-

The Minneapolis company attributed the uptick to new tech tools, additional loan officers and other process improvements — not to mention the refi boom fueled by lower rates. It’s a formula other banks are expected to copy.

October 16 -

Executives sent a letter to the federal banking regulators last month expressing concern that an alternative to the London interbank offered rate could limit credit availability.

October 16 -

The Minneapolis bank says recent investments in its retail operation contributed to strong improvement in home lending and mortgage banking fees.

October 16 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

With long-term interest rates at historic lows, mortgage refinancing is coming on strong. But that additional revenue may not be enough to offset net interest margin pressures and lost servicing income.

August 15 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

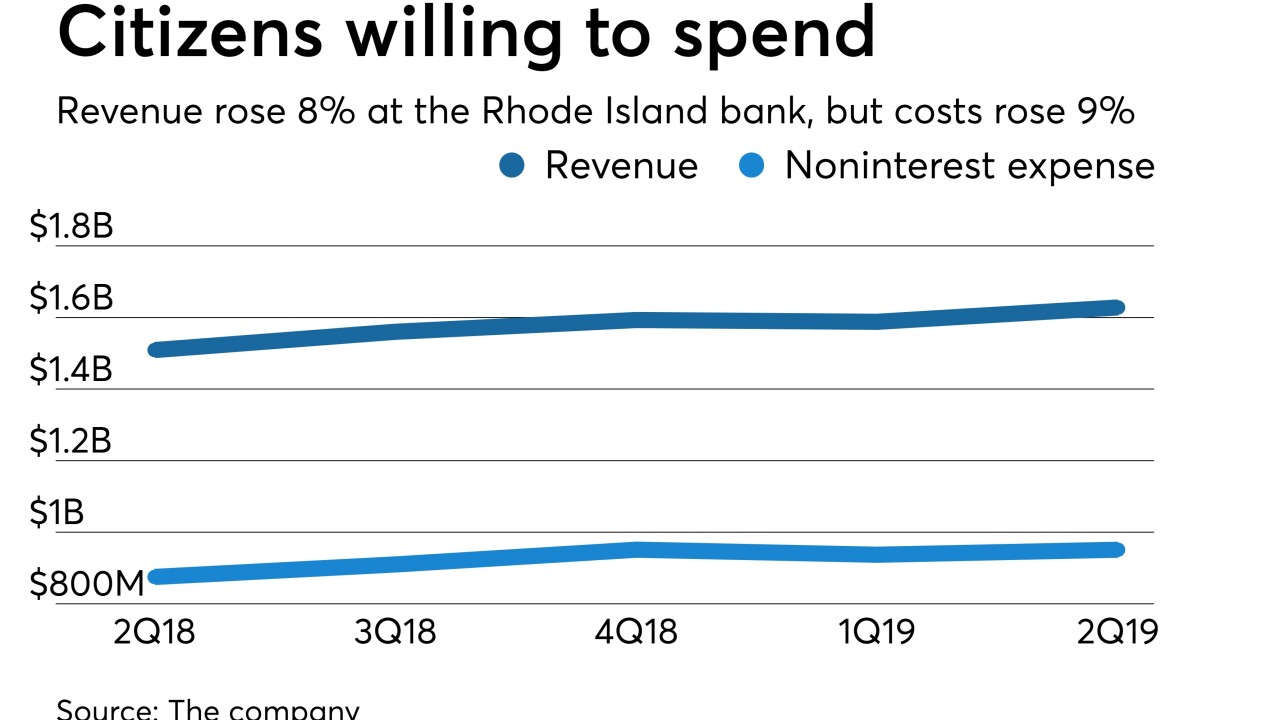

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

The company disclosed that it paid $146 million for servicing rights associated with $13 billion in mortgages.

February 21 -

Credit card issuers would have to set aside more in reserves because of higher loss histories, according to research by Keefe, Bruyette & Woods on the impact of the new loan-loss standard.

February 20 -

Why now? Will it work? How will their rivals respond? The megadeal between the two East Coast regionals offers up plenty of grist for speculation.

February 8

-

The industry's largest acquisition in more than a decade will create the sixth-biggest bank in the country, with assets of more than $442 billion.

February 7 -

CrediFi helps bankers pursuing commercial real estate loan growth minimize the risk in lending to customers they historically haven't served.

January 29 -

The move allows the New York multifamily lender to make more loans without having to raise capital.

November 15 -

A deal between TD Bank and a Vermont nonprofit is just one example of how banks are getting creative in addressing affordable housing needs while reaping financial and regulatory benefits.

October 30 -

The company is facing criticism after a big chargeoff on two properties, showing that investors have little patience when a risky business model shows signs of distress.

October 19 -

The Portland, Ore, company also benefited from lower expenses and an improved efficiency ratio.

October 18 -

A number of banks have stepped up efforts to lend to residential developers, though they are mindful of missteps made before the financial crisis.

August 20