-

Kenneth Mahon, the new CEO of Dime Community Bank, wants to reduce the 152-year-old institution's multifamily exposure by diversifying into other asset classes. But finding new business amid already fierce competition could be an immense challenge for Dime and other community banks in 2017.

December 30 -

From selling servicing rights along with the loans to issuing private-label securities, a host of strategies from the past could return to the market as a result of the new political climate and interest rate environment.

December 29 -

Opus Bank has completed a $509 million securitization of its multifamily loans through a Freddie Mac-sponsored "Q-deal" risk-transfer securitization.

December 27 -

Rising interest rates typically squelch demand for refinancing, leaving lenders to compete for homebuyers' business. But plain-vanilla purchase loans aren't the only saleable products in this rising-rate environment. Here are five other products likely to find demand.

December 27 -

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better compared to the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

Loans originated in the third quarter were among the highest in credit quality since 2000, according to CoreLogic.

December 20 -

A regulatory 2017 scorecard for Fannie Mae and Freddie Mac calls on the firms to transfer a significant portion of credit risk to third-party private investors on at least 90% of unpaid principal balance of newly acquired single-family mortgages.

December 15 -

The surge in mortgage rates since the November election is expected to offset the increase to lenders' short-term funding costs following the Federal Open Markets Committee's 25-basis-point increase to the federal funds rate.

December 14 -

Of the five banks that failed their living will tests earlier this year and were forced to resubmit plans, only Wells Fargo failed again, resulting in immediate regulatory action that will restrict its growth, including its ability to expand internationally and buy nonbank subsidiaries.

December 13 -

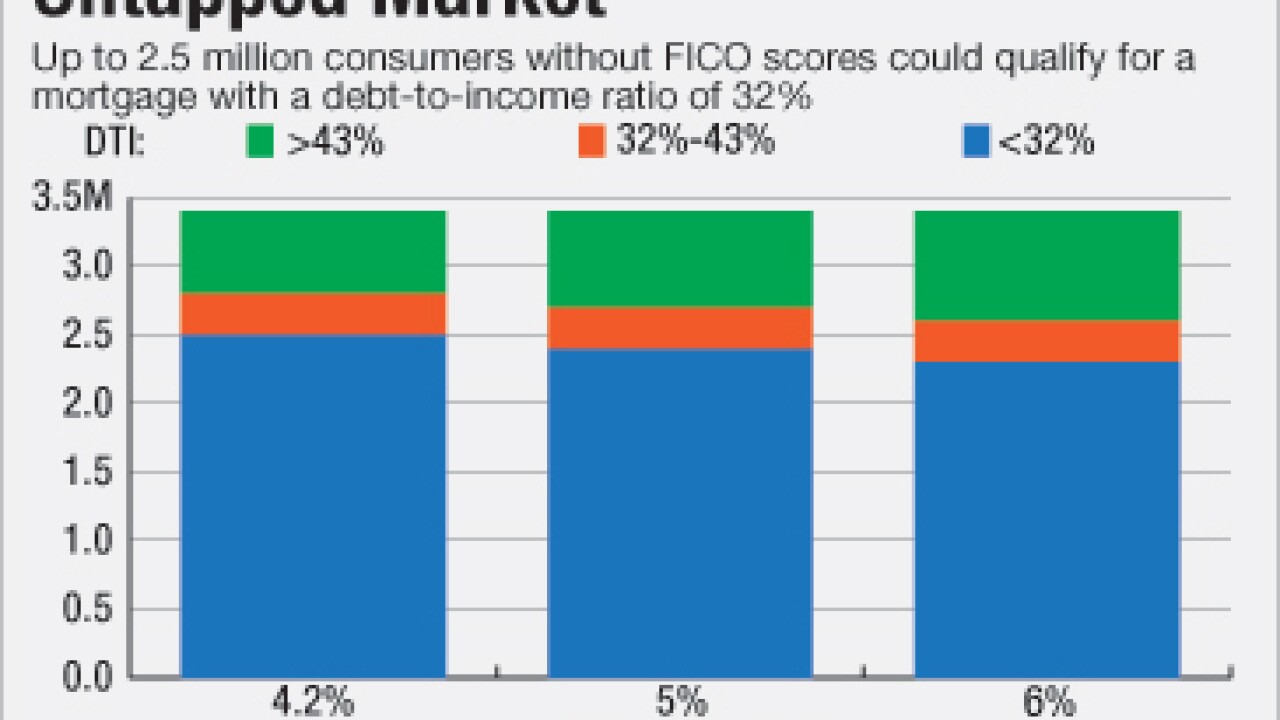

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Manufactured housing advocates are "guardedly optimistic" that the Federal Housing Finance Agency will soon issue a long-awaited final rule that they hope will expand the secondary market for mobile homes.

