-

Wells Fargo & Co. surprised investors this week by withholding more than $90 million due to buyers of pre-crisis residential mortgage-backed securities.

June 30 -

It's the largest increase in five years; the percentage of securitized commercial mortgages behind on payments is now 5.75%, according to Trepp.

June 29 -

Angel Oak was able to secure triple-A credit ratings for its next offering of nonprime residential mortgage bonds, despite offering considerably less credit enhancement.

June 28 -

The Blackstone Group is tapping the commercial mortgage bond market to help finance the purchase of 11 multifamily properties from IMT Capital, according to Kroll Bond Rating Agency.

June 28 -

Lea Overby was formerly managing director, research; she replaces Charles Citro, who left the credit rating agency to pursue other opportunities.

June 28 -

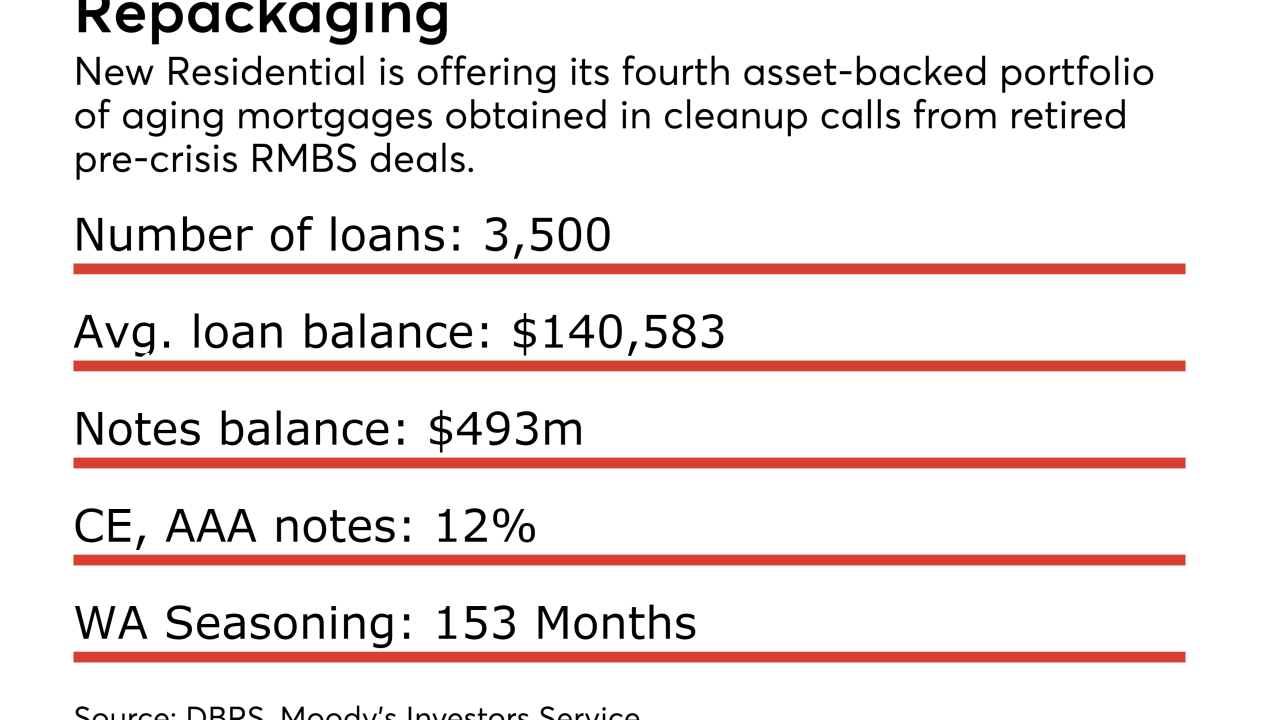

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

June 28 -

The NCUA is letting federal credit unions securitize and sell assets. Such transactions would free up capital at credit unions, allowing them to make more loans.

June 26 -

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21 -

Housing finance reform discussions are heating up and there's a growing sense that legislation can be enacted sooner rather than later. Here's why.

June 21 -

CLO managers who accept lower interest payments on loans risk running afoul of deal covenants; but if they take their money back, there are few attractive options for putting it back to work

June 20 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

Five Oaks Investment Corp. priced its follow-up 4 million common stock offering at $4.60 per share.

