The deadline for initial forbearance requests for Federal Housing Administration-insured and Department of Veterans Affairs guaranteed loans has been extended, according to the

Previously set for Sept. 30, the deadline for initial forbearance requests for FHA, VA and U.S. Department of Agriculture loans won’t arrive until the pandemic ends.

“If you have a home loan backed by HUD/FHA, USDA, or VA, your mortgage servicer is authorized to approve initial COVID hardship forbearance requests until the...National Emergency is officially over,” the CFPB said.

The Department of Housing and Urban Development and the VA confirmed the change. HUD is now providing an additional six months for borrowers with coronavirus hardships for borrowers who request forbearance between Oct. 1 and the end of the National Emergency. Forbearance may be extendable for a second six-month term if it expires before the National Emergency ends, according to an FHA bulletin.

The move follows

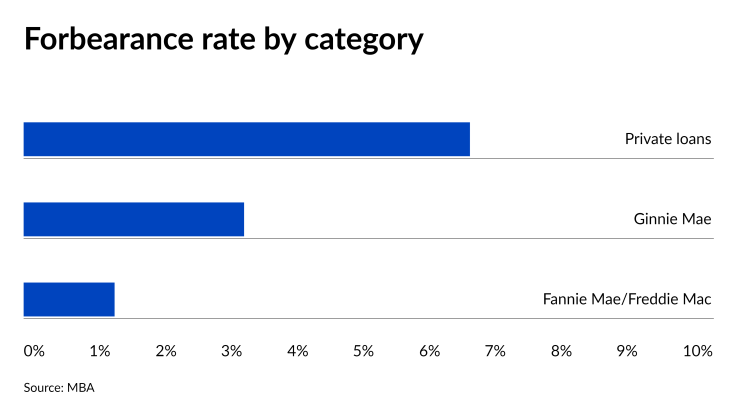

The extension provides additional assistance to a group of government-related borrowers with relatively higher levels of distress and could affect what’s generally been a downward trajectory in forbearance rates. It also could reduce the extent to which workout activity spikes this fall. Modifications had been expected to increase following the original forbearance request deadline.

The forbearance rate for FHA, VA and USDA loans packaged into government-insured Ginnie Mae securities was 3.35%, down from 3.42% in