Regulation and compliance

Regulation and compliance

-

Federal law enforcement authorities have arrested 74 people in this country and abroad, accusing them of participating in a wire fraud scam whose victims included real estate attorneys and settlement service providers.

June 12 -

The agency proposed new minimum capital requirements for Fannie Mae and Freddie Mac that would only go into effect if the government ends its conservatorships.

June 12 -

Groups representing banks, credit unions, the housing industry and others argue in favor of a bill requiring the CFPB to issue timely guidance on its rules.

June 12 -

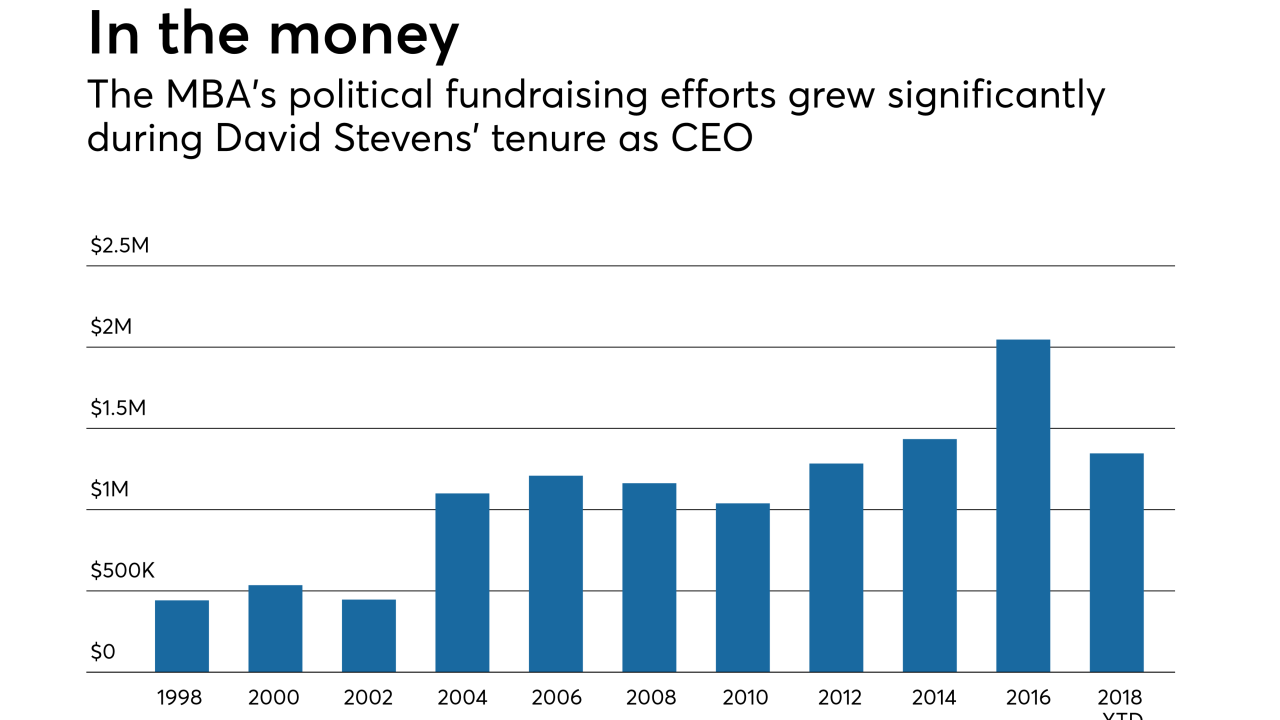

Robert Broeksmit has a tough act to follow succeeding David Stevens, the CEO revered for navigating the Mortgage Bankers Association through one of its most tumultuous eras on record. But in doing so, Broeksmit has a distinct advantage over many of his predecessors: inheriting an organization on the upswing.

June 8 -

The acting director cited the size of advisory boards and some members’ reticence among reasons for his decision.

June 8 -

Federal authorities charged a third real estate investor with bribery-related offenses in a long-running corruption probe of the process through which the Philadelphia Sheriff's Office sells seized and foreclosed properties.

June 8 -

Acting CFPB Director Mick Mulvaney wrote in a two-paragraph filing that the Mount Laurel, N.J., company did not violate the Real Estate Settlement Procedures Act.

June 7 -

Two Orange County, Calif., men were to federal prison for their part in a mortgage scheme that led to the fraudulent purchase of more then 100 condominium units and $10 million in losses.

June 7 -

The Consumer Financial Protection Bureau fired all 25 members of the agency's Consumer Advisory Board during a conference call Wednesday, saying it wanted to bring in more diverse views.

June 6 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney is poised to dismiss its administrative proceeding against the mortgage lender, following a four-year battle over the agency's structure.

June 6 -

The Atlanta bank had previously failed compliance metrics in five straight quarters before passing them last year, according to the settlement's monitor.

June 6 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

Freedom Mortgage is being punished by a government-owned mortgage guarantor amid concerns that the Mount Laurel, N.J.-based company is helping to enable unnecessary refinances of veterans' loans.

June 4 -

While all cities show signs of healthy mortgage competition nationwide, some areas have higher concentrations of lender activity but also face varying degrees of competitiveness based on loan type, according to LendingTree.

June 1 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

Ditech Holding Corp. has received a second notice from the New York Stock Exchange warning its common stock could be delisted for not being in compliance with the exchange's requirements.

May 29 -

Lenders would have a lighter data-reporting burden, but they may end up deciding to collect the data anyway.

May 25 -

Gary Klopp of Nottingham, Md., was ordered to pay more than $525,000 and temporarily barred from working in the mortgage industry by a U.S. District Court judge for violating a previous court order, according to Maryland Attorney General Brian Frosh.

May 24 -

As President Trump signed the regulatory relief bill into law on Thursday, most of the attention was on a provision to help regional banks with more than $50 billion of assets. But a majority of the new law is aimed at helping institutions below $10 billion. Here's how.

May 24