-

Increased competition among non-qualified mortgage lenders leading to lower starting interest rates for borrowers should result in fewer of these loans prepaying within one year of origination, said Standard & Poor's.

September 24 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

The dollar volume of private-label residential mortgage-backed securities issuance this year is the highest it has been since the Great Recession, despite a decline in new originations.

September 6 -

The sponsor has increased the credit enhancement on the senior support class of notes on offer in order to offset the slightly higher risk to investors.

August 31 -

Annaly Capital Management will be able to proceed with a delayed exchange offer needed for its acquisition of MTGE Investment Corp. because it has been able to satisfy incomplete deal conditions.

August 22 -

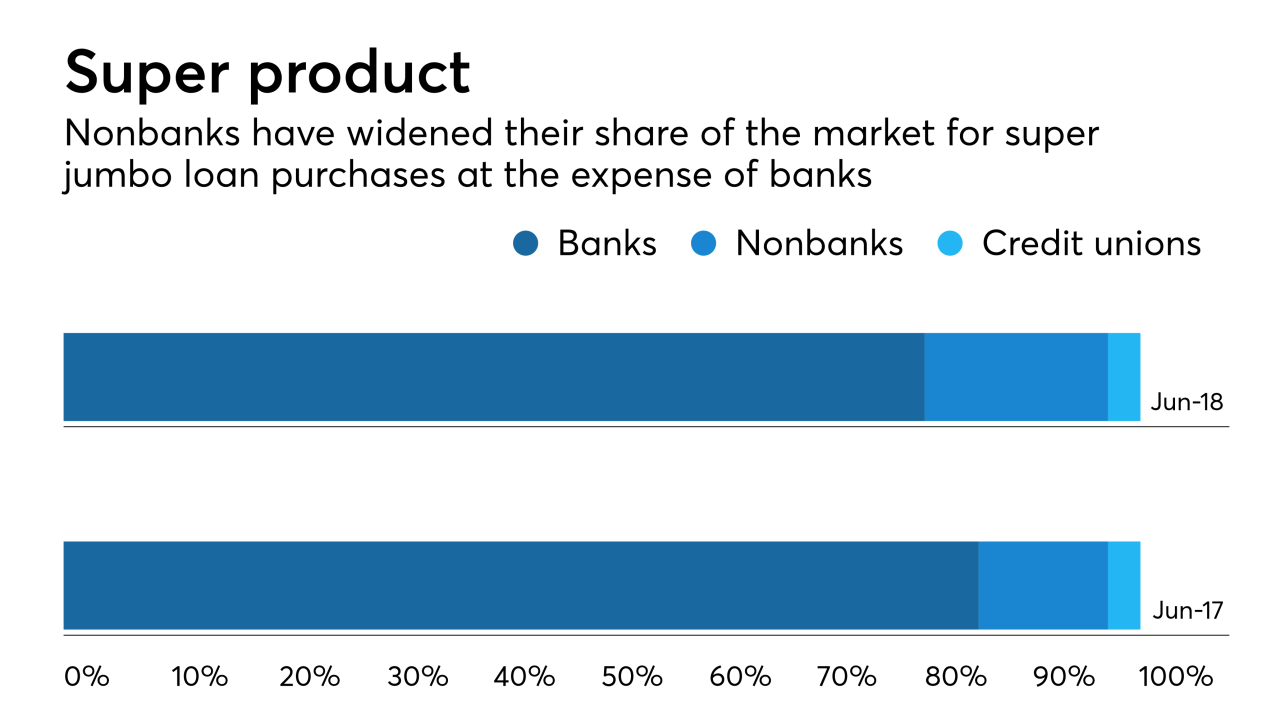

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

The expiration of Annaly Capital Management's offer to purchase MTGE Investment Corp. was delayed until Sept. 7 so the two real estate investment trusts have more time to satisfy deal conditions.

August 20 -

The $653 million Bellemeade Re 2018-2 is being rated by both Fitch Ratings and Morningstar Credit Ratings, though Fitch sees more risk to the transaction.

August 10 -

AmeriHome GMSR Issuer Trust, consists of $155 million of fixed-rate, five-year notes and $500 million of two-year variable funding notes; it is modeled on deals by PennyMac.

August 8 -

The mortgage servicer plans to add PHH advance receivables to the collateral once the acquisition closes, though these will only account for around 6% of the total pool.

August 8