-

The security that was incorporated into the index is backed exclusively by loans on green building certified properties; the GSE is still working on acceptance of financing for green upgrades.

March 15 -

A mortgage program created by a 2015 partnership between the Federal Home Loan Bank of Chicago and Ginnie Mae has securitized over $1 billion in government-backed mortgages, the partnership announced.

March 14 -

Commercial banks typically compete with CMBS, but this Delaware state chartered bank is securitizing 30 floating-rate loans secured by 35 apartment complexes, retail and office buildings.

March 12 -

With the exception of the troubled retail sector, delinquency rates across property types supporting commercial mortgage-backed securities were flat to declining in February compared with January.

March 12 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

Over 40% of the collateral is from two 2016-vintage transactions that were recently "collapsed" because proceeds from liquidations had slowed. Then there's the exposure to Puerto Rico.

March 9 -

Tight margins, regulatory clarity and a renewed appetite to expand have made mortgage brokers and the wholesale channel attractive again, at least to the small and medium mortgage lenders.

March 8 -

The success of the government-sponsored enterprises' credit risk transfer programs shows that they can be the basis for housing finance reform.

March 7 -

Royal Bank of Scotland Group has agreed to pay $500 million to the state of New York after a $5.5B agreement last year with the FHA, and another probe is pending.

March 6 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

The $446 million Pearl Street Mortgage Company 2018-1 Trust is backed by 30-year, fixed-rate loans with credit characteristics in line with recent private-label prime jumbo transactions rated by Fitch Ratings.

March 5 -

Growing competition may prompt commercial mortgage-backed