-

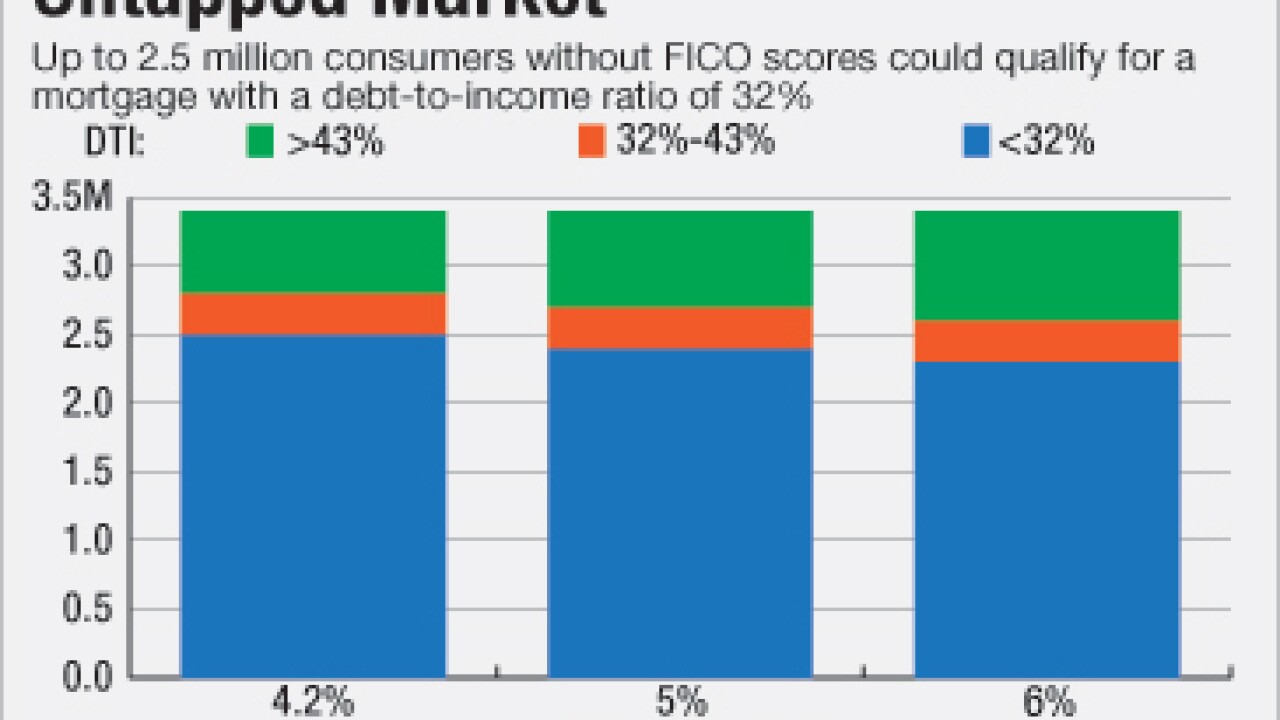

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Rising mortgage interest rates affect the volume of refinance and purchase originations, but don't necessarily spell bad news for home prices, explains Fannie Mae Chief Economist Doug Duncan.

December 12 -

Fannie Mae and Freddie Mac will again halt evictions nationwide for foreclosed properties during the holiday season.

December 12 -

A group of traders in JPMorgan's investment bank has expanded from selling commercial mortgage-backed securities to underwriting loans that are unsuitable for bonds, such as those for big construction projects.

December 12 -

A former Cantor Fitzgerald & Co. trader was charged with defrauding customers by lying about prices of mortgage-backed securities, becoming the latest target of a U.S. crackdown on deceptive practices in the bond market.

December 12 -

Manufactured housing advocates are "guardedly optimistic" that the Federal Housing Finance Agency will soon issue a long-awaited final rule that they hope will expand the secondary market for mobile homes.

December 12 -

One of latest proposals for reviving the private-label residential mortgage market involves improving communications between issuers and investors.

December 9 -

The Mortgage Industry Standards Maintenance Organization is proposing a standard for the maintenance and sharing of commercial and multifamily real estate rent-roll information.

December 9 -

A bipartisan duo of House lawmakers introduced a bill Thursday that would push Fannie Mae and Freddie Mac to engage in more credit risk-sharing transactions.

December 8 -

Digital mortgages are not an idea for the future; they are here to stay, and the mortgage industry must put aside its misplaced fear of technology and change and embrace them.

