-

Radian Group's second-quarter earnings beat consensus estimates because of lower loan loss provisions than forecast, along with record new mortgage insurance written.

July 26 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

The Internal Revenue Service's settlement with Radian Group may result in a $74 million tax benefit for the mortgage insurer that could improve its second-quarter results.

July 19 -

Oaktown Re II is National Mortgage Insurance's first rated transaction, according to Morningstar; it reinsures $5.47 billion of policies on mortgages with a total balance of $30.12 billion.

July 18 -

Continued favorable loss development trends allowed MGIC Investment Corp. to beat analyst estimates for the second-quarter earnings report.

July 18 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11 -

Private mortgage insurance was used on approximately 4% fewer loans in 2017 when compared with 2016, according to the U.S. Mortgage Insurers.

June 8 -

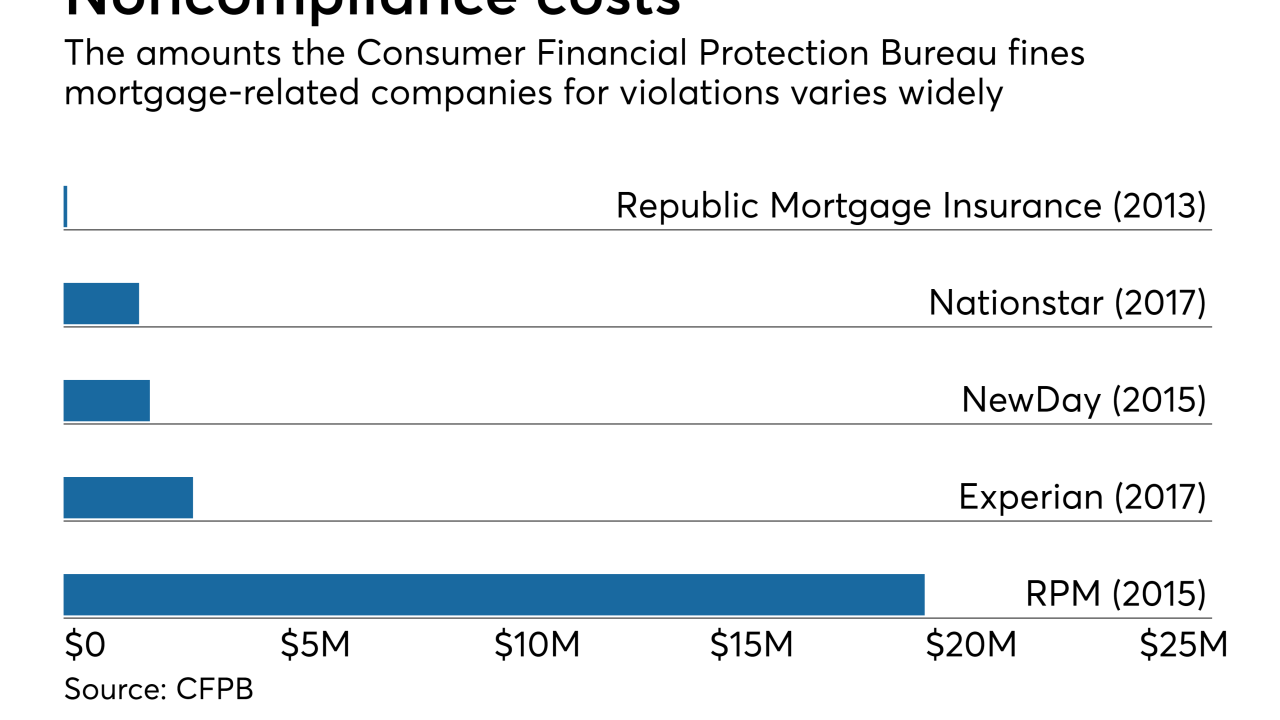

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

An increase in title orders opened helped Fidelity National Financial improve its first-quarter net income by 59% over the same period last year.

May 4 -

Arch Capital Group's mortgage insurance subsidiary slipped to No. 2 in market share just five quarters after completing the acquisition of former No. 1 United Guaranty Corp.

May 2 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

Mortgage and title insurance companies licensed in New York need to file disaster response plans this year in line with increased state attention to business continuity planning.

April 25 -

MGIC Investment Corp.'s first-quarter net income beat analysts' estimates due to favorable loss development and that should be seen with the other private mortgage insurers.

April 18 -

Radian Group is adding 40-state title insurer and settlement services company Entitle Direct to its operations in a move aimed at complementing the geographic reach of its existing title agency.

March 28 -

Freddie Mac and Arch Capital are testing a new form of risk-sharing deal to boost investor appetite for low down payment mortgages. But the pilot is raising concerns about "charter creep" because it dictates private mortgage insurance decisions typically made by lenders.

March 14 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

NMI Holdings' common stock sale puts the company in a stronger position for future fundraising efforts, such as a now-delayed debt offering.

February 28 -

Participants at the Structured Finance Industry Group conference in Las Vegas say that future deals could be linked to the performance of jumbo, as well as conforming loans.

February 28 -

First-time homebuyers using loans backed by private mortgage insurance soared in the fourth quarter on the growing popularity of Fannie Mae and Freddie Mac's 3% down payment options, according to Genworth.

February 22