-

The Department of Housing and Urban Development issued a proposal Wednesday to codify recent changes to its reverse mortgage program and to provide additional protections for seniors, including a cap on annual interest rate increases.

May 18 -

Walter Investment Management Corp. sank into a deeper $172.7 million net loss during the first quarter, as lower interest rates caused pressure on the company's mortgage servicing rights valuation.

May 3 -

Borrowers of "forward" Federal Housing Administration mortgages are unfairly being expected to backstop the disparate mission and risks of the Home Equity Conversion Mortgage program.

April 18 Potomac Partners

Potomac Partners -

CIT Group, the commercial lender run by John Thain, found a material weakness in the accounting of a mortgage business, causing the company to delay the filing of its annual report to the Securities and Exchange Commission.

March 1 -

Nationstar Mortgage is in the market with the second rated securitization of what are nonperforming Home Equity Conversion Mortgage loans, according to Moody's Investors Service.

February 24 -

Bank of New York Mellon has become a big believer in reverse mortgages, particularly home equity conversion mortgages insured by the Federal Housing Administration.

January 25 -

Home Equity Conversion Mortgage servicers have received an additional three months to explore loss mitigation options when borrowers or their spouses have difficulty paying their property taxes and insurance.

January 14 -

The reverse mortgage industry is optimistic after recent reforms to the Home Equity Conversion Mortgage by the FHA and newfound respect from financial planners.

January 14 -

Senior citizens' equity in their homes rose by about $147 billion to $5.76 trillion, from the second quarter to the third quarter, according to the National Reverse Mortgage Lenders Association.

December 23 -

Loan limits for the Federal Housing Administration mortgage insurance program in 2016 will rise in 188 counties across the nation where home prices increased.

December 9 -

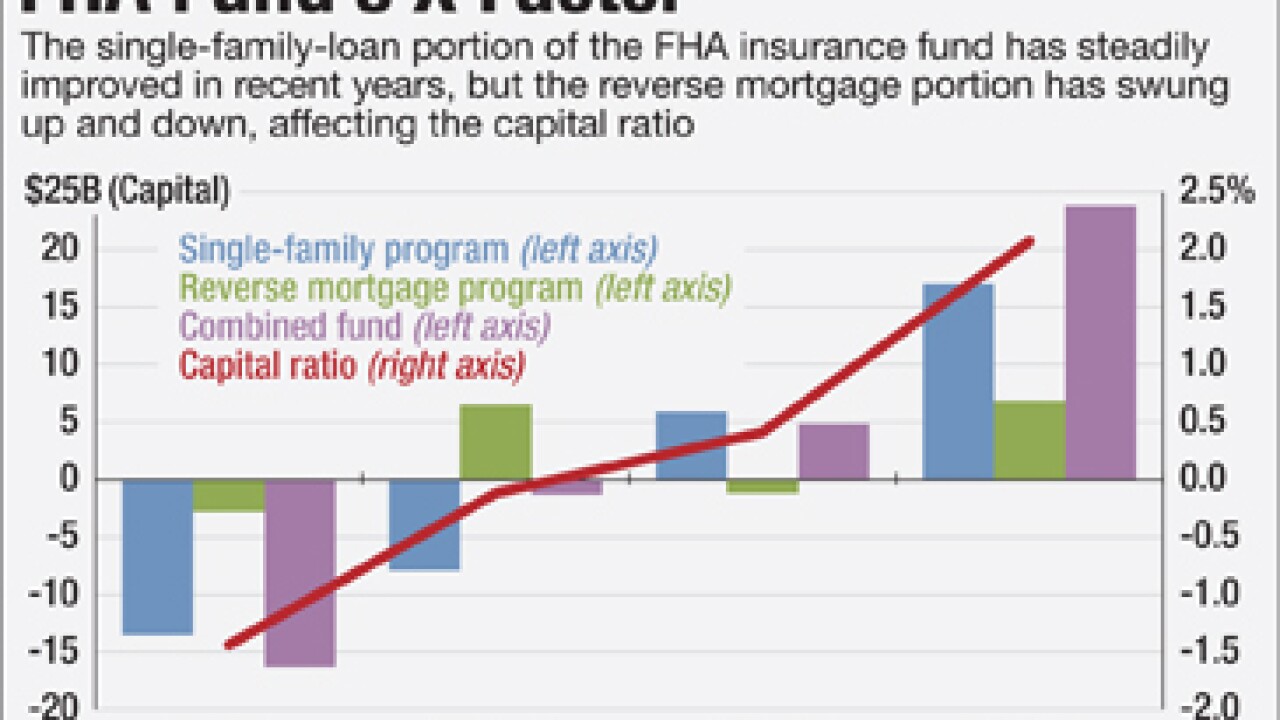

The Federal Housing Administration's annual financial report demonstrates the outsized influence of reverse mortgages on the performance of its insurance fund, fueling a debate about whether those loans belong there.

November 23 -

The Federal Housing Administration's unexpected windfall is already generating industry talk about another premium cut by the agency but FHA officials insist such discussion is premature.

November 16 -

The report from independent auditors will likely show that FHA remains below its 2% statutory minimum capital ratio, but HUD officials and outside observers still expect it to show major improvement over last year.

October 29 -

The CFPBs expanded data requirements for the Home Mortgage Disclosure Act will create a powerful tool for analyzing fair lending compliance. But some say the initiative is a massive overreach that could compromise borrower privacy.

October 23 -

Walter Investment Management has promoted its vice chairman to CEO, after Mark O'Brien said he will retire from that position.

October 5 -

Senior home equity rose by $117 billion in the second quarter, compared to the previous quarter, according to the National Reverse Mortgage Lenders Association.

September 23 -

American Advisors Group has begun marketing a jumbo reverse mortgage loan over a year after it first planned to issue them.

September 11 -

Walter Investment Management has reached a settlement with federal authorities over reverse-mortgage practices at a business unit.

September 8 -

Home Equity Conversion Mortgages have gotten a bad rap, but they're often a better alternative to home equity lines of credit for both borrowers and lenders.

September 4 Wendover Consulting

Wendover Consulting -

The Department of Housing and Urban Development's policies governing the Home Equity Conversion Mortgage program failed to detect instances where borrowers failed to comply with residency requirements, according to a report.

August 27