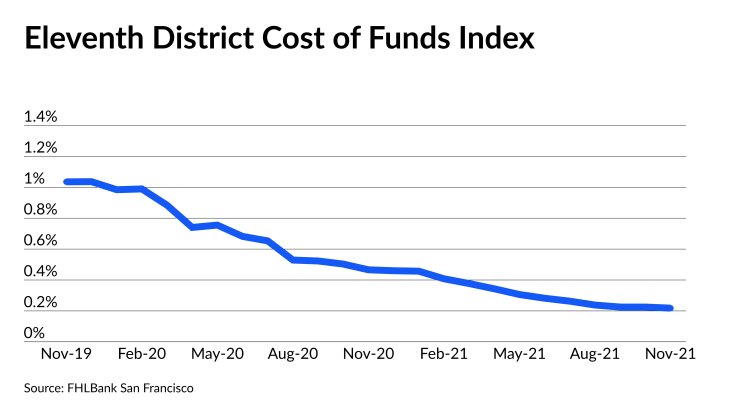

The Eleventh Federal Home Loan District Cost of Funds Index was published for the second to last time on New Year's Eve as the once-popular adjustable rate mortgage metric goes out on a low point in more ways than one.

November's index of 0.218 is at its all-time lowest value, at 7 basis points below what it was for the previous two months. However, as

But the driving factor for the end of COFI was that the pool of reporting FHLBank San Francisco members kept shrinking, due to consolidations and failures. At the time of COFI's first publication, for the month of July 1981, over 200 institutions from California, Arizona and Nevada reported data. When the discontinuation

The index had been popular in part because its weighted average calculation made it less vulnerable to sudden spikes or drops than other ARM indices. That feature was among those used to sell pay-option ARMs to consumers.

Originally, the index's final publication was set for Jan. 31, 2020, but concerns over

Unlike

That will appear on a dedicated web page on the Freddie Mac website on the last business day of every month starting on Feb. 28, for January.

"As a reminder, on or before the date of the next mortgage interest rate adjustment that uses the Enterprise 11th District COFI Replacement Index, the Servicer must provide impacted Borrowers with written notice identifying the replacement index and stating where the index is posted," said Freddie Mac Bulletin 2022-31, which was issued in October. "In addition, the Servicer must store a copy of this notice in the Freddie Mac Mortgage file and send a copy of the notice to the Document Custodian with instructions to store the notice with the original Note."

Fannie Mae published a notice in April calling on servicers to use the Freddie Mac replacement index for mortgages it owns.

Besides single-family mortgages, the government-sponsored enterprises have multifamily loans and collateralized mortgage obligations indexed to COFI.

Freddie Mac will at first publish two versions of its index, with the single-family calculation including a one-year transition period. The other version will apply to multifamily and Freddie Mac CMOs.

Fannie Mae's CMOs have different fallback language in the documents that call for them to use Libor after COFI's discontinuation. Eventually that will then default to the Structure Offered Financing Rate once

The Mortgage Bankers Association earlier this year developed

At the group's 2019 National Secondary Market Conference, a panelist said the end of COFI could be