-

A Dallas developer has admitted to paying bribes to a former city councilwoman in exchange for her lobbying efforts and votes to provide $650,000 in taxpayer money for his Fair Park apartment project.

August 10 -

Developer Doug Loose says he is "living in a cloud" after recently securing financing through Frankenmuth Credit Union for a portion of his $4.2 million purchase of a damaged condominium complex in Midland, Mich.

August 10 -

Citizens Bank Financial Group is funding the construction of two apartment buildings in neighborhoods northwest of Center City with a total of $27.5 million in loans, allowing the projects to move forward despite economic headwinds from the coronavirus pandemic.

August 7 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

Commercial real estate fundamentals improved in July, but the pandemic continues to affect development projects and is likely to remain a significant challenge for more than a year, according to a COVID-19 impact report by the NAIOP Commercial Real Estate Development Association.

August 6 -

For 32 years, the Bay Area city of Sausalito has used strict zoning restrictions to protect its scrappy industrial waterfront, banning both housing and offices in the 225-acre Marinship district, which stretches for about a mile north of downtown.

August 5 -

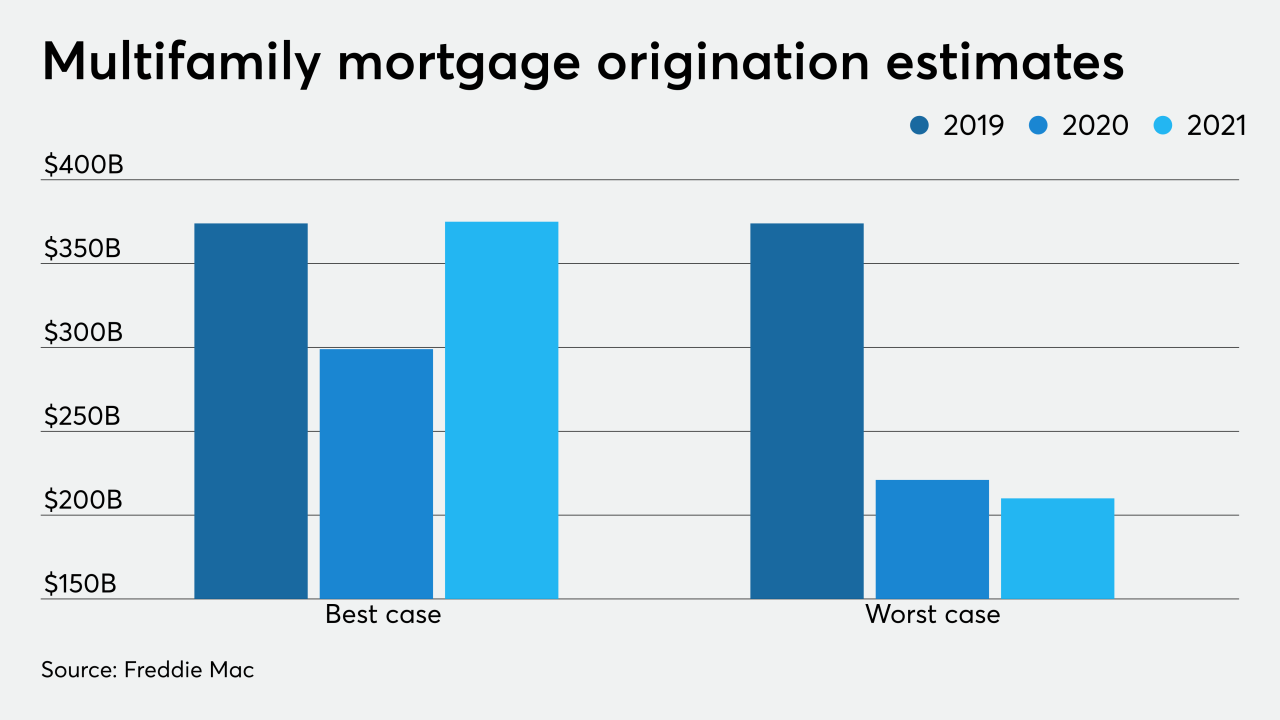

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The government-sponsored enterprise reported net earnings of $2.55 billion, up from $461 million in the first quarter.

July 30 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Congress should act in the next relief bill to provide the additional resources needed to build more affordable housing.

July 10 National Community Renaissance

National Community Renaissance -

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

July 6 -

Multifamily borrowers with loans from Fannie Mae and Freddie Mac will get an extended break for coronavirus-related hardships if they continue to give their tenants relief as well.

June 30 -

St. Louis officials approved using $5 million in federal tax credits to extend a loan to national low-income housing firm McCormack Baron Salazar, an unusual move the company said will help it weather the financial impact of the coronavirus pandemic.

June 22 -

The coronavirus pandemic brought more attention to the affordable housing issue and illuminated already vulnerable, low-income populations.

June 12 -

Homebuilding in San Diego County nearly doubled from last year in the first quarter of 2020 despite COVID-19 closures.

June 4 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

Fannie Mae and Freddie Mac have different timelines for the switch.

May 28 -

Both Fannie Mae and Freddie Mac have relaunched existing websites to provide COVID-19 tools to borrowers and servicers.

May 26