Regulation and compliance

Regulation and compliance

-

Cathay General Bancorp in Los Angeles has agreed to a community reinvestment plan tied to its deal to buy SinoPac Bancorp from Bank SinoPac in Taiwan.

November 1 -

The Federal Reserve has maintained historically low interest rates for too long, causing superficially high prices in housing and other assets. The outcome of the presidential election will likely decide whether the Fed maintains the status quo or embraces risk and raises rates.

October 31 -

The mortgage industry is welcoming the Obama administration's possibly final word on housing finance reform, hoping it will serve as guidepost for the future.

October 28 -

Mortgage brokers were among the companies that received the regulator's warning letters, but brokers are not required to report HMDA data leading many to suspect mini-correspondents, which straddle the line between broker and lender, were the recipients.

October 28 -

Both Fannie Mae and Freddie Mac failed to achieve their low-income and very low-income single-family home purchase goals for 2015, the Federal Housing Finance Agency annual housing report said.

October 28 -

The CFPB sent letters Thursday to 44 mortgage lenders and brokers warning them of potential reporting violations related to their mortgage lending activities infractions the bureau is increasingly pushing lenders to take seriously.

October 27 -

A financial report due out soon could reignite a battle over whether the Federal Housing Administration should again reduce its annual premium.

October 27 -

Barclays is trying to draw a line at $2 billion in penalties to settle a U.S. investigation into its sale of mortgage securities after it received an opening offer that it considered too high.

October 27 -

Flagstar Bancorp's quarterly profit increased after a decline in the value of a 2012 legal settlement liability tied to its mortgage lending practices.

October 25 -

The Consumer Financial Protection Bureau will require underperforming servicers to document the technology and process changes they're making to implement the agency's recently released servicing regulations.

October 25 -

-

David Stevens, the chief executive and president of the Mortgage Bankers Association, revealed Monday that he has been diagnosed with cancer in prepared remarks at the association's annual conference in Boston.

October 24 -

A title agent's cost for closing a loan increased an average of $210 nationwide in the third quarter because lenders are using disparate processes after implementing the TILA/RESPA integrated disclosures, according to First American.

October 24 -

The U.S. housing market is about 10 times larger than Canada's, but we can learn a few lessons from the country's cautious approach to its housing policy.

October 24 -

As Rodrigo Lopez begins his term as chairman of the Mortgage Bankers Association, the Nebraska multifamily lender seeks to use the platform to embrace the challenges of improving diversity and technology throughout the industry, while remaining vigilant about the ever-changing regulatory landscape.

October 23 -

The Consumer Financial Protection Bureau's proposed changes to new mortgage disclosure requirements do not go far enough, according to many in the industry.

October 21 -

Moody's Corp. said federal officials are planning a lawsuit over its ratings of residential mortgage securities that critics contend were inflated to win business in the years leading up to the 2008 financial crisis.

October 21 -

A federal court appeals decision could theoretically mean that Comptroller of the Currency Thomas Curry now answers directly to Treasury Secretary Jack Lew, a significant break from the agency's history of independence.

October 21 -

In an election year dominated by controversy and big personalities, political contributions from the mortgage industry have remained muted, reflecting apathy and uncertainty toward Hillary Clinton and Donald Trump.

October 21 -

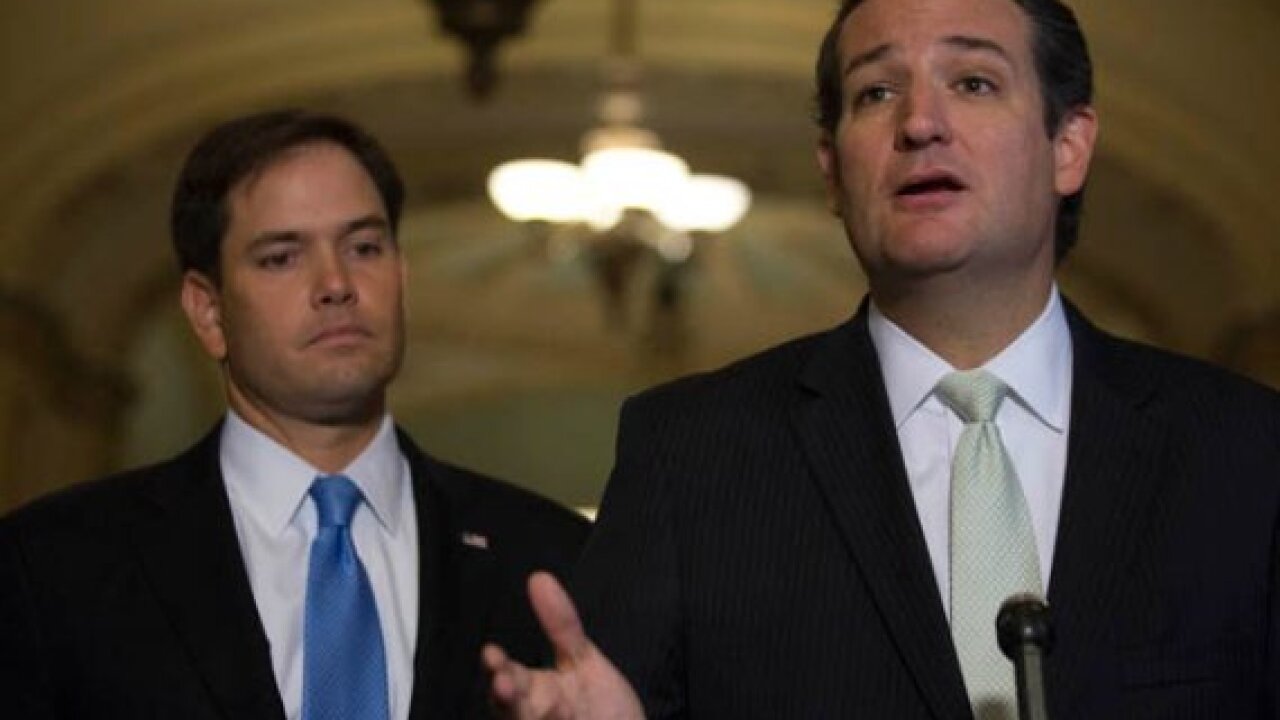

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21