-

To keep winning business in an increasingly competitive loan channel, United Wholesale Mortgage is giving brokers more control of the borrower relationships that persist even after loans close.

July 13 -

This year's sluggish spring home buying season led to generally softer mortgage-related second quarter results at Wells Fargo, JPMorgan Chase, Citigroup and PNC Financial Services Group, but First Republic Bank bucked the trend.

July 13 -

The deal is designed to improve capital ratios and reduce risk at the Seattle company.

July 3 -

Incenter Mortgage Advisors is facilitating the sale of more than $10 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans originated by mortgage brokers.

June 21 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

Declining mortgage origination volume and record-high costs drove production income for independent mortgage bankers into negative territory, according to the Mortgage Bankers Association.

June 6 -

The Atlanta bank had previously failed compliance metrics in five straight quarters before passing them last year, according to the settlement's monitor.

June 6 -

MountainView is brokering a $3.6 billion nonrecourse package of Fannie Mae mortgage servicing rights with a high refinance loan concentration.

June 4 -

Citizens Bank's $511 million acquisition of Franklin American Mortgage will beef up the bank's servicing portfolio and diversify its origination business at a time when higher interest rates have put a damper on refinance volume.

May 31 -

From the latest economic news to the latest developments in digital mortgages, here's a look at six things we learned at the MBA Secondary Conference 2018.

May 23 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

The Ginnie Mae 2020 report coming out this summer will reveal the path the agency is taking toward working with digital mortgages, an agency executive said at an industry conference.

May 22 -

Impac Mortgage Holdings generated almost $4 million in net income during the first quarter as it continued to downsize to adjust for origination declines and benefited from servicing gains.

May 10 -

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Nationstar Mortgage Holdings reported first-quarter net income nearly four times higher compared to the fourth quarter of 2017.

May 4 -

Ocwen Financial Corp. got back in the black during the first quarter after selling New Residential Investment Corp. $110 million in economic rights to mortgage servicing.

May 2 -

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

April 30 -

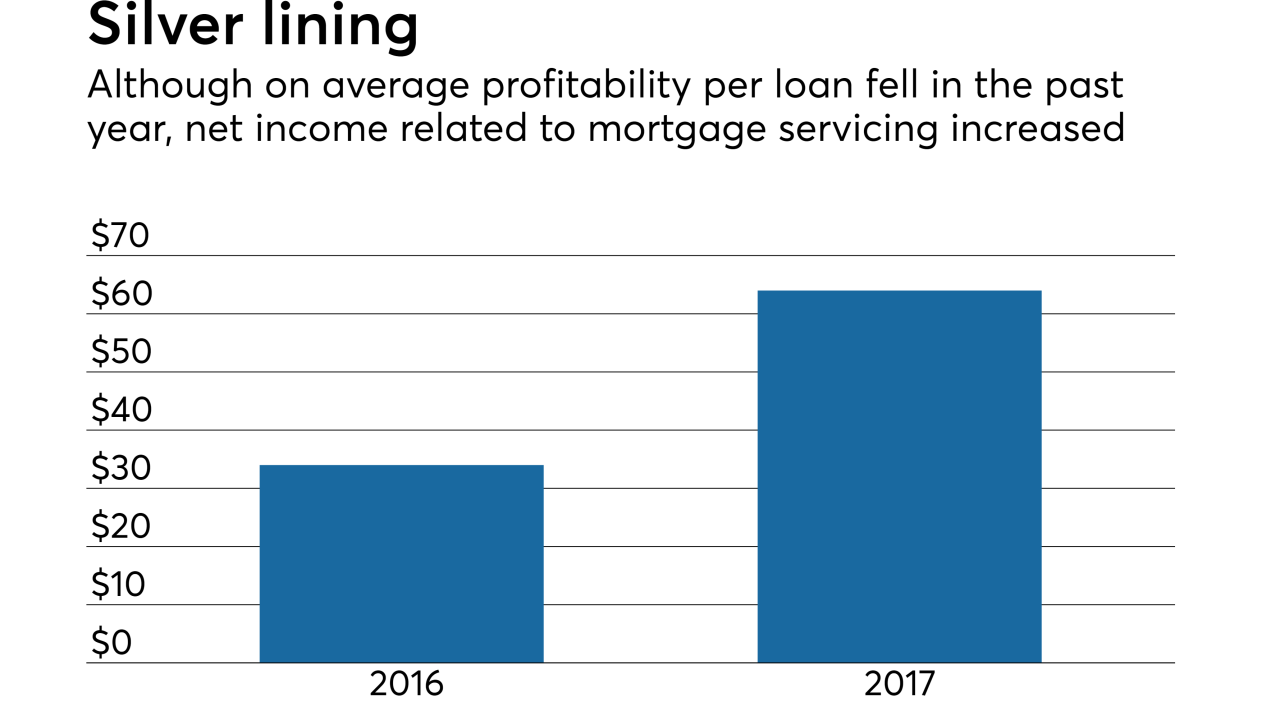

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24