-

Remote work helped fuel migration and erased the loss of rural residents that occurred in the decade prior to the arrival of Covid, Harvard researchers found.

December 15 -

The threshold regards loans where the annual percentage rate is at least 1.5 percentage points higher than the average prime offer rate on first liens.

December 15 -

The home purchase market, which competes for consumers with rentals, should remain subdued in 2026 because of high mortgage rates and low affordability.

December 15 -

Rising labor and material costs could weigh on final expenses, despite a slower summer for hurricane and tornado claims, according to Verisk.

December 15 -

The partnership also includes a $50 million equity investment in Finance of America, securing long-term alignment between the companies.

December 15 -

Confidence among US homebuilders edged up in December as builders continued to deploy sales incentives to motivate buyers.

December 15 -

After home equity surged in 2023, average gains slowed last year before falling into negative territory over the past 12 months, Cotality said.

December 12 -

For 2026, the mortgage industry operating environment will improve, while nonbank financial metrics should be within Fitch's rating criteria sensitivities.

December 12 -

The Department of Housing and Urban Development announced the FHA-insured loan caps for low- and high-cost areas, which are set based on conforming loan limits.

December 12 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12 -

ETHZilla partnered with Zippy to bring manufactured home chattel loans on-chain as tokenized real-world assets.

December 11 -

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

The lowest-priced properties purchased by investors typically left them in the red when sold, according to the latest home flipping report from Attom.

December 11 -

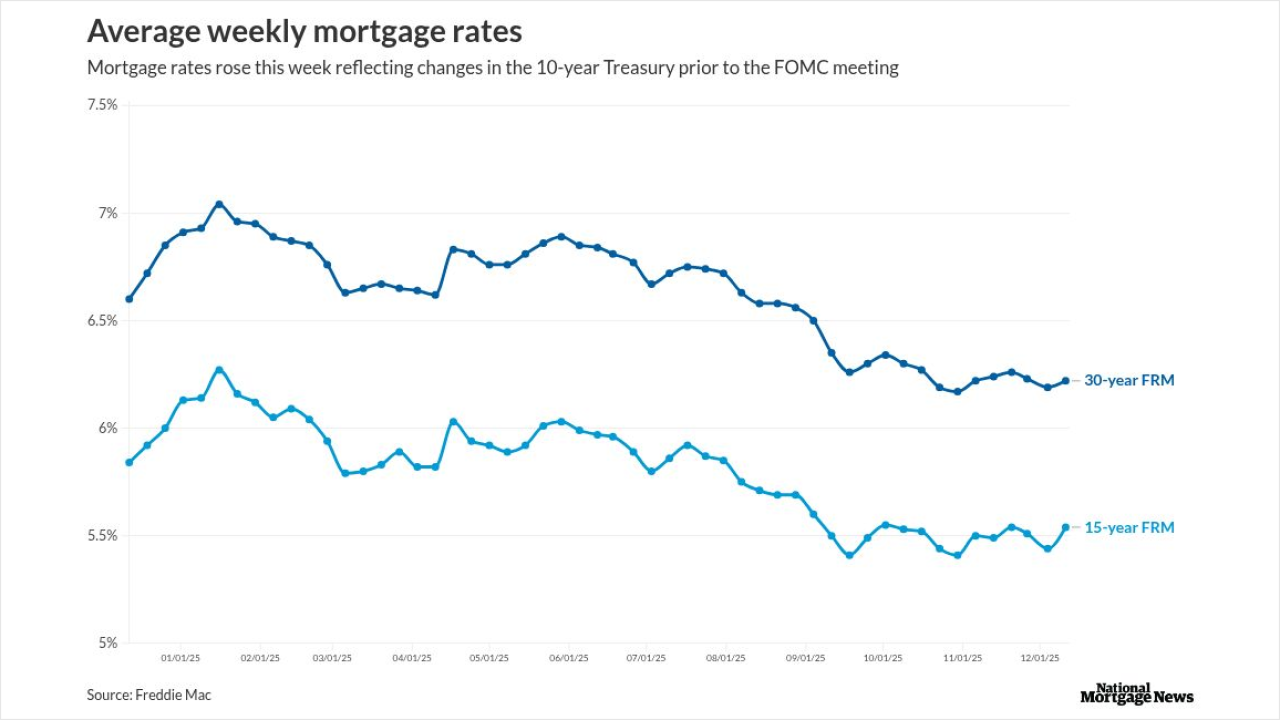

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11 -

A federal judge recommended that an enhanced real estate reporting requirement, which could send paperwork and costs soaring next year, remain intact.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

December 10 -

Hartford, Connecticut, Rochester, New York, and Worcester, Massachusetts, headed the list of the 100 largest metro areas in the country, according to Realtor.com.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10