-

Fannie Mae and Freddie Mac’s new limits on loans secured by investor properties and second homes may put pressure on applicants to misrepresent their occupancy status.

April 21 -

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

Gene Thompson goes to deciding what the company's next steps are, rather than implementing them.

April 16 -

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

Securitization is a sound delivery model for any lender when combined with adequate research and preparation and it offers unique benefits, too — especially in terms of greater control and efficiencies, writes Black Knight’s managing director of pipeline analytics, James Baublitz.

April 1 Black Knight

Black Knight -

But UWM says the provision is designed to protect against a broker double-locking the loan and is used by other lenders.

March 24 -

Volumes were at a record high in the final quarter of 2020 but lenders didn’t make quite as much since gains on loan sales to the secondary market fell.

March 23 -

The company is still searching for someone to fill the roll on a full-time basis, but the $600,000 annual salary cap may limit the candidate pool.

March 16 -

The government-sponsored enterprise announced Wednesday it will change eligibility criteria for vacation homes and investor properties starting April 1 to fulfill a directive by former Treasury Secretary Steven Mnuchin.

March 11 - LIBOR

Progress toward replacement benchmarks, such as the Secured Overnight Financing Rate in the U.S. and the Tokyo Overnight Average Rate in Japan, has been sluggish, and there are hopes Friday’s announcement could accelerate the process.

March 5 -

The former president of the private mortgage insurer is coming out of retirement to direct the bank's missions on affordable housing, community and economic development.

February 23 -

January’s excess return came in at a level well above the trailing average for the month, thanks in large part to a helpful hand from the Federal Reserve.

February 2 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

The transaction consisting of $24 million in securitized Ginnie pools followed a 265% jump in broader industry eNote registrations last year.

January 29 -

Upcoming changes to underwriting regulations, as well as the end of the QM patch, in addition to growing home values, all add up for this market to have a good year.

January 19 -

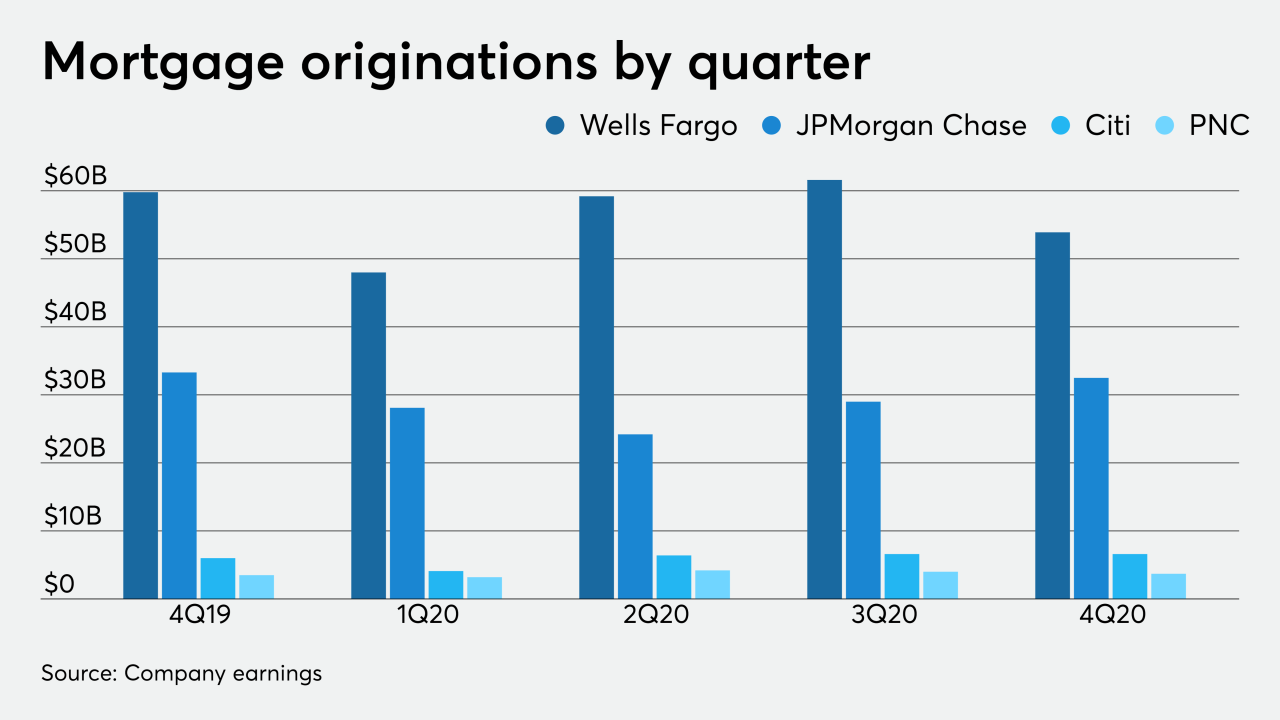

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

Industry watchers make their wildest guesses (more or less) about developments in real estate finance that could rock the industry in the upcoming months.

December 29 -

Michael Gramins, who a jury convicted in 2017, was among more than a half-dozen traders charged by federal prosecutors in Connecticut with misrepresenting the prices of mortgage-backed securities to clients in order to increase their firm’s profits and their bonuses.

December 18 -

Last year, smaller lenders were put at a slight disadvantage in terms of what they were charged in guarantee fees when they sold loans for cash.

December 15 -

The problem in the sector boils down to a lack of portability of data, whether it’s digital or contained in documents, that can be trusted between parties, LoanLogics Chief Product Officer Dave Parker argues.

December 10 LoanLogics

LoanLogics