-

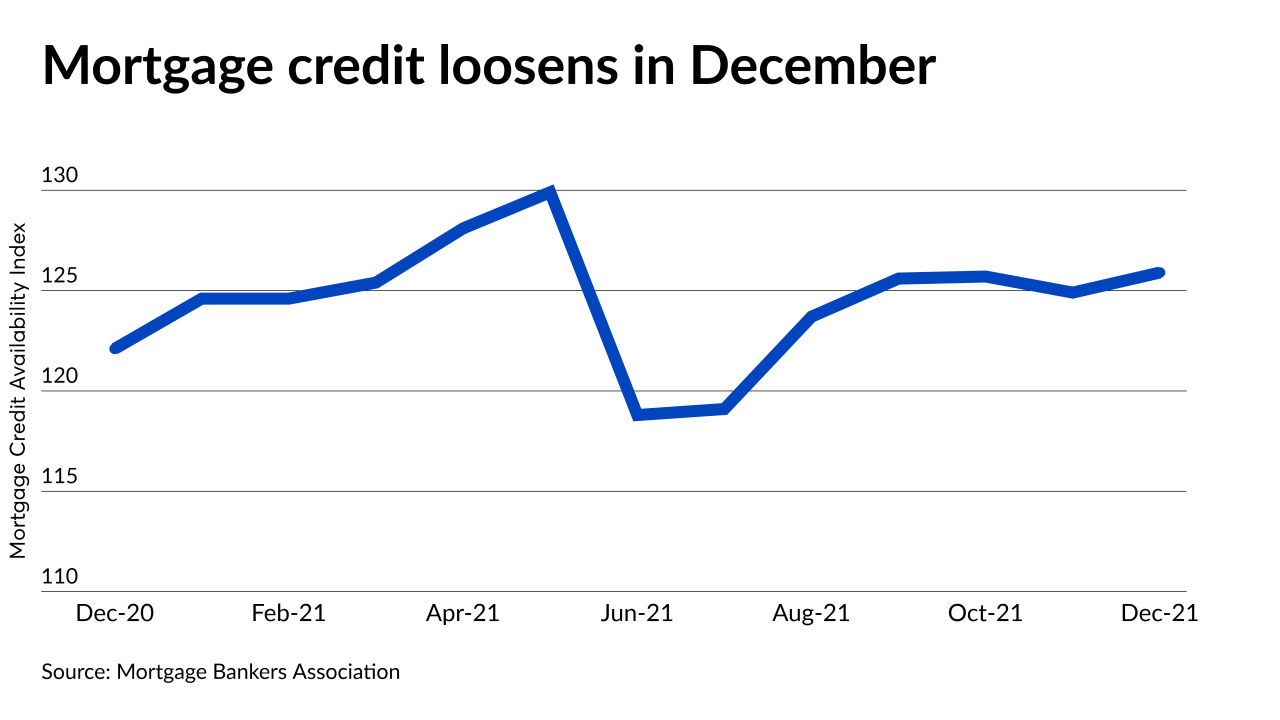

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

The change reflects a growing focus on an emerging banker segment that sells loans to the company on a non-delegated basis and includes a greater focus on servicing retention.

January 10 -

The loans in the portfolio on offer have nearly 11 months of seasoning, indicating they were amassed during a loan production boom that has contributed to higher average servicing deal sizes.

January 7 -

The Duty-to-Serve goals currently under review drew some objections from a coalition of affordable housing groups last year.

January 6 -

The government-sponsored enterprise also unveiled two new tranche slices for investors to purchase.

January 6 -

The company plans to hire an unspecified number of people in servicing as a result of the shift, with a particular focus on recruiting people for “customer-facing” positions.

January 4 -

The metric’s imminent end after more than 40 years means servicers need to put replacement plans in motion if they haven’t already.

January 3 -

The new leader, who officially joined the government mortgage-bond insurer on Jan. 3, is the first Senate-confirmed holder of the post in close to five years.

January 3 -

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

Average per-loan charges last year were little changed despite the addition of a new temporary fee for refinancing. Those for loan-to-value ratios above 80%, home-purchase financing and adjustable-rate mortgages only rose slightly.

December 27