-

A legislative proposal would expand Fannie Mae and Freddie Mac's use of specially-created debt securities to share their risk with private investors, but such risk transfer deals are not a replacement for core capital.

December 19

-

Deutsche Bank may reach a deal as early as Wednesday to settle allegations by the Department of Justice that it misled investors when selling mortgage-backed securities, Reuters reported.

December 19 -

Although Steven Mnuchin has close ties to Wall Street and was involved in some contentious deals, Democrats face an uphill battle making the case that those connections disqualify him to serve as Treasury secretary.

December 16 -

JPMorgan is returning to a familiar structure as it again pools large-market prime jumbo mortgages for investors in collateralized residential mortgage loans.

December 16 -

The Federal Open Market Committee agreed unanimously Wednesday to raise the federal funds rate by 25 basis points, a move that was widely anticipated by markets. The committee's expectations for interest rates in 2017, however, were more varied.

December 14 -

Credit Suisse Group must face New York Attorney General Eric Schneiderman's $10 billion lawsuit accusing the bank of fraud in the sale of mortgage-backed securities prior to the 2008 financial crisis, a state appeals court ruled Tuesday in a split decision.

December 14 -

Interest rates may climb to 3% on 10-year Treasuries by next year as deficits and inflation rise under a Donald Trump presidency and that would hurt the housing market, said Jeffrey Gundlach, chief investment officer of DoubleLine Capital.

December 14 -

Stanford Kurland will step down from his role as CEO of PennyMac Financial Services and its affiliate PennyMac Mortgage Investment Trust and assume the role of executive chairman of both as part of a broader executive reorganization.

December 13 -

SoFi Lending Corp.'s securitization of its student loan refis for high net worth individuals is now a model for its recent expansion into super prime jumbo mortgages.

December 13 -

A group of traders in JPMorgan's investment bank has expanded from selling commercial mortgage-backed securities to underwriting loans that are unsuitable for bonds, such as those for big construction projects.

December 12 -

A former Cantor Fitzgerald & Co. trader was charged with defrauding customers by lying about prices of mortgage-backed securities, becoming the latest target of a U.S. crackdown on deceptive practices in the bond market.

December 12 -

One of latest proposals for reviving the private-label residential mortgage market involves improving communications between issuers and investors.

December 9 -

The Mortgage Industry Standards Maintenance Organization is proposing a standard for the maintenance and sharing of commercial and multifamily real estate rent-roll information.

December 9 -

A bipartisan duo of House lawmakers introduced a bill Thursday that would push Fannie Mae and Freddie Mac to engage in more credit risk-sharing transactions.

December 8 -

Development on the Common Securitization Platform has reached a point where Fannie Mae and Freddie Mac may be able to issue a uniform mortgage-backed security sometime in 2018, the Federal Housing Finance Agency said Thursday.

December 8 -

Some mortgage bond traders tangled up in investigations are moving into the shadow banking system, where their new employers have greater latitude to hire people with blemishes on their records.

December 7 -

Fannie Mae joined Freddie Mac in announcing plans to delist some previously issued Connecticut Avenue Securities, which transfer the credit risk on residential mortgages, from the Irish Stock Exchange.

December 7 -

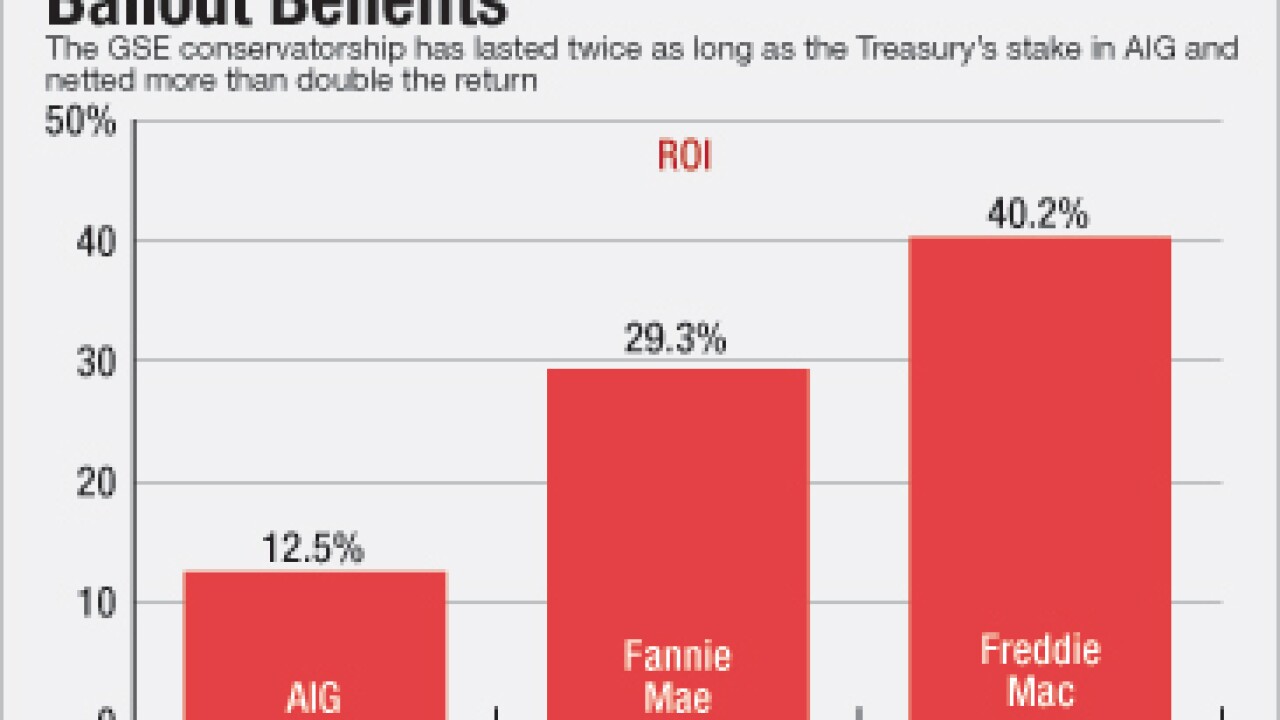

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Treasury Secretary-designate Steven Mnuchin's plan to remove Fannie Mae and Freddie Mac from government control could mean increased competition for lenders' loans. But it could also prompt a rise in mortgage rates.

November 30 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30