-

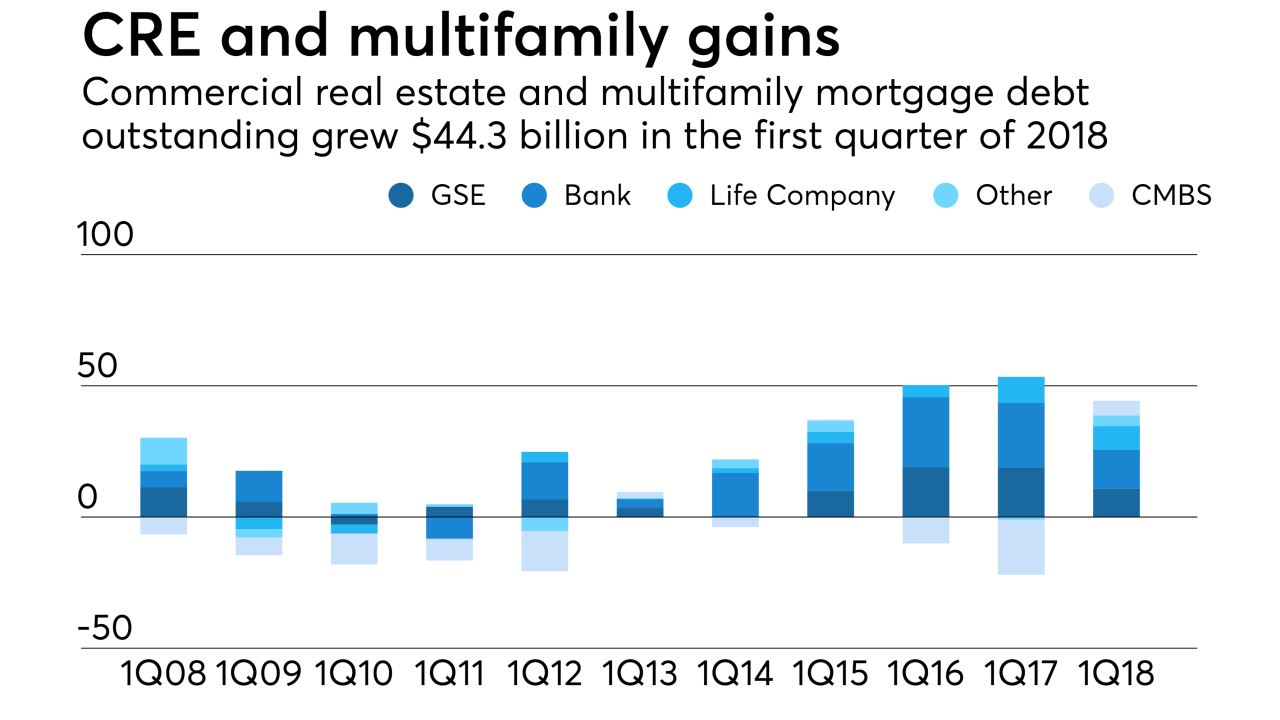

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Overcapacity in the mortgage industry led to more competitive pricing in the first quarter, said Wells Fargo CEO Tim Sloan.

June 1 -

Digital mortgage efficiencies span from origination to the secondary market and beyond, but something as small as a low-quality image in the loan file can cause headaches with investors.

May 23 -

From the latest economic news to the latest developments in digital mortgages, here's a look at six things we learned at the MBA Secondary Conference 2018.

May 23 -

The Ginnie Mae 2020 report coming out this summer will reveal the path the agency is taking toward working with digital mortgages, an agency executive said at an industry conference.

May 22 -

Originations and margins are thinning, and there will be mortgage banking firms that don't make it through this year, but after that, the numbers may look better.

May 22 -

Reducing unnecessary compliance burdens will pave the way for economic growth, larger job creation and wage increases, and re-evaluating technology will play an important role in doing so, according to Craig Phillips, counselor to the secretary at the Department of the Treasury.

May 21 -

JPMorgan Chase has largely sat on the sidelines of Federal Housing Administration lending due to compliance concerns. But recent regulatory relief efforts have Chase Home Mortgage CEO Mike Weinbach eyeing an opportunity to jump back in.

May 21 -

Test your knowledge of the secondary mortgage market with this quiz of key industry abbreviations.

May 18 -

Capital One Financial Corp. plans to repurchase shares following the sale of $17 billion in mortgages to a Credit Suisse subsidiary.

May 8 -

Demands for loan quality aren't just coming from regulators and the government-sponsored enterprises. Secondary market partners and investors don't want to be left holding the bag if loans that lenders create have quality issues.

May 4 LoanLogics

LoanLogics -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

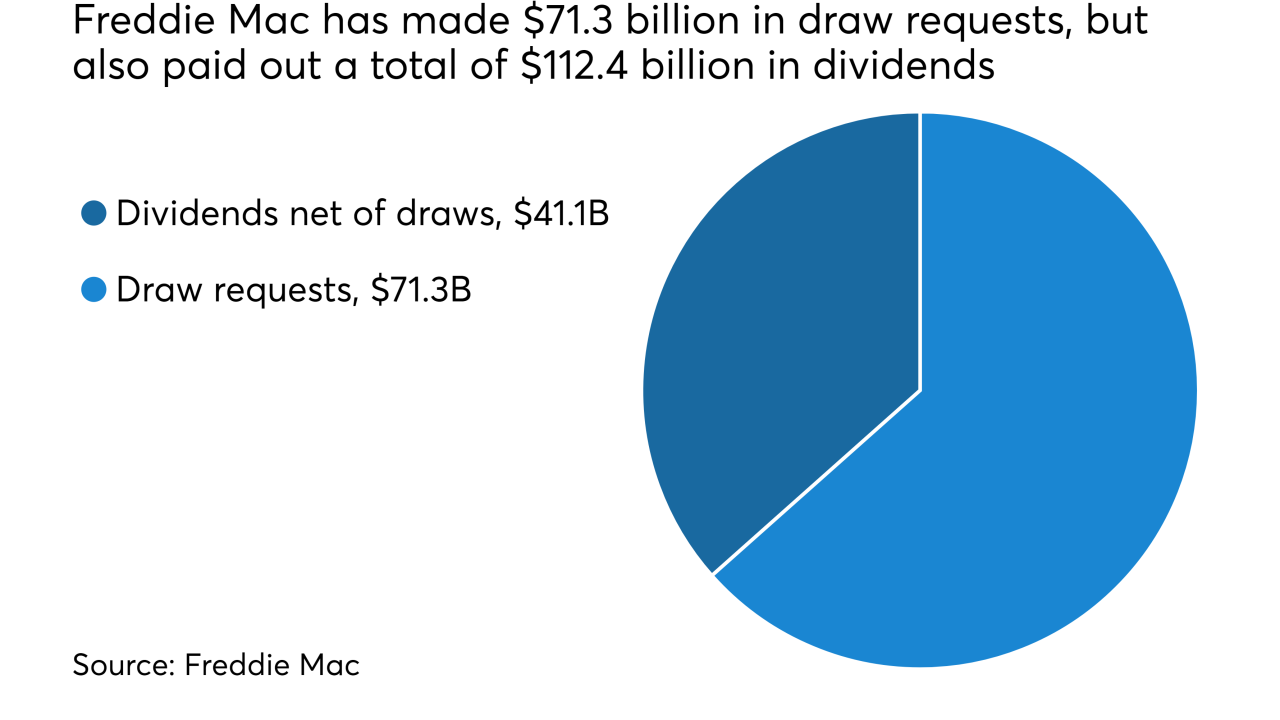

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

The future secondary mortgage market entities will receive high investment grade ratings, even as there is no clarity on their scope or form, Fitch Ratings said.

April 10 -

A pair of the nation's largest banks, Citigroup and Wells Fargo, made changes to their mortgage banking executive teams.

April 2 -

There is an oncoming liquidity crisis that will force consolidation in the mortgage industry as margins tighten and funding sources dry up.

March 28 -

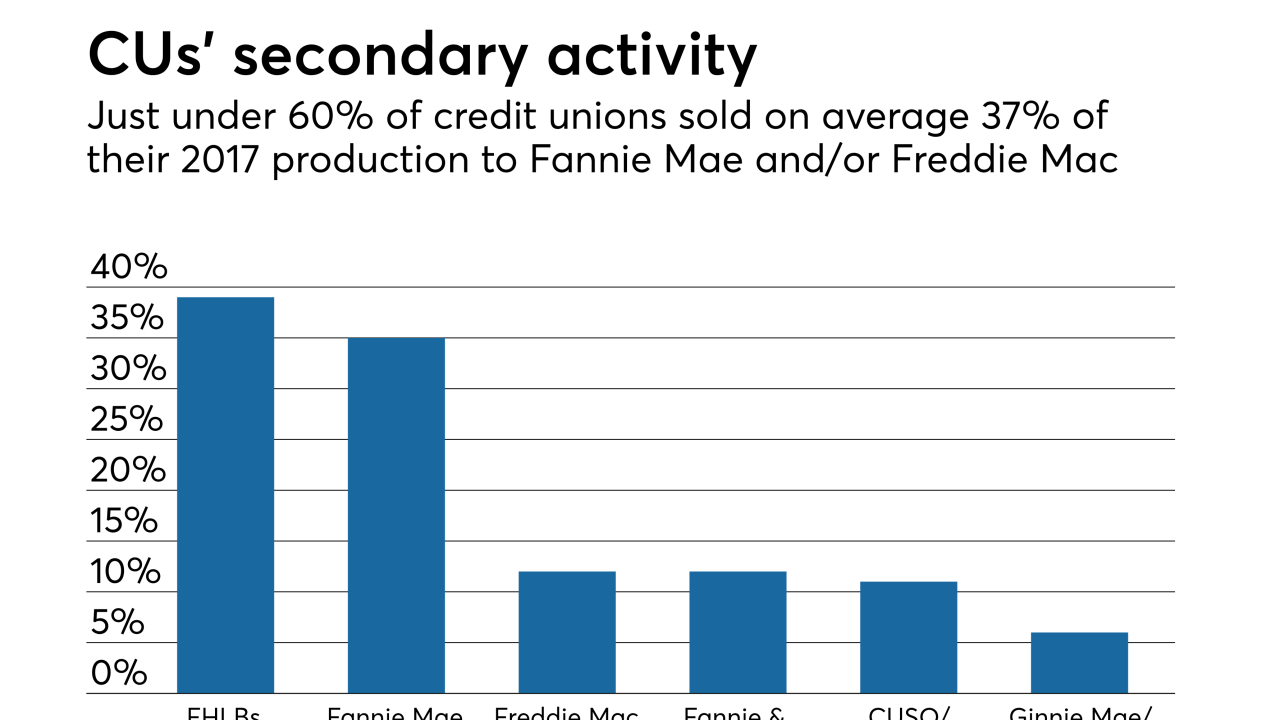

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15