-

Heartland Financial USA has hired Insuritas to help it expand its insurance business.

September 16 -

In the wake of an unprecedented U.S. housing bust that evolved into a global financial crisis, the business of bundling home loans that aren't backed by the American government into bonds that can be sold to investors has all but disappeared.

September 11 -

American International Group won a decision that narrowed the claims by six investment funds that opted out of a $970.5 million class-action settlement last year over allegations the insurer misled investors about its exposure to subprime mortgages.

September 11 -

Three former Nomura Holdings Inc. traders pleaded not guilty to charges that they defrauded investors by inflating the prices of mortgage-backed securities in the wake of the U.S. financial crisis.

September 10 -

Three former Nomura Holdings Inc. traders were charged with defrauding investors by inflating the prices of mortgage-backed securities, the latest cases to come out of a U.S. crackdown on deceptive sales practices in the market for complex bonds.

September 9 -

Years after the great American housing bust, mortgages akin to the so-called liar loans which were made without verifying peoples finances are creeping back into the market.

September 8 -

About a fifth of the $163 million in credit Citi has earned under terms of the 2014 settlement would be considered extra credit. Citi can earn extra credit by doing things such as completing loan modifications early or reducing loan-to-value ratios below certain levels.

September 3 -

The price of loans that underlie commercial mortgage-backed securities rose in July on a monthly basis, according to DebtX.

September 2 -

American Homes 4 Rent is sticking with a feature that reduces refinancing risk in its upcoming single-family rental securitization.

September 2 -

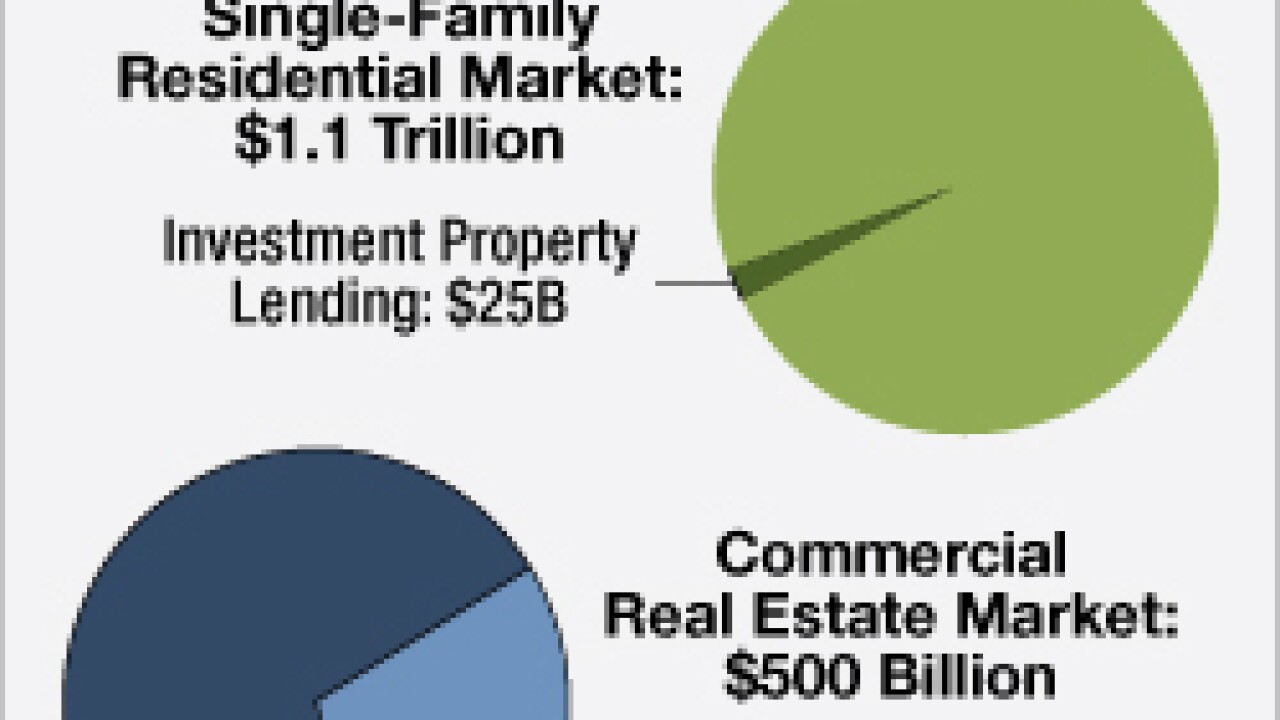

Marketplace lenders seek to disrupt traditional financial services with online platforms that connect borrowers to investors. But in real estate, this burgeoning sector has taken an approach that seeks to co-exist with, rather than supplant, the traditional mortgage market.

August 31 -

Residential mortgage servicers are once again tapping the securitization market to fund advances to bondholders for the first time since April 2014.

August 28 -

Four more Federal Home Loan Banks have won regulatory approval to participate in a program that allows member institutions to sell jumbo mortgage loans through a conduit to Redwood Trust.

August 14 -

It was a small deal about 220 U.S. home loans packaged into a $72 million bond offering but it's looking like a post-crisis milestone.

August 14 -

New Residential Investment Corp., real estate investment trusts, residential mortgage bonds, mortgage servicing rights

August 11 -

Shellpoint Partners is preparing to issue its first private-label residential mortgage-backed security since walking away from its last deal in 2013.

August 7 -

United Guaranty Corp., the private mortgage insurance subsidiary of American International Group, has obtained reinsurance coverage on approximately $299 million of the book of business it wrote between 2009 and the first quarter of 2013.

August 6 -

Stark Enterprises, a commercial real estate developer in Cleveland, has formed a capital-markets division to provide equity and debt financing and related services.

August 5 -

Goldman Sachs Group Inc. increased its estimate for reasonably possible legal costs in excess of reserves by 55% to $5.9 billion.

August 3 -

The price of loans that underlie commercial mortgage-backed securities fell from May to June, according to DebtX.

July 28 -

JPMorgan Chase & Co. agreed to pay $388 million to settle a suit by investors who claimed the bank misled them about the safety of $10 billion worth of residential mortgage-backed securities, a lawyer said.

July 20