-

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

Jeff Tennyson is out as president of Radian Group's Clayton Holdings real estate services business as the holding company provided further details about its restructuring plan.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Entrepreneurs like LendingHome's Matt Humphrey are upending mortgage finance with tactics borrowed from fintech, marketplace lending and the traditional mortgage playbook.

October 16 -

Hurricane Irma could potentially affect more private-label mortgage securities collateral than any other recent storm.

September 11 -

Former Ginnie Mae President Ted Tozer will join securitization pioneer Lewis Ranieri at a new housing policy team at the Milken Institute.

September 7 -

MFA Financial Inc. co-CEO William Gorin died Aug. 10 after a long illness. He was 59.

August 14 -

Wells Fargo & Co. surprised investors this week by withholding more than $90 million due to buyers of pre-crisis residential mortgage-backed securities.

June 30 -

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

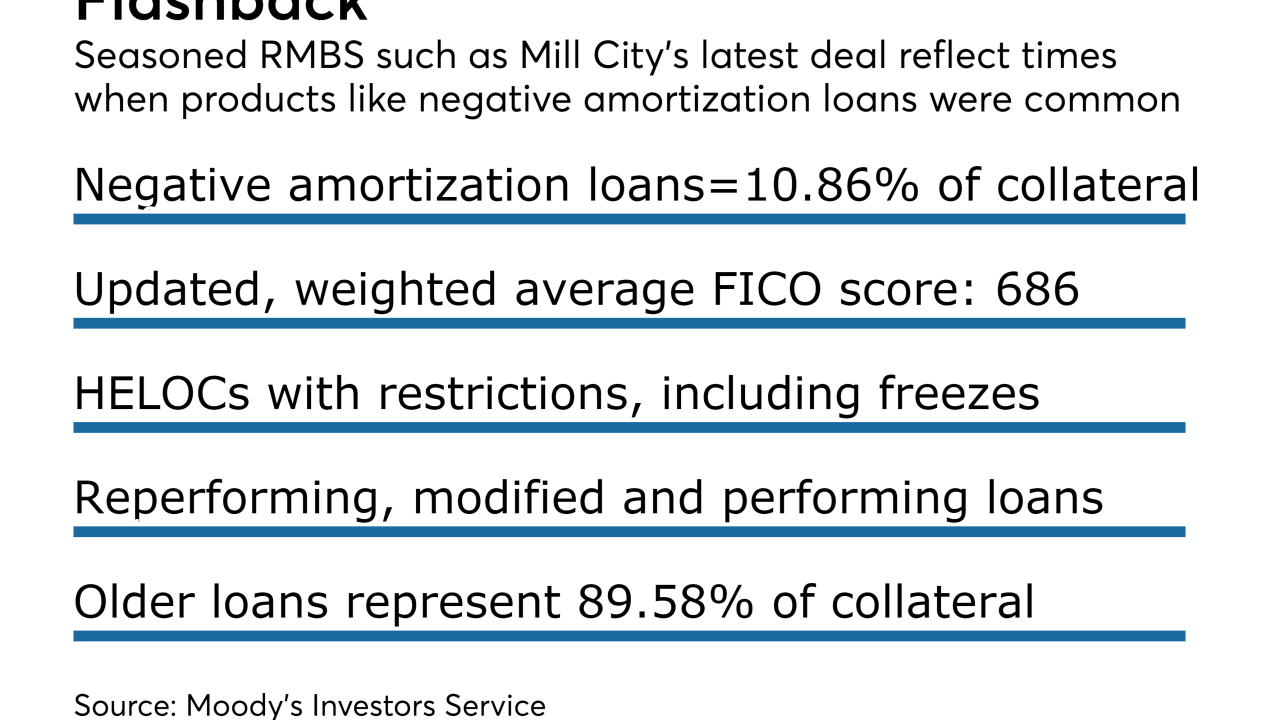

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

American International Group Inc. could securitize through a unit it has previously used to buy jumbo loans.

June 6 -

Two Harbors Investment Corp. is spinning out its commercial real estate lending business to a newly created real estate investment trust, Granite Point Mortgage Trust Inc.

May 24 -

PHH Corp.'s first-quarter net loss more than doubled as the troubled mortgage company dumps its origination unit and servicing rights and rebuilds as a subservicer.

May 10 -

U.S. securities regulators are investigating whether bonds backed by single-family rental homes and sold by Wall Street's biggest residential landlords used overvalued property assessments.

May 9 -

Incenter Mortgage Advisors is brokering an $898 million alt-A bulk servicing rights portfolio for an undisclosed bank.

April 21 -

Royal Bank of Canada is the latest Canadian firm to explore a sale of bonds backed by uninsured residential mortgages.

April 20 -

The real estate investment trust has become a regular issuer, relying on a strategy of exercising "clean-up calls" on older mortgage bonds that it services.

April 18 -

Fourteen institutional investors represented by the law firm Gibbs & Bruns are supporting the Lehman Brothers bankruptcy plan administrator's offer to settle certain securitized mortgage repurchase claims with securities' trustees.

April 3