-

Mamdani issued several other orders, including one that created a new office devoted to community engagement and three that concern housing and real estate.

January 2 -

A definitive move could occur as early as fiscal year 2026 or take until 2033, depending on what the government is willing to do, according to one analyst.

January 2 -

For 2026, most Wall Street interest-rate strategists expect stable-to-higher Treasury yields as the Fed's rate-cutting cycle comes to an end.

January 2 -

After the ceremony on Thursday, Mamdani announced three executive orders focused on housing affordability to kickstart his agenda.

January 2 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

December 30 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30 -

As CFPB oversight recedes, servicers are turning to FHA, VA and state rules for guidance, with distressed loan compliance, redefaults and local registration risks rising in 2026.

December 30 -

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

December 29 -

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

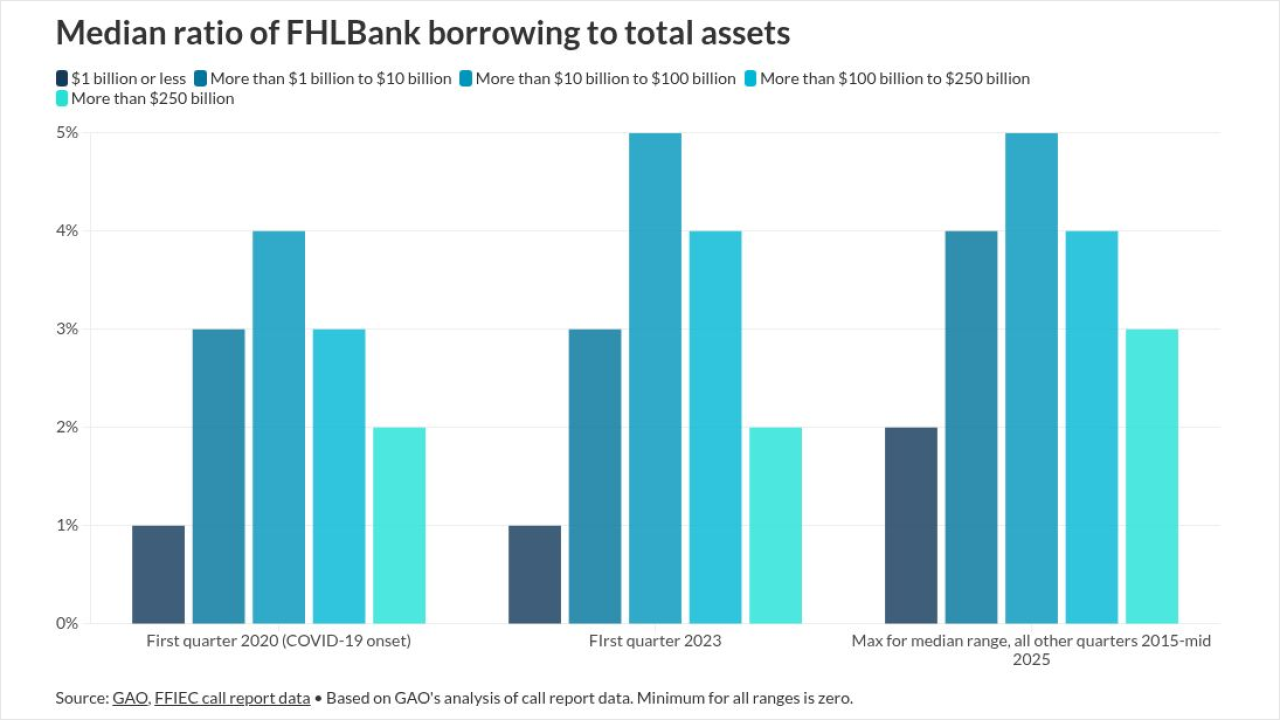

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

A group of 22 Democratic state attorneys general filed a lawsuit against acting Consumer Financial Protection Bureau Director Russell Vought, the bureau and the Federal Reserve, arguing that the administration's position that the CFPB cannot be funded is wrong.

December 23 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

The Federal Reserve said in a statement that its "understanding of innovation products and services have evolved" since the initial guidance was published in 2023.

December 18 -

A markup of the bipartisan Housing for the 21st Century Act was passed by a 50-to-1 margin by the House Financial Services Committee earlier this week.

December 18 -

Further mortgage payment reductions and other "aggressive" changes to federal policy impacting homeowners are on the roadmap for the coming year.

December 18 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16