-

The seasoning clock for securitization eligibility restarts when a modification takes place, the government agency said.

November 4 -

The Fed said it would reduce Treasury purchases by $10 billion and mortgage-backed securities by $5 billion, marking the beginning of the end of the program aimed at shielding the economy from Covid-19.

November 3 -

Lawmakers from both parties are pushing for legislation to automatically substitute a new interest rate benchmark for the expiring London interbank offered rate in certain hard-to-amend legacy contracts.

November 2 -

The move by the agency, which is an arm of the Department of Housing and Urban Development, will help further efforts to give servicers more leeway to modify mortgage terms.

October 29 -

The bureau’s new director named former Obama administration officials Lorelei Salas and Eric Halperin, respectively, as the heads of supervision policy and enforcement.

October 29 -

Secretary Marcia Fudge’s statement has implications for other tribal nations in Oklahoma and may be watched closely by other government officials, housing and civil rights advocacy groups.

October 25 -

Eric Halperin, a longtime consumer advocate, is the first big hire by the new director of the Consumer Financial Protection Bureau.

October 22 -

Several housing groups wrote a letter calling for “substantially improved written proposals” for the period starting in 2022, and support for chattel manufactured-home loans.

October 21 -

Democrats’ $3.5 trillion social policy package would appropriate over $300 billion for housing-related measures, including down payment assistance for first-time homebuyers. But those provisions could be on the chopping block as centrists try to trim the bill’s price tag.

October 13 -

Zixta Q. Martinez has been with the Consumer Financial Protection Bureau since its inception a decade ago and most recently was a senior advisor in the supervision, enforcement and fair-lending division.

October 13 -

Federal Reserve Vice Chairman for Supervision Randal Quarles will be removed from his role as the main watchdog of Wall Street lenders after his title officially expires this week.

October 13 -

An Indiana housing nonprofit wants the Fed to take a closer look at the proposed merger. Its latest move is a lawsuit that alleges racial discrimination by the regional bank.

October 7 -

Lawmakers appeared supportive of Alanna McCargo's nomination at a Senate hearing Thursday. If confirmed, the former Urban Institute vice president would fill a role that has been vacant since 2017.

October 7 -

Common Securitization Solutions has disbanded a group of independent board members originally brought on in early 2020 to look into using the government-sponsored enterprises’ platform to serve a broader market.

October 6 -

The change could reduce the workout activity expected to spike around what had been final cut-off dates set for this fall.

October 5 -

The organizations have created the Racial Equity Accelerator for Homeownership, a two-year incubator for the development of innovations to address racial inequality in wealth and housing.

October 5 -

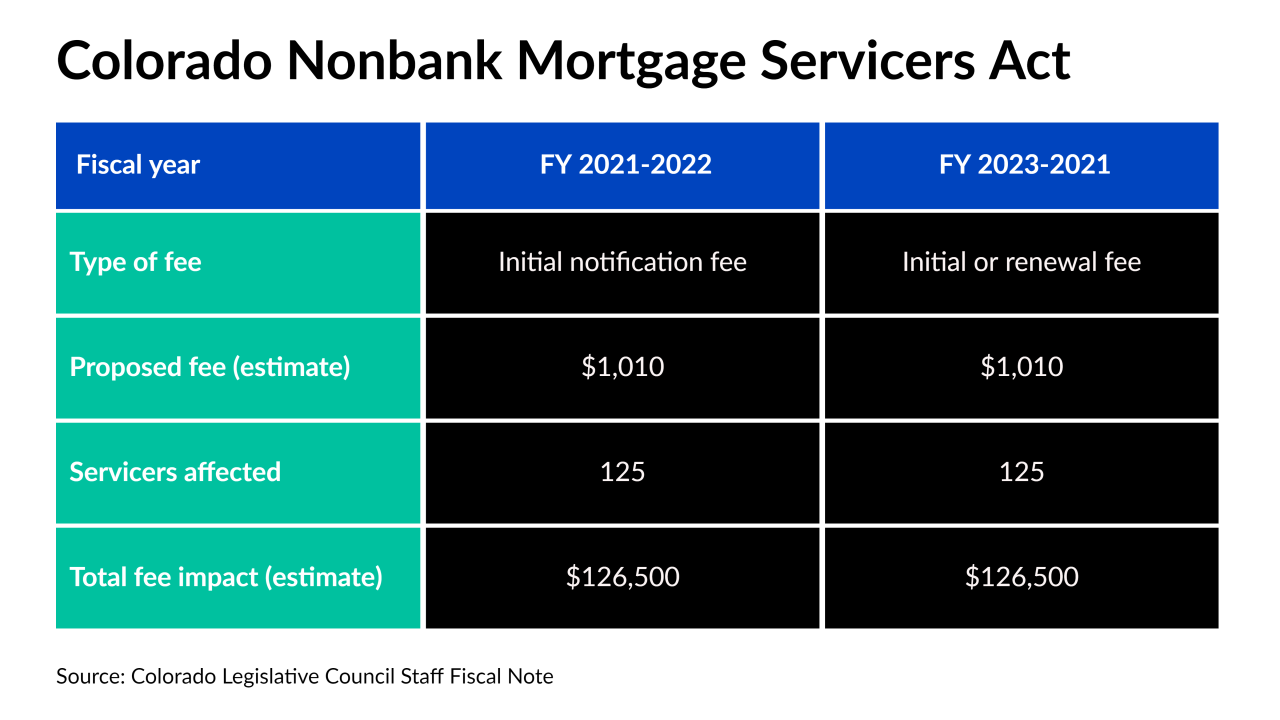

Non-depositories in the business also will have to submit annual reports and retain records for four years after they stop servicing the loan.

October 4 -

The Federal Housing Administration changes are effective immediately with a mandatory Dec. 31 compliance deadline, according to an information bulletin published Sept. 30.

October 1 -

Rohit Chopra, a liberal consumer watchdog, was approved as the agency’s director nine months after the Biden administration first announced him as the nominee.

September 30 -

The Federal Housing Finance Agency agreed to rework and improve procedures for regulatory communication about issues like servicing lapses in response to a recent inspector general audit.

September 29