-

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

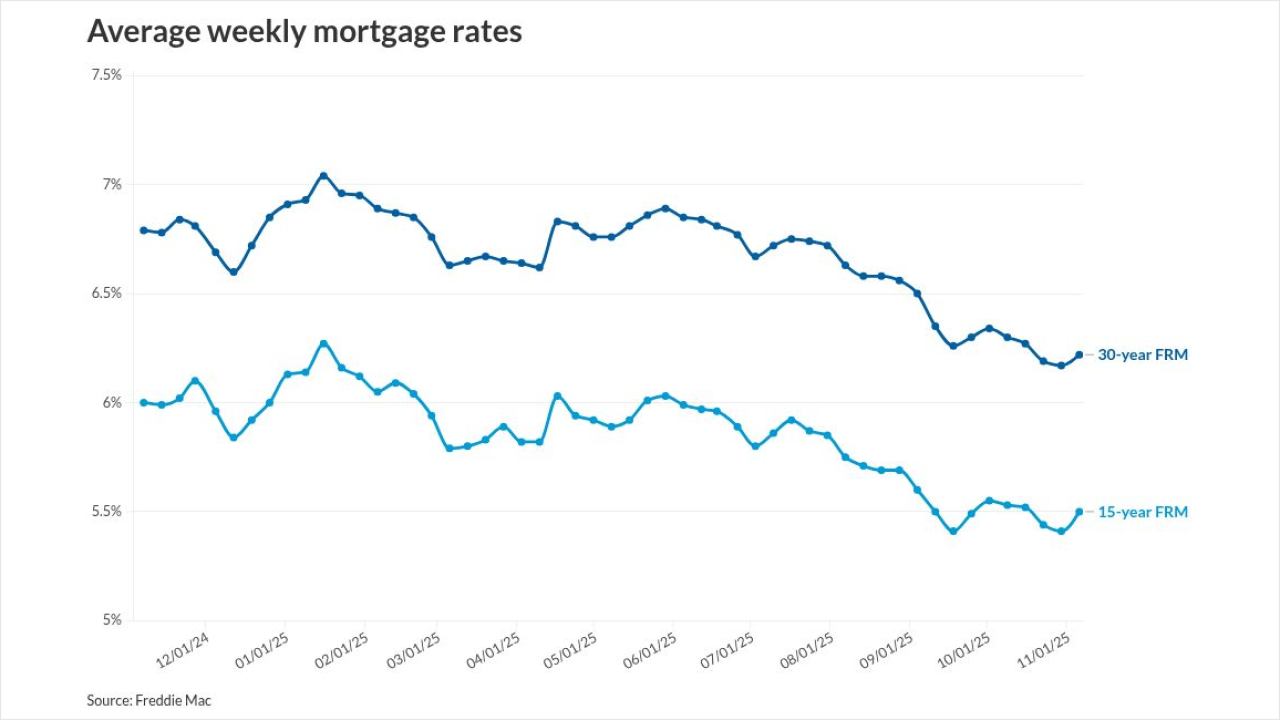

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6 -

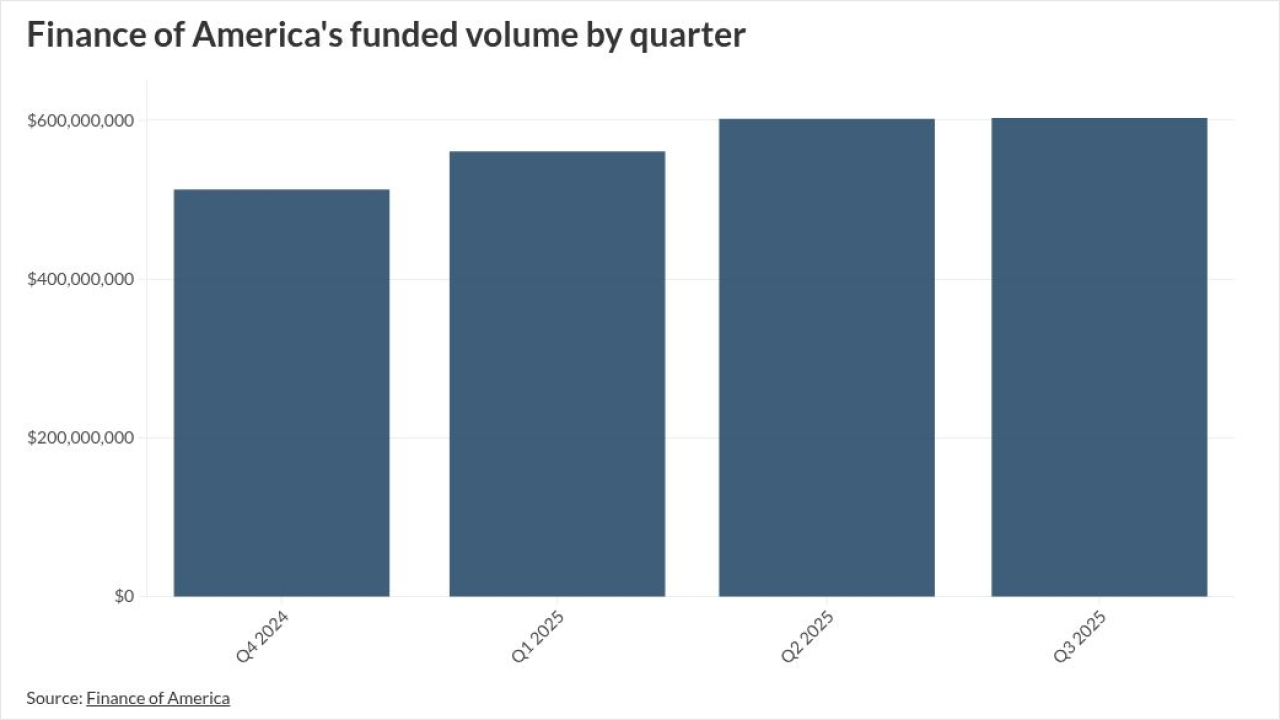

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

November 6 -

In markets across the US, homebuilders sitting on unsold inventory are subsidizing mortgage rates so heavily they sometimes match the record lows last seen during the Covid-19 pandemic.

