-

Total consumer debt in the United States hit $18.2 trillion by the end of last year, with $12.8 trillion attributed to first mortgages, according to Equifax.

February 25 -

Competitive credit could offer nine-figure cost benefits, according to a study VantageScore cited. FICO, which just added a new borrower tool, disagrees.

February 25 -

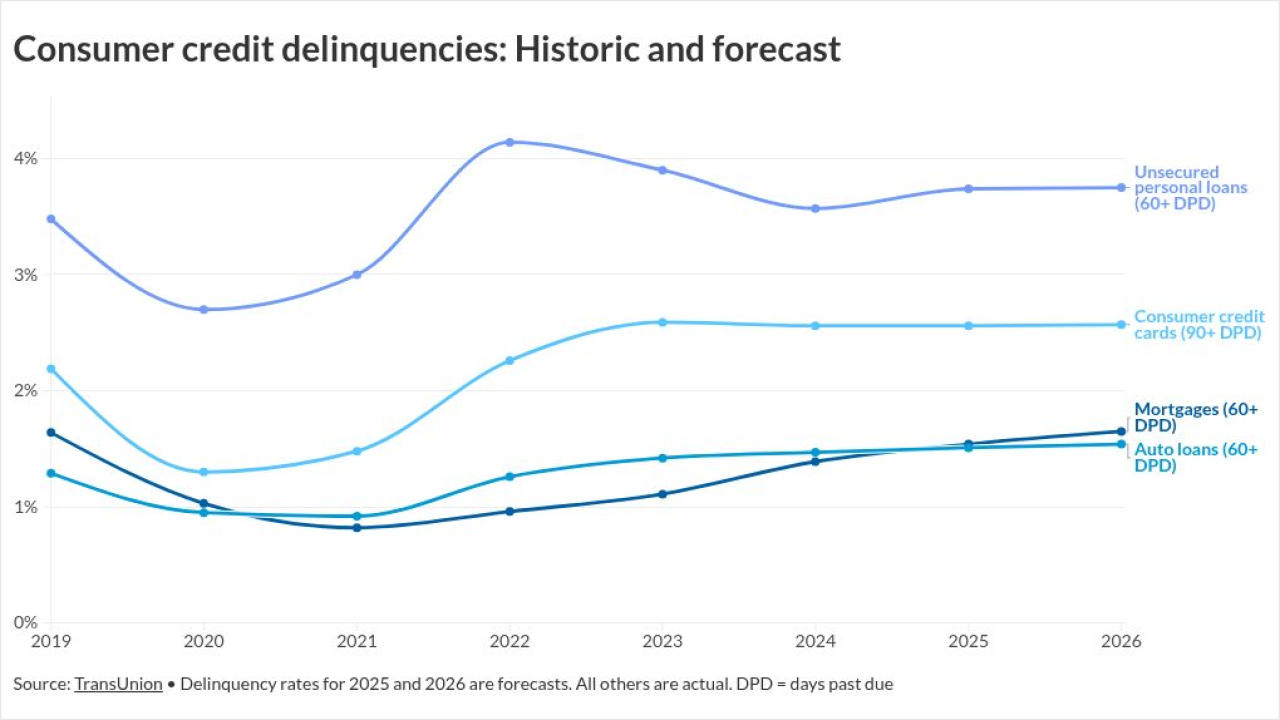

TransUnion projected moderate growth in 2026 for mortgages, projecting purchases and refinances to increase 4% and 4.2% year over year.

February 19 -

Mortgage tech's speed is undermined by flawed credit data, causing costly fallout. Lenders must treat data accuracy as a pipeline risk, not a peripheral issue, according to the founder of Consumer Attorneys

February 12 Consumer Attorneys PLLC

Consumer Attorneys PLLC -

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

The documents that the Housing Policy Council obtained from FHFA show past debate over one newer score and concerns about a single report with redacted context.

February 5 -

The National Consumer Law Center is claiming the Credit Data Industry Association wants to suppress Consumer Financial Protection Bureau complaint filings.

