-

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

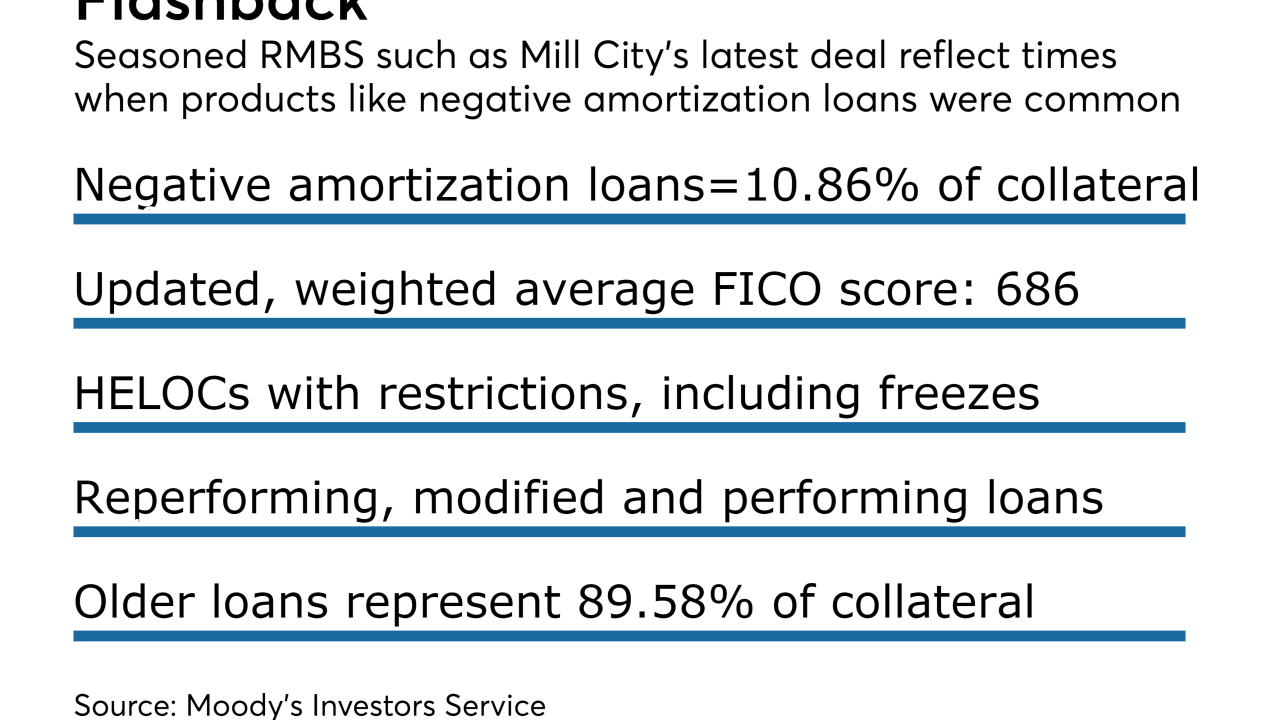

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

American International Group Inc. could securitize through a unit it has previously used to buy jumbo loans.

June 6 -

Two Harbors Investment Corp. is spinning out its commercial real estate lending business to a newly created real estate investment trust, Granite Point Mortgage Trust Inc.

May 24 -

PHH Corp.'s first-quarter net loss more than doubled as the troubled mortgage company dumps its origination unit and servicing rights and rebuilds as a subservicer.

May 10 -

U.S. securities regulators are investigating whether bonds backed by single-family rental homes and sold by Wall Street's biggest residential landlords used overvalued property assessments.

May 9 -

Incenter Mortgage Advisors is brokering an $898 million alt-A bulk servicing rights portfolio for an undisclosed bank.

April 21 -

Royal Bank of Canada is the latest Canadian firm to explore a sale of bonds backed by uninsured residential mortgages.

April 20 -

The real estate investment trust has become a regular issuer, relying on a strategy of exercising "clean-up calls" on older mortgage bonds that it services.

April 18 -

Fourteen institutional investors represented by the law firm Gibbs & Bruns are supporting the Lehman Brothers bankruptcy plan administrator's offer to settle certain securitized mortgage repurchase claims with securities' trustees.

April 3 -

PHH Corp. President and CEO Glen Messina will step down in June at the company's annual meeting.

March 30 -

The new entity, called Guaranteed Rate Affinity, will primarily originate and market its services to Realogy's real estate brokerage and relocation subsidiaries.

February 16 -

PHH Corp. has struck a deal with LenderLive to sell its private-label mortgage operations in Jacksonville, Fla., to the Denver-based mortgage services provider.

February 16 -

In the aftermath of enforcement actions, non-executive chair Phyllis Caldwell is directing the special servicer's efforts to diversify its leadership and business model.

February 14 -

JPMorgan Chase is known to eschew selling conforming mortgage loans to Fannie Mae and Freddie Mac, preferring to securitize them in the private-label market.

February 13 -

Invictus Capital Partners, a nonprime mortgage lender based in Washington, D.C., is making its debut in the securitization market.

February 10 -

In order to address lenders' issues with mortgage servicing rights financing, the industry needs to reconsider its typical securitization structures.

January 20 Alston & Bird LLP

Alston & Bird LLP -

PHH is selling its remaining residential mortgage servicing portfolio to the real estate investment trust New Residential.

December 29 -

It's unclear how the new political environment will affect the platform's viability or how investors will view the securities issued on it. The next year could determine the project's success and role reshaping the secondary mortgage market.

December 27 -

Deutsche Bank and Credit Suisse Group agreed to pay a combined $12.5 billion to resolve U.S. investigations into sales of the toxic debt that fueled the financial crisis, putting behind them a major dispute that undermined confidence in the banks and raised questions about their turnarounds.

December 23