-

Corporate culture can be a powerful tool for a good leader and a poison pill for a bad one.

November 16 STRATMOR Group

STRATMOR Group -

LoanDepot, a fast-growing mortgage lender founded after the U.S. housing bubble burst, aborted a plan to sell as much as $540 million of stock to the public, hours before it was scheduled to set a price.

November 13 -

Funds associated with David Tepper sued to block CWCapital Asset Management LLC from recovering more than $500 million in interest from the mortgage on Manhattan's largest apartment complex.

November 12 -

Loan originations for commercial and multifamily properties rose in the third quarter, the Mortgage Bankers Association reported, backing up the group's projection from last month.

November 10 -

The Consumer Financial Protection Bureau is pushing back against a lawsuit from PHH Corp. that claims the agency erred in overturning an administrative law judge's recommendation to limit the amount of penalties it could face.

November 9 -

While regulatory pressures remain top of mind for the mortgage industry, lenders surveyed by National Mortgage News are shifting their attention from defensive-minded compliance initiatives to ones that improve companies' ability to compete.

November 9 -

Clayton Homes reported a higher third-quarter profit on increased sales of its manufactured homes.

November 9 -

Nonbank mortgage lenders added 1,600 employees to their payrolls in September, which combined with revised August figures brought industry employment to its highest point in more than two years.

November 6 -

Many millennials lack knowledge about credit, despite their own concerns with their financial futures, according to a study by Experian.

November 4 -

Cherry Hill Mortgage Investment Corp. has purchased its first mortgage servicing rights portfolio, with an aggregate unpaid principal balance of roughly $1.4 billion.

November 3 -

Arch MI U.S. did $3.2 billion in new insurance written, approximately 60% more than the nearly $2 billion done in the same quarter in 2014.

October 29 -

A major investor in insurance giant American International Group is calling on the company to break itself up into three companies to get out from under its designation as one of only four systemically risky nonbanks.

October 29 -

Quicken Loans CEO Bill Emerson's term as chairman of the MBA underscores how the consumer-direct mortgage channel has grown from a quirky novelty to the force leading a technology revolution.

October 26 -

Legislation would require GAO to study the impact the FHFA membership rule would have on the FHLB System and its members.

October 23 -

The CFPBs expanded data requirements for the Home Mortgage Disclosure Act will create a powerful tool for analyzing fair lending compliance. But some say the initiative is a massive overreach that could compromise borrower privacy.

October 23 -

The head of the Consumer Financial Protection Bureau warned software vendors that they face new scrutiny from regulators for causing mortgage lenders to miss the TRID-compliance deadline. He was vague about how far the CFPB might go, but many in the industry are prone to fear the worst.

October 21 -

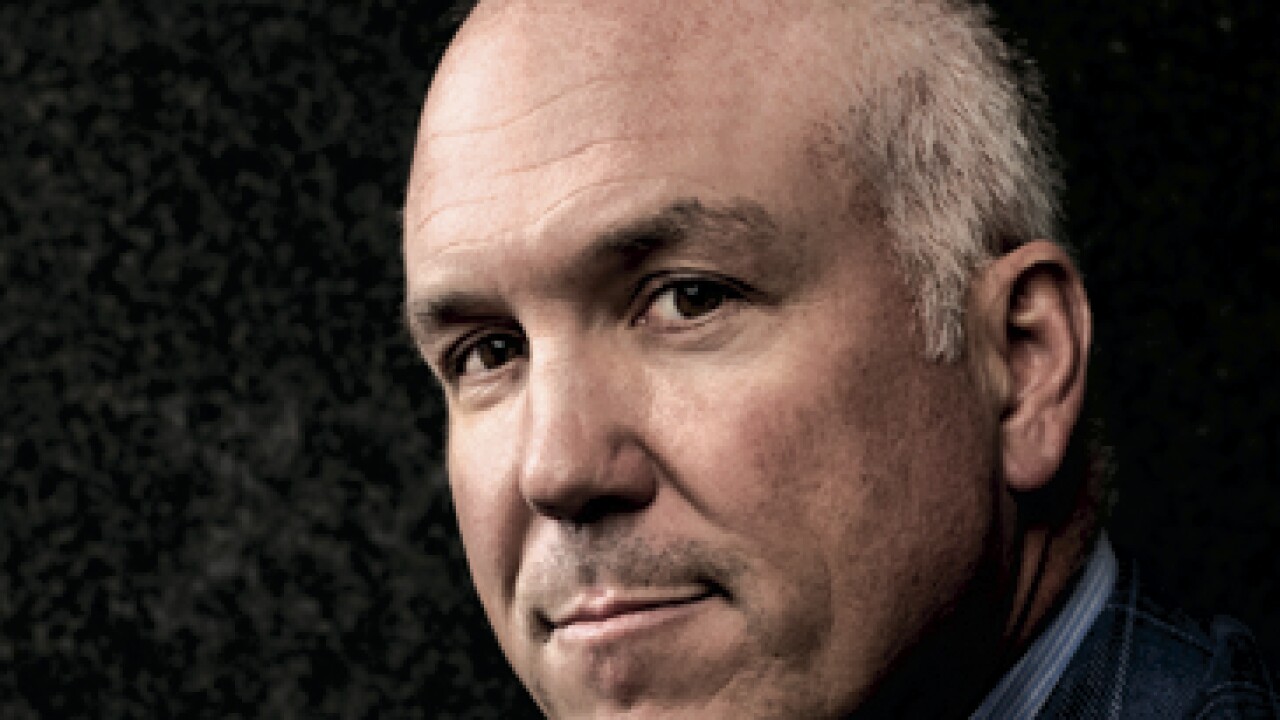

From thrift deregulation to government domination, the mortgage business is prone to dramatic shifts. Here are 10 people who share the credit, or the blame, for major industry changes.

October 21 -

Should credit unions step into a giant breach gradually being vacated by the big banks, or is the bank pull-out a sign that CUs should do the same?

October 20 -

The servicing industry is also facing higher capital requirements under the Basel III accord that are being phased in.

October 19 -

Ditech Financial, a nonbank lender in Fort Washington, Pa., is the latest lender to bring back the piggyback mortgage by offering a closed-end home equity loan product.

October 15