February 2 -

IMBs outperform banks, face outsized scrutiny, and confront rising affordability challenges, according to the President of the Community Home Lenders of America.

February 2 Developer’s Mortgage Co.

Developer’s Mortgage Co. -

Tri-merge mandates prop up a credit bureau/FICO oligopoly, raising mortgage costs with little benefit despite risk concerns, the chairman of Whalen Global Advisors argues.

January 22 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

A Community Home Lenders of America adds arguments against use of single bureau while another paper takes the position that the idea merits further study.

January 16 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

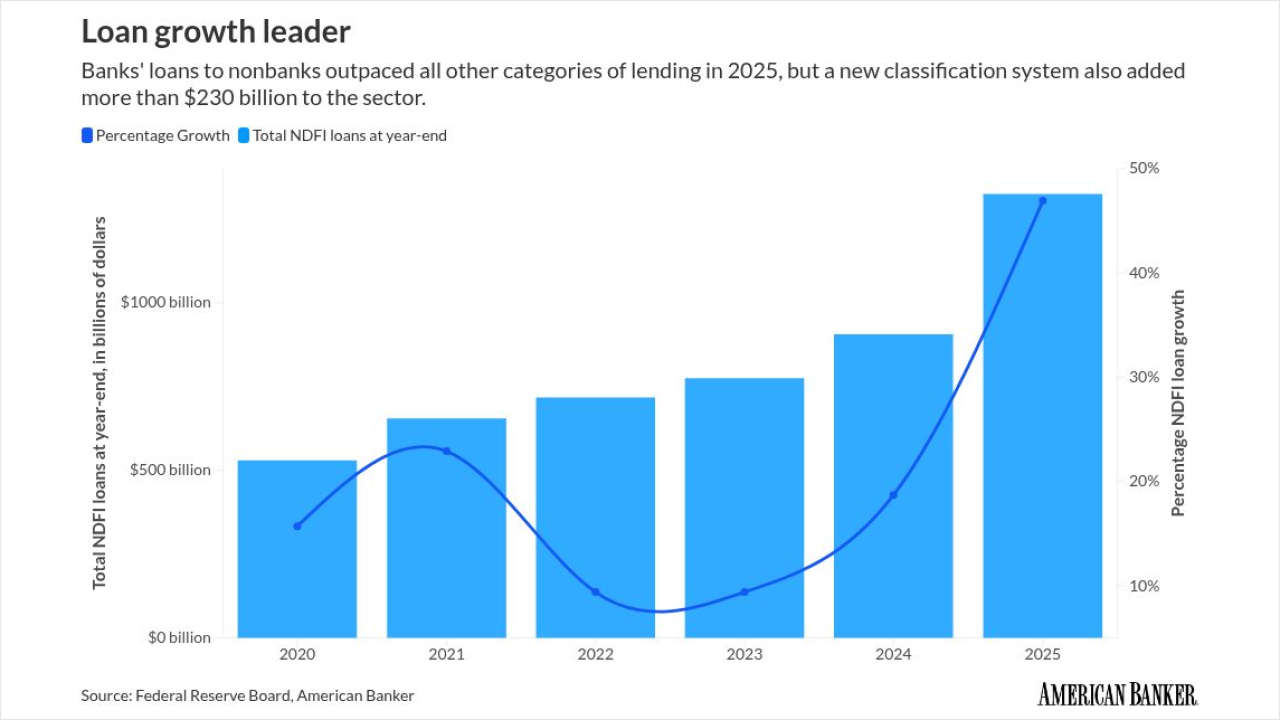

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

The trade group's letter to FHFA Director Bill Pulte pointed out that lenders were facing credit report price hikes for four straight years.

December 16 -

The rent reporting platform says it's helped tenants raise their credit scores by double digits and unlocked $30 billion more in mortgage lending.

December 11 -

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

Renters can now enroll in CreditClimb through Zillow to have their on-time rent payments reported to the three major credit bureaus.

November 21 -

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

The multi-year, $100 million agreement will allow users to take financial actions without leaving the ChatGPT app.

November 18