November 6 -

Industry professionals shared stories of homeowners looking to get out and investors pausing deals, while others cautioned a wait-and-see approach.

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

The latest sale consists of close to 1,200 HECMs secured by vacant residential units found in 46 states, according to data provided by the government agency.

November 5 -

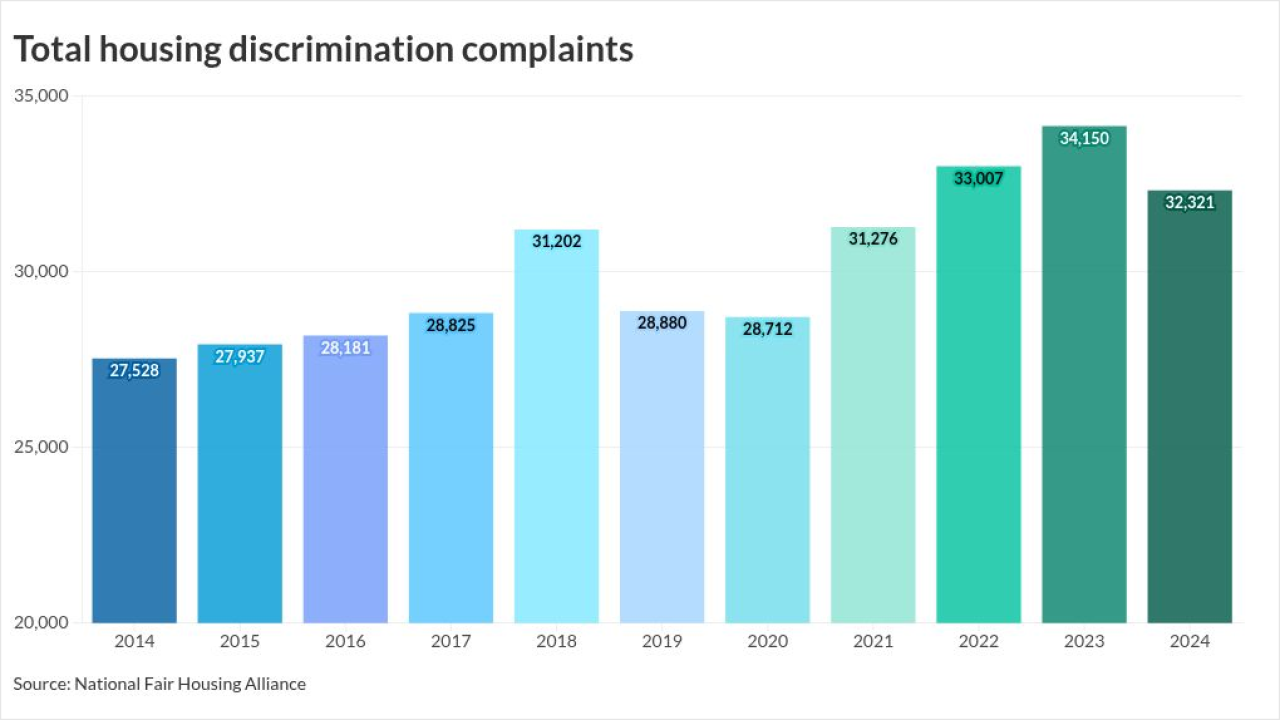

What makes the situation alarming is the government attack on the fair lending enforcement infrastructure, said Lisa Rice of the National Fair Housing Alliance.

November 5 -

Private-sector payrolls increased by 42,000 after a revised 29,000 decline a month earlier, according to ADP Research data released Wednesday.

November 5 -

Treasuries fell after the US government signaled that larger auction sizes are on the horizon, while signs of economic resilience hurt the odds a Federal Reserve interest-rate cut in December.

November 5 -

Southern states' government-sponsored enterprise share lags outside of a small number of metros, the Center for Mortgage Access' analysis of HMDA data shows.

November 5 -

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

The latest case comes after at least three other zombie lawsuits in the past year, with the owner of the loan in question claiming $173,000 in past-due interest.

November 4 -

Newer automation that can serve as a wraparound to existing technology can cut servicing costs in a competitive industry, according to fintech executives.

November 4 -

The age at which people purchase their first home has climbed rapidly since 2021, when the median was 33, according to a National Association of Realtors survey of transactions from July 2024 through June.

November 4 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

Refinancing pushed mortgage originations higher as rates eased, and home equity lending kept growing, but rising delinquencies signal mounting borrower stress.

November 3 -

Financial literacy advocate John Hope Bryant has joined with a Los Angeles-based developer in an effort to raise up to $300 million from banks to preserve and construct low-income housing around the country.

November 3