December 12 -

A bipartisan duo of House lawmakers introduced a bill Thursday that would push Fannie Mae and Freddie Mac to engage in more credit risk-sharing transactions.

December 8 -

Fannie Mae joined Freddie Mac in announcing plans to delist some previously issued Connecticut Avenue Securities, which transfer the credit risk on residential mortgages, from the Irish Stock Exchange.

December 7 -

Construction loans are a big source of interest income for community banks but also carry a lot of risk. A few fintech firms say their platforms can reduce the risk and improve the lending process.

December 6 -

The mortgage interest deduction will be limited in reforms designed to provide tax cuts for middle-class borrowers, but not those with higher incomes, according to Treasury Secretary-designate Steve Mnuchin.

December 1 -

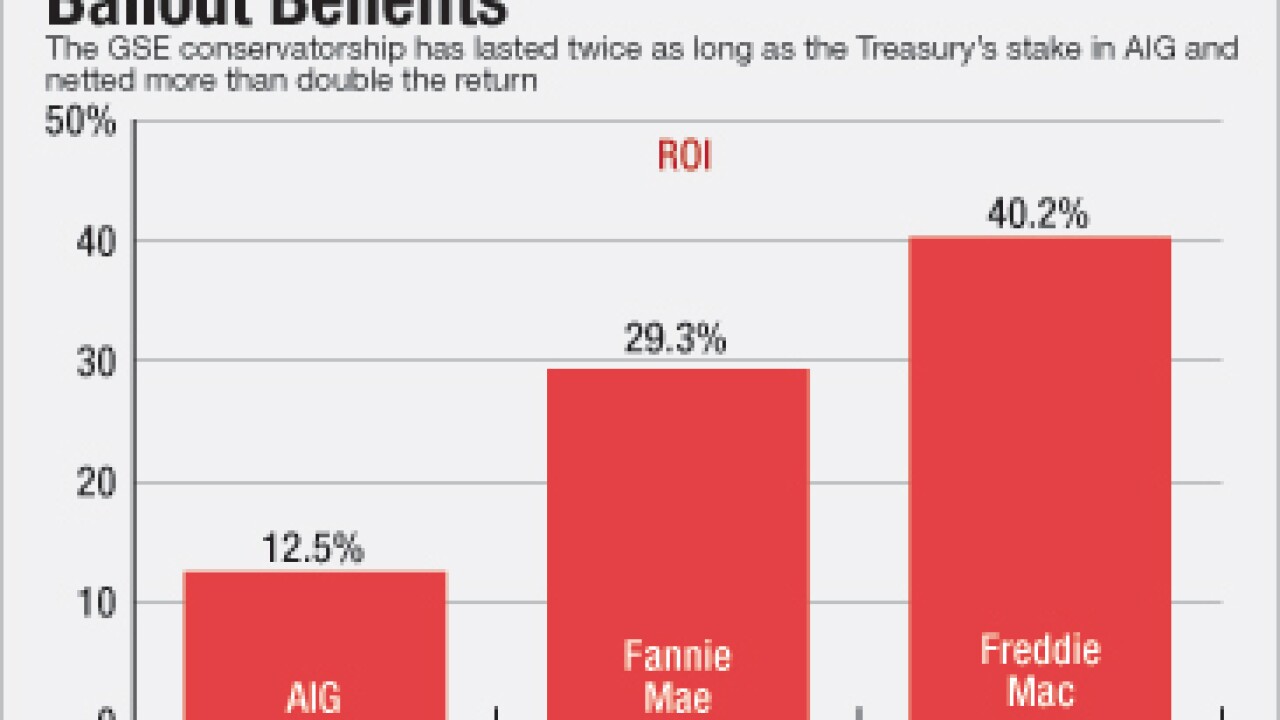

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

Mortgage bankers are anxiously waiting to see who President-elect Donald Trump will pick as the next Treasury secretary. Several prominent names have been floated for the job, though with every passing day, a new possible choice seems to pop up. Following is a look at the current crop of candidates and their chances.

November 29 -

Shortage of appraisers in rural areas and compensation issue force lawyers to re-consider restrictions on communications between lenders and appraisers.

November 21 -

The Federal Communications Commission has denied a request to exempt servicers from getting consent before robo-calling borrowers' mobile phones, rejecting arguments that the waiver would enable the mortgage industry to better help delinquent borrowers.

November 18