-

The mortgage interest deduction will be limited in reforms designed to provide tax cuts for middle-class borrowers, but not those with higher incomes, according to Treasury Secretary-designate Steve Mnuchin.

December 1 -

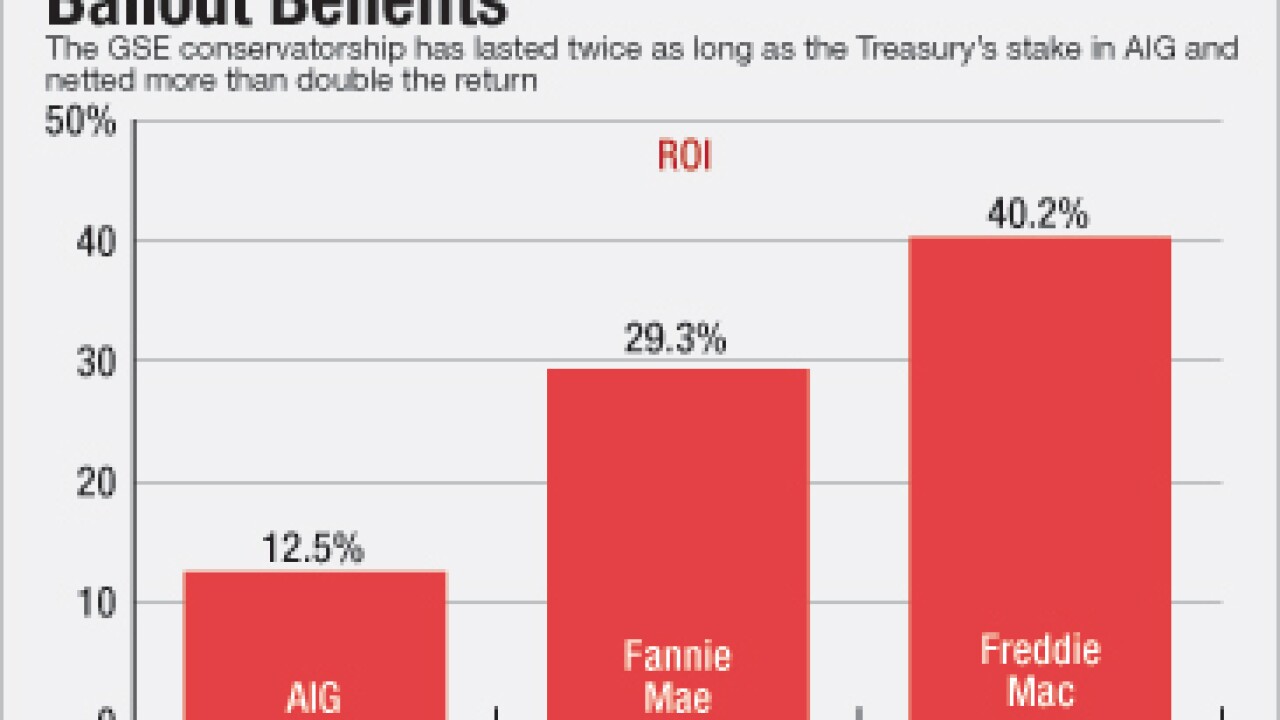

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

Mortgage bankers are anxiously waiting to see who President-elect Donald Trump will pick as the next Treasury secretary. Several prominent names have been floated for the job, though with every passing day, a new possible choice seems to pop up. Following is a look at the current crop of candidates and their chances.

November 29 -

Shortage of appraisers in rural areas and compensation issue force lawyers to re-consider restrictions on communications between lenders and appraisers.

November 21 -

The Federal Communications Commission has denied a request to exempt servicers from getting consent before robo-calling borrowers' mobile phones, rejecting arguments that the waiver would enable the mortgage industry to better help delinquent borrowers.

November 18 -

Fannie Mae said Thursday it obtained reinsurance on another $11.7 billion of residential mortgages through its Credit Insurance Risk Transfer of the year.

November 18 -

As the Justice Department winds down its Mortgage Fraud Task Force and a new administration prepares to enter the White House, the number of False Claims Act cases brought against Federal Housing Administration lenders is expected to dwindle.

November 16 -

The Federal Housing Administration's insurance fund saw its fourth consecutive annual boost in its ratio of reserves to insured mortgages, reaching 2.32% in fiscal year 2016, the Department of Housing and Urban Development said Tuesday.

November 15 -

Experian, like fellow credit bureaus TransUnion and Equifax, is now offering trended credit reports to lenders that originate single-family loans.

November 14 -

None of President-elect Donald Trump's tax reforms target the mortgage interest deduction, according to a member of his economic advisory council.

November 11 -

A Florida hedge fund transformed risky Fannie Mae and Freddie Mac debt into investment-grade securities, and it could end up helping the mortgage giants' efforts to offload more of their risk.

November 8 -

Since the government-sponsored enterprises began experimenting with both frontend and backend deals in which part of the credit risk is shared with third parties, investors have been watching carefully.

November 4 -

Fannie Mae's new representation and warranty relief offers lenders a long-awaited incentive to use its automated loan validation technology. But is it enough for lenders to make the necessary technology updates and process changes to implement the tools?

November 3 -

Regulators have pressed banks to watch out for rising concentrations of commercial real estate loans. Some banks have paid heed, but others are skyrocketing past recommended thresholds.

November 3 -

Freddie Mac's credit risk transfers come with a hefty price tag, but are ultimately still worth it, according to Chief Executive Don Layton.

November 1 -

The mortgage industry is welcoming the Obama administration's possibly final word on housing finance reform, hoping it will serve as guidepost for the future.

October 28 -

The CFPB sent letters Thursday to 44 mortgage lenders and brokers warning them of potential reporting violations related to their mortgage lending activities infractions the bureau is increasingly pushing lenders to take seriously.

October 27 -

Barclays is trying to draw a line at $2 billion in penalties to settle a U.S. investigation into its sale of mortgage securities after it received an opening offer that it considered too high.

October 27 -

The Consumer Financial Protection Bureau will require underperforming servicers to document the technology and process changes they're making to implement the agency's recently released servicing regulations.

October 25