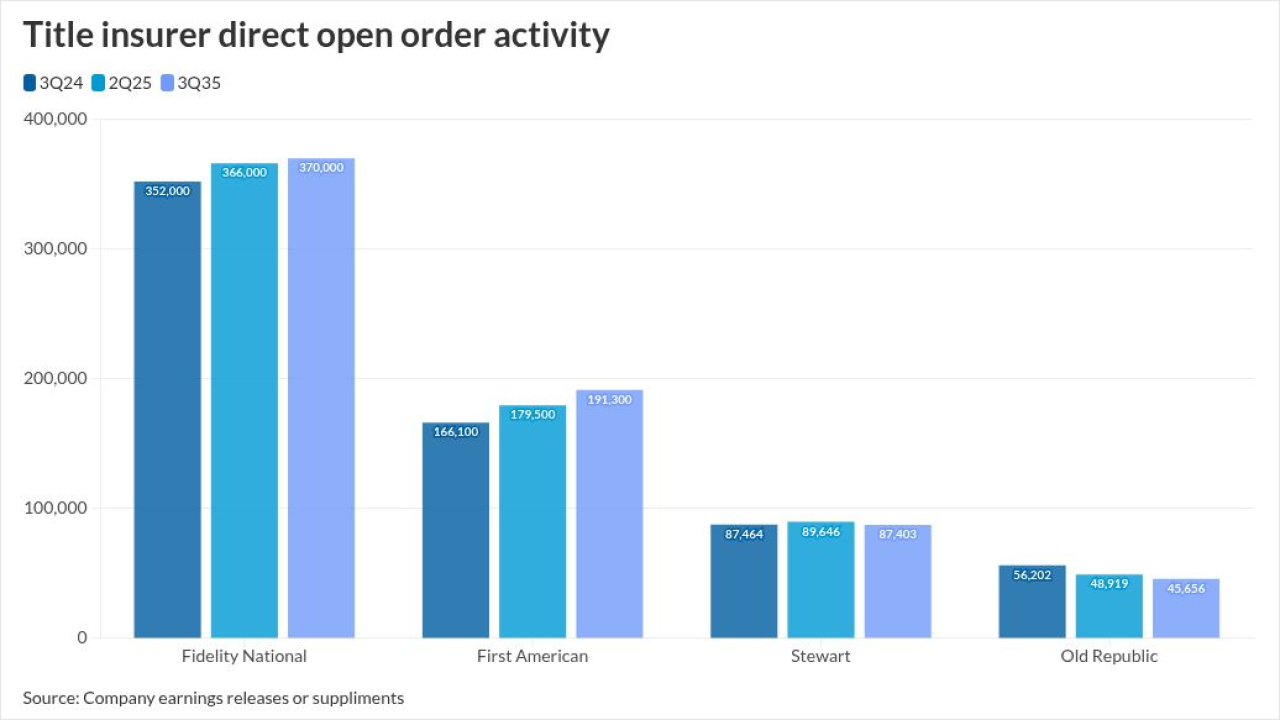

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Bill Pulte's X post has the industry excited that loan level price adjustments could change, but the impact would not be as beneficial as some think, KBW said.

October 27 -

Several claims in a recent Loan Think column misrepresented how credit scores and resellers work in mortgage lending, according to the president of the National Consumer Reporting Association.

October 24 National Consumer Reporting Association

National Consumer Reporting Association -

The NRMLA/Riskspan Reverse Mortgage Market Index set a new high of 502.42, with the dollar amount of home equity for those 62 or over reaching $14.4 trillion.

October 21 -

In dollar terms, the amounts consumers had to come up with increased by $500 on a consecutive quarter basis, in contrast to a $100 drop the year before.

October 20 -

Other studies have found fewer credit pulls could be viable, but this shows millions more would be adversely impacted than in a bi-merge.

October 20 -

Transunion will offer the credit scoring model for $4 in 2026, following previous moves made by VantageScore partners Experian and Equifax.

October 18 -

LendingTree found that during 2024, May's median price for a 1,500 square foot home was $194.20 versus January's $178.60, a difference of $23,400.

October 17 -

The new platform already counts two businesses as embedded partners, with the rollout coming as mortgage leaders see rising demand coming for DSCR loans.

October 15 -

Growth in multifamily and investment property mortgage originations, the highest risk segments, drove the 6% rise in the National Fraud Index, Cotality said.

October 9 -

Bisignano will continue to lead the Social Security Administration while managing day-to-day operations at the IRS.

October 7 -

Mortgage Research Center is adding First Residential Independent Mortgage to do conventional and FHA, but it will be sunsetting the Paddio branding.

October 7 -

VantageScore's claims of outperforming Classic FICO rely on flawed methods and biased comparisons that overstate its impact, according to analysts from AEI Housing Center.

October 3 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

The credit scoring agency's rollout comes after years of criticism from home lenders over its prices, with delivery costs rising over 40% in the past year.

October 2