-

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

The Department of Housing and Urban Development is selling more due-and-payable HECMs on homes that are occupied while reviewing the loan program.

January 7 -

A shared client base helped lead to introduction of the new integration, with implementation scheduled to come later this year, the companies said.

January 7 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

A definitive move could occur as early as fiscal year 2026 or take until 2033, depending on what the government is willing to do, according to one analyst.

January 2 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26 -

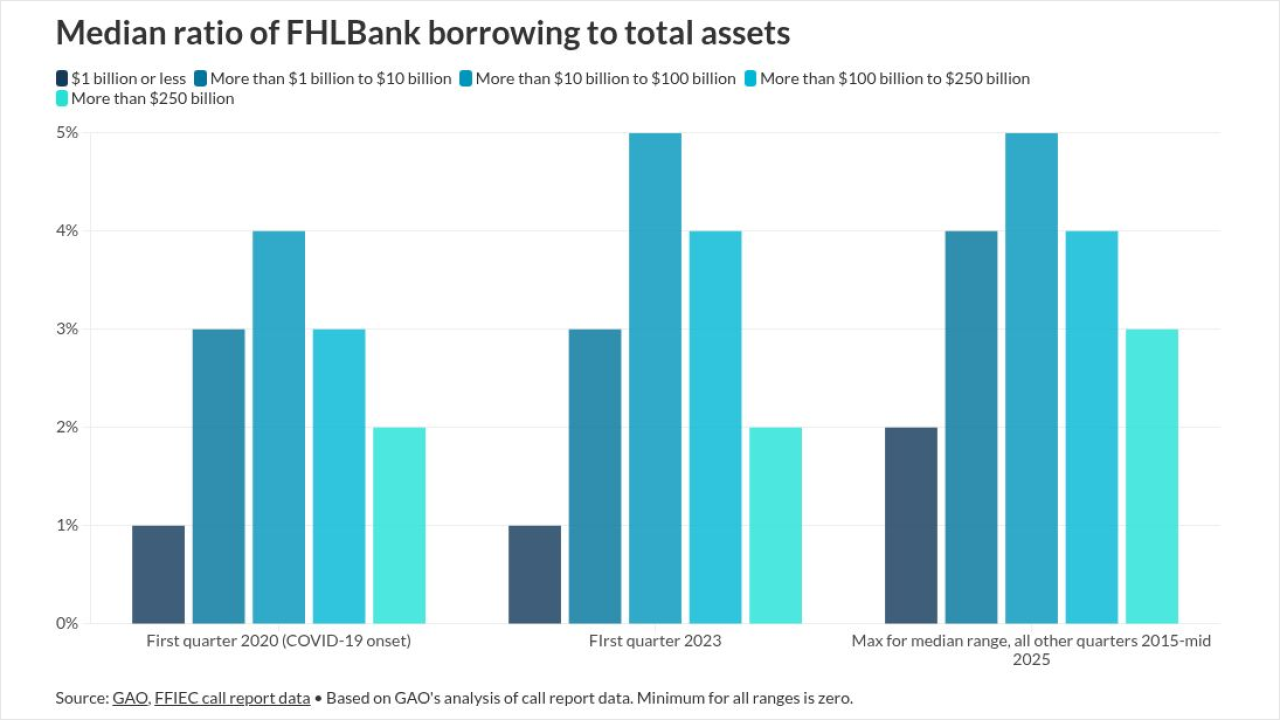

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

December 18 -

A coalition of mortgagees said the zombie seconds law negatively impacts 1.2 million junior liens statewide, despite just over 500 potential "zombie" loans.

December 18 -

Further mortgage payment reductions and other "aggressive" changes to federal policy impacting homeowners are on the roadmap for the coming year.

December 18 -

Bloomberg Intelligence puts odds on a release from conservatorship and issuing new shares. Its study estimates critical steps would take "months if not years."

December 18 -

The Treasury official renewed a pledge to avoid hurting how mortgages trade in a Fox Business News interview as a new study highlighted one way to do that.

December 17 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16