June 16 -

A former Nomura Holdings trader was found guilty of conspiring to lie to clients about mortgage-bond prices, while another was cleared of all charges in a verdict that highlights the challenge of policing fraud in the market.

June 15 -

The REIT obtained a $2.3 billion loan on the 50-story office and retail property from four banks; a $1.3 billion portion serves as collateral for BXP Trust 2017-GM.

June 15 -

Freddie Mac has priced its first credit-risk transfer securities backed in part by tax-exempt loans used to finance affordable multifamily rental properties.

June 15 -

The move follows mounting criticism that many homeowners using property assessments to finance energy efficiency upgrades can neither understand, nor afford, the terms of deals.

June 15 -

Federal Reserve officials forged ahead with an interest-rate increase and additional plans to tighten monetary policy despite growing concerns over weak inflation.

June 14 -

The $500 million commercial mortgage that serves as collateral was underwritten by Deutsche Bank and Citigroup; it allowed the building's owner, Alexander's, to cash out $187 million of equity.

June 13 -

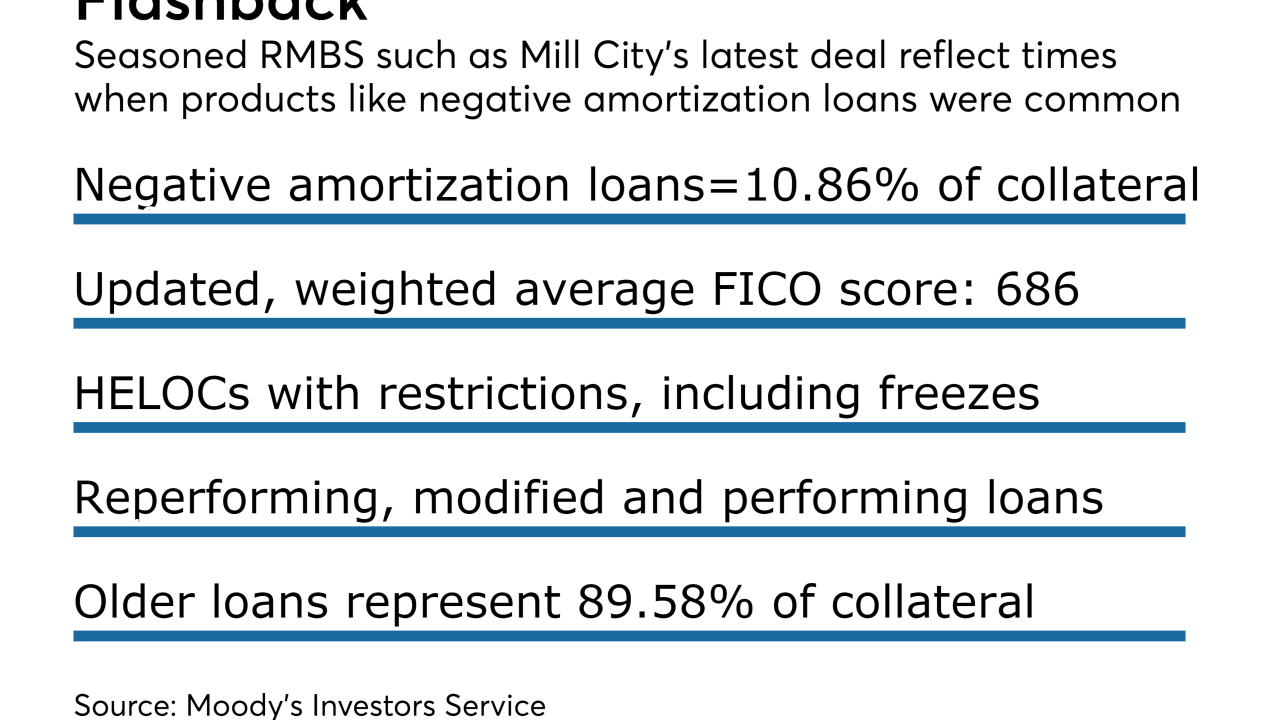

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

Federal Reserve officials surprised some onlookers by unveiling a rough plan for balance sheet runoff in the minutes for their May meeting.

June 12