-

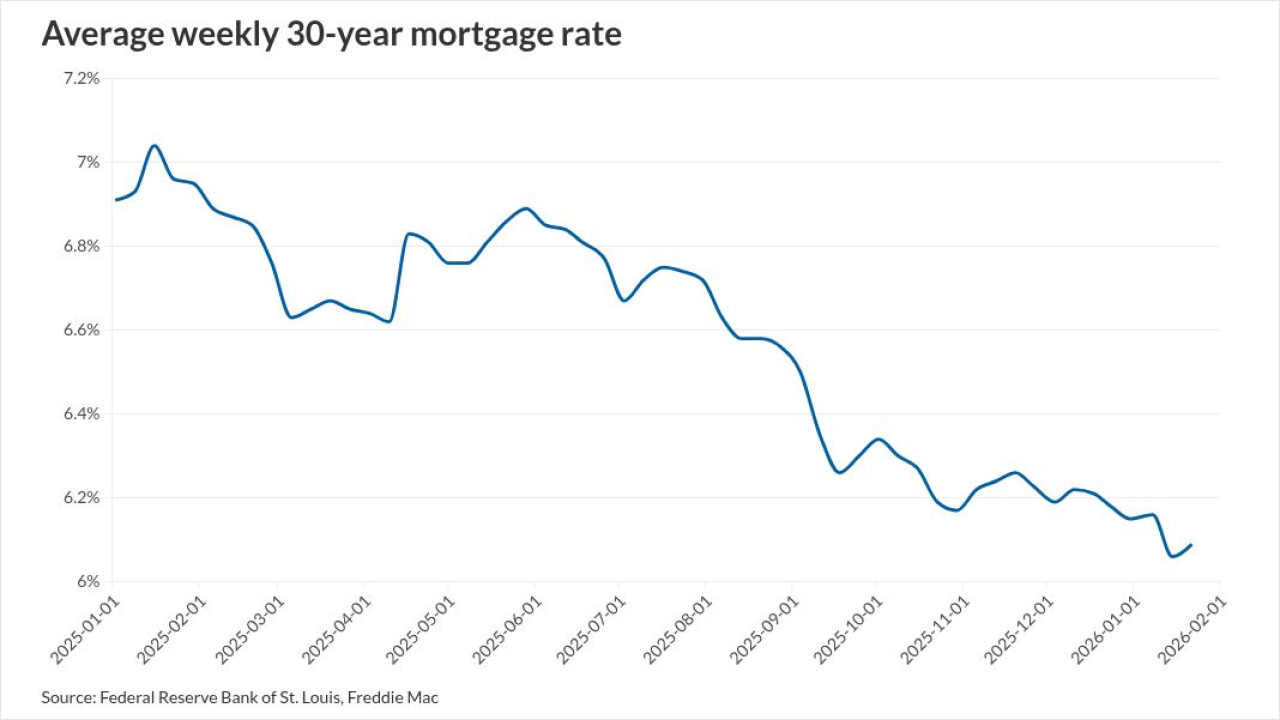

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

Reducing agency loan pricing adjustments and credit reports may help, a trio of industry groups wrote in a letter to the National Economic Council's director.

January 22 -

The President is promising big announcements on housing affordability issues in Switzerland, but will it include ending the GSE conservatorships?

January 20 -

What's said in the online video, which replicates the president's voice with his permission, may be as important to lenders as how the message is delivered.

January 20 -

Hot securitization sectors such as non-qualified mortgages and home equity are set to expand further amid market shifts this year, recent forecasts suggest.

January 20 -

Freddie Mac's investment in affordable housing increased by 17% in 2025 compared with the year prior, the government-sponsored entity said.

January 16 -

A Community Home Lenders of America adds arguments against use of single bureau while another paper takes the position that the idea merits further study.

January 16 -

The government securitization guarantor could move forward with more big-picture initiatives as well this year now that it officially has a confirmed president.

January 15 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

The Department of Housing and Urban Development is selling more due-and-payable HECMs on homes that are occupied while reviewing the loan program.

January 7 -

A shared client base helped lead to introduction of the new integration, with implementation scheduled to come later this year, the companies said.

January 7 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

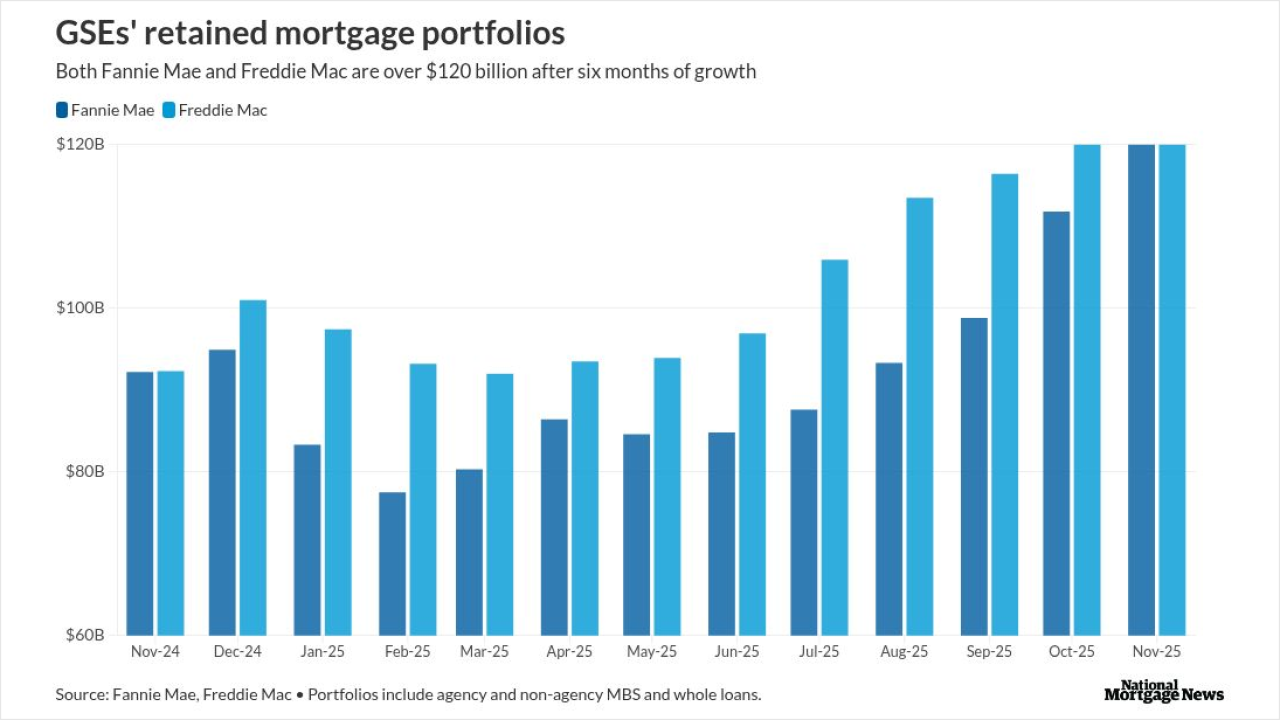

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

A definitive move could occur as early as fiscal year 2026 or take until 2033, depending on what the government is willing to do, according to one analyst.

January 2 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26