-

With more younger Americans renting than buying homes, apartment builders expect their current construction wave to continue.

January 27 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

Groundbreakings on new homes surged in December to a 13-year high, giving the housing market momentum heading into the new year amid low mortgage rates, solid job growth and optimistic buyers and builders.

January 17 -

State officials are set to grant a private-equity firm building a passenger train to Las Vegas the ability to issue tax-exempt bonds, while requests for using the funding for affordable housing go by the wayside.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

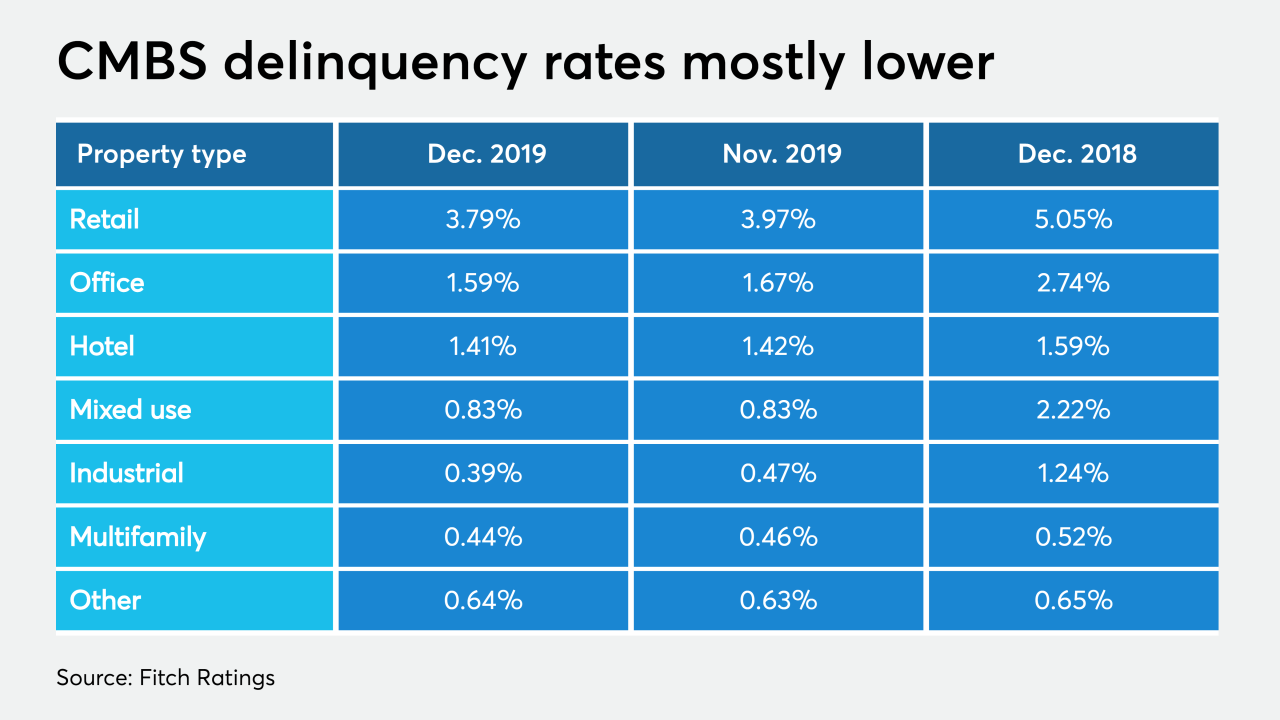

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

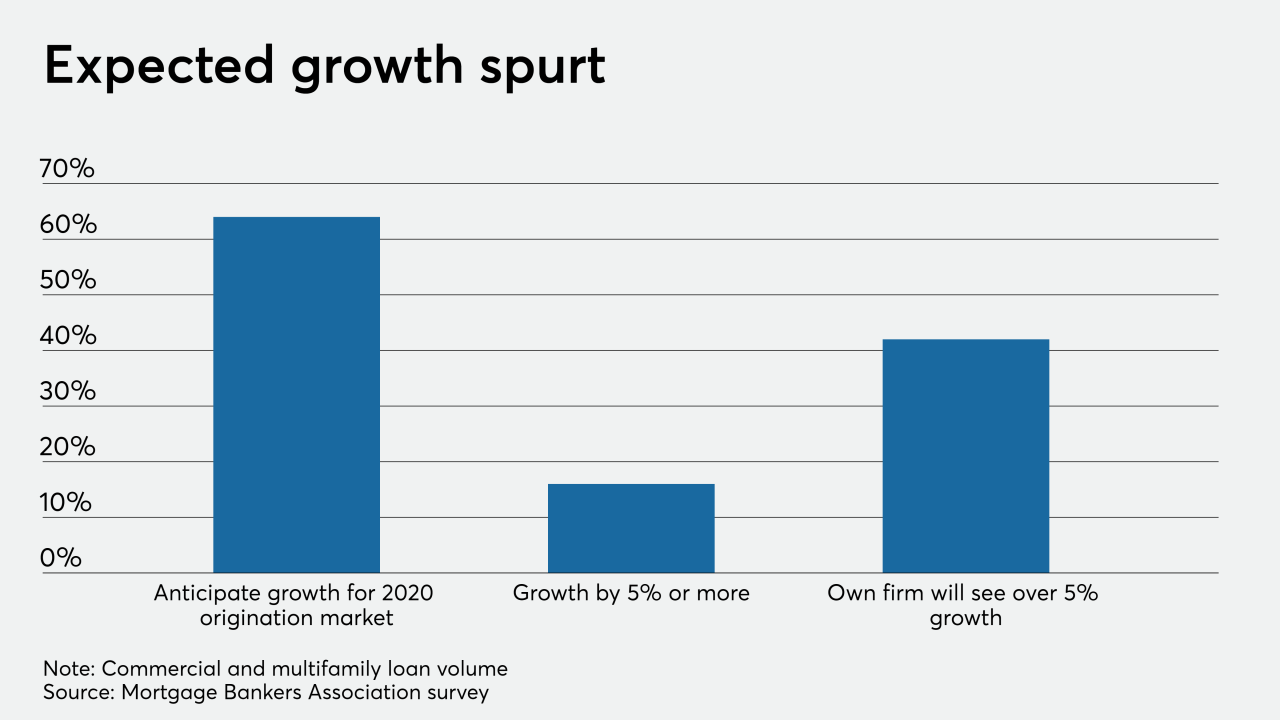

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

A Charlotte, N.C., developer detailed plans to build apartments and commercial space through a federal tax program that has faced scrutiny in recent months.

January 7 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

For decades, Seattle has been primarily a city of homeowners, but those days may be coming to an end. It's one of the many ways that the city's current population boom has been transformative.

January 6 -

Construction of new homes increased more than forecast in November and permits to build climbed to a 12-year high as the housing market strengthened amid low mortgage rates, solid job growth, and optimistic buyers and builders.

December 17 -

Issuance of Ginnie Mae mortgage-backed securities slipped after several months of gains, but high volume still pushed the year-to-date total for 2019 ahead of 2018’s full-year figure.

December 16 -

Freddie Mac launched a groundbreaking multifamily structured pass-through deal that includes a class of floating rate bonds indexed to the Secured Overnight Financing Rate for the first time ever.

December 13 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

Most U.S. construction takes place in counties with millennial concentrations, but the rate that new homes are built in these regions is relatively slower than it is elsewhere.

December 3 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

Proposals by a couple of firms that sought support from Washington Ind. officials to get special housing credits to finance the projects were turned down by the state.

November 29 -

New-home construction rose in October as single-family starts registered the strongest pace since the beginning of the year.

November 19 -

Elizabeth Warren called out Blackstone Group Inc. for its real estate practices as she laid out her tenants' rights plan, accusing the company of "shamelessly" profiting from the 2008 housing crisis.

November 19