-

Fannie Mae has priced its Connecticut Avenue Securities, the series 2016-C04, at tighter spreads to its previous deal, completed in April.

July 20 -

A private flood insurance bill passed by the House is making Fannie Mae and Freddie Mac uneasy because they fear it could lead to greater losses, according to a recent report by the Government Accountability Office.

July 20 -

Uncertainty about what constitutes a TRID error has had a direct impact on independent mortgage bankers. But some warehouse lenders that provide those originators with interim funding have also been affected by the liquidity concern, taking on increased risk exposure.

July 18 -

Upcoming risk retention requirements may be the proverbial straw that breaks the back of the commercial mortgage-backed securities market.

July 15 -

When Congress lifted the conforming loan limit in certain high-cost housing markets, it provided some much-needed liquidity for homebuyers.

July 14 -

The debate over a Republican bill to overhaul the Dodd-Frank Act is increasingly focused on two widely different philosophies about capital regulation, which were both on display at a hearing Tuesday.

July 13 -

Nonbanks continue to expand their share of lending volumes as depositories keep scaling back their business in the residential mortgage space.

July 12 -

While many depositories do just enough mortgage lending to low- to moderate-income borrowers to meet statutory requirements, The Federal Savings Bank has made it a backbone for growth.

July 12 -

Ginnie Mae has hired Nancy Corsiglia as its chief operating officer.

July 11 -

New rules designed to stop U.S. companies from moving their tax addresses offshore are written so broadly that they could disrupt the mortgage securitization market, the Structured Finance Industry Group warned Thursday.

July 7 -

Assurant Inc. in Atlanta has acquired American Title, a title and valuation services provider.

July 7 -

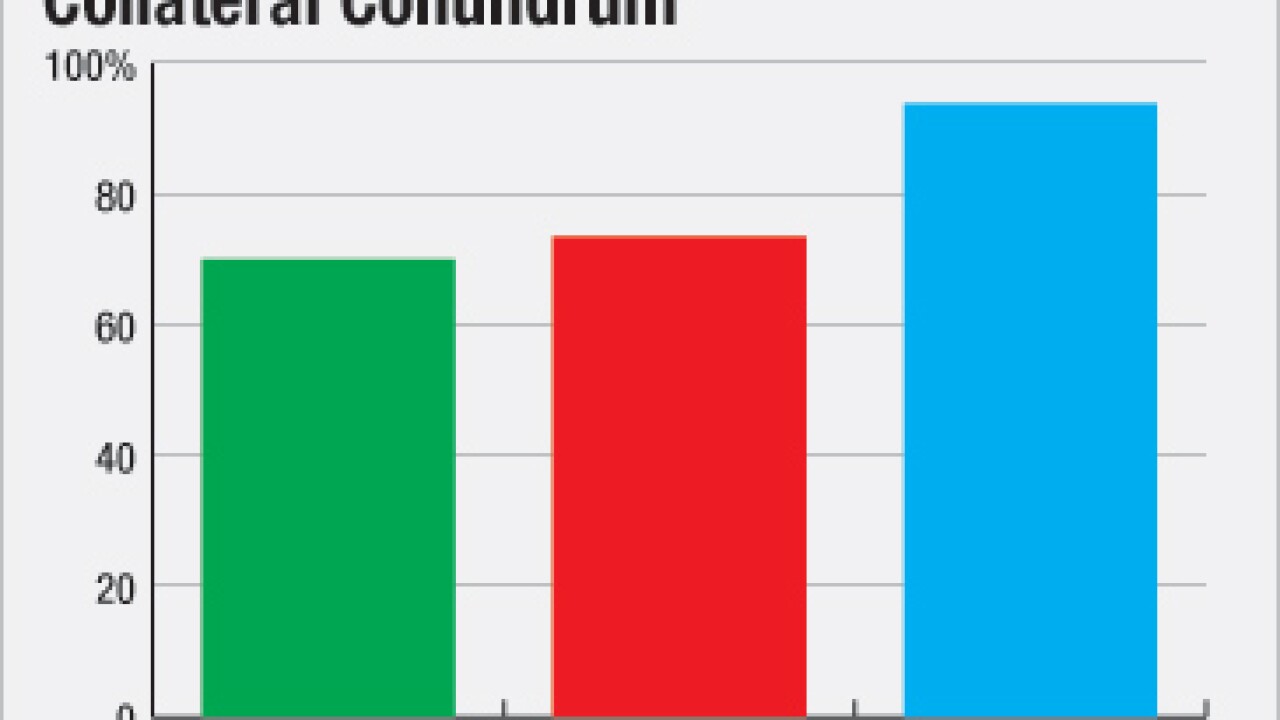

The Federal Housing Finance Agency has opened the door to experimenting with front-end credit risk transfer transactions, but it is not wide enough for some market players.

July 5 -

Loan application defect risk continued to decline in May, according to First American Financial Corp.

June 30 -

The Federal Housing Finance Agency is soliciting industry input on how to improve Fannie Mae and Freddie Mac's credit risk transfer transactions, for the first time considering front-end transactions rather than back-end deals.

June 29 -

Fitch Ratings will now conduct reviews of residential mortgage-backed securities deal agents as part of its RMBS master criteria, with Clayton Holdings as the first deal agent to receive an assessment.

June 27 -

The deadline has arrived for mandatory submissions to the Federal Housing Administration's Electronic Appraisal Delivery portal, but as many as one-third of lenders that originate FHA-insured mortgages have yet to use the new system.

June 27 -

Steve Victor, a 33-year-old IT contractor from London, says he's pulling out of the purchase of a new four-bedroom home in the town of Bedford after Britain voted to leave the European Union.

June 24 -

Brokers remain perplexed over how to strike a balance between helping borrowers shop for the best deal and maintaining compliance with the TILA-RESPA integrated disclosures. Specifically, how do brokers and wholesalers meet TRID's delivery deadline and accuracy requirements when a loan is resubmitted to a new lender?

June 21 -

Optimal Blue will be acquired by private equity firm GTCR in a deal that makes Mortgagebot founder and tech veteran Scott Happ CEO of the Texas-based product and pricing engine software vendor.

June 17 -

Delinquencies on non-owner-occupied commercial real estate loans ticked up in the first quarter after years of steady declines. Some are shrugging off the increase, saying it was expected given the strong demand for CRE loans, but others say there's good reason to be concerned.

June 14