December 8 Pavaso

Pavaso -

Development on the Common Securitization Platform has reached a point where Fannie Mae and Freddie Mac may be able to issue a uniform mortgage-backed security sometime in 2018, the Federal Housing Finance Agency said Thursday.

December 8 -

Mortgage rates moved higher for the sixth consecutive week, according to Freddie Mac, even though yields on the 10-year Treasury are down from their post-election peak.

December 8 -

Some mortgage bond traders tangled up in investigations are moving into the shadow banking system, where their new employers have greater latitude to hire people with blemishes on their records.

December 7 -

Fannie Mae joined Freddie Mac in announcing plans to delist some previously issued Connecticut Avenue Securities, which transfer the credit risk on residential mortgages, from the Irish Stock Exchange.

December 7 -

Flushing Financial in Uniondale, N.Y., made $12.3 million on a recent property sale, part of a series of moves as it restructures its balance sheet.

December 6 -

The National Fair Housing Alliance and 20 local fair housing groups have filed a lawsuit in federal court against Fannie Mae over its maintenance and marketing of foreclosure properties.

December 6 -

While the designation of retired neurosurgeon Ben Carson to run the Department of Housing and Urban Development appears like an unusual choice, lenders are hoping he can bring a fresh perspective to the industry.

December 5 -

The mortgage interest deduction will be limited in reforms designed to provide tax cuts for middle-class borrowers, but not those with higher incomes, according to Treasury Secretary-designate Steve Mnuchin.

December 1 -

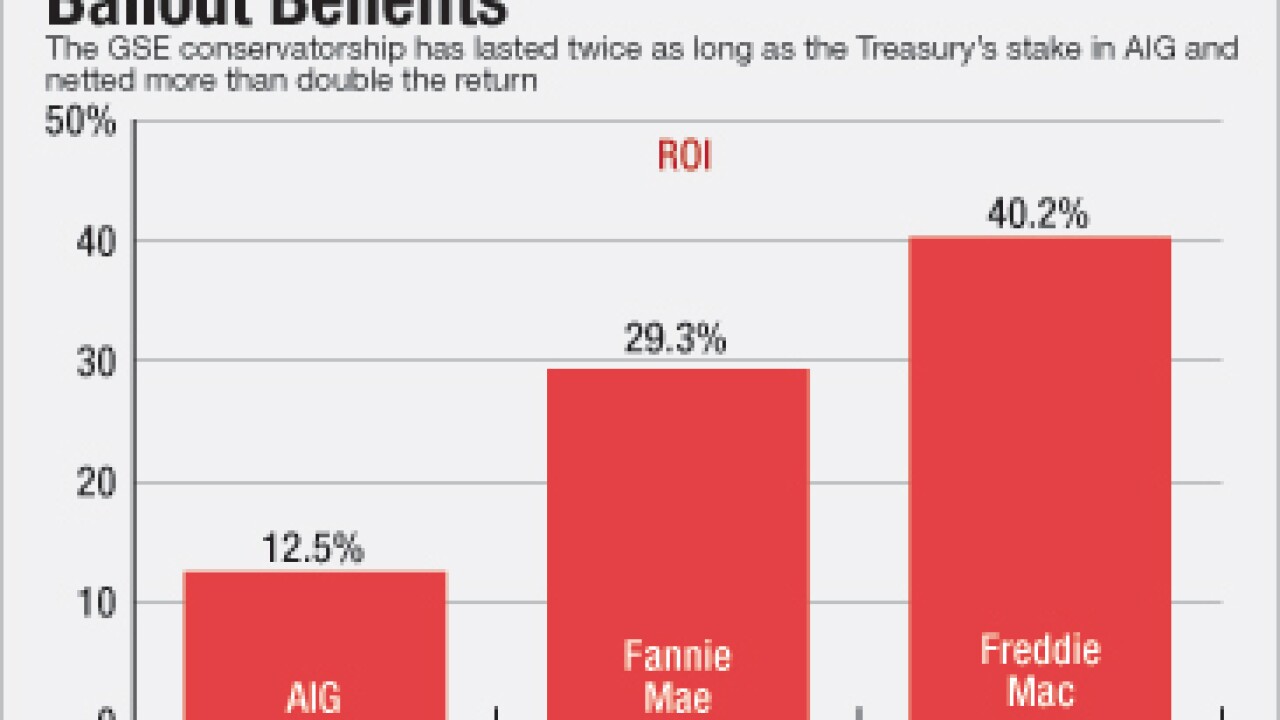

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Conforming mortgage rates are at their highest level this year after increasing 51 basis points since Election Day, according to Freddie Mac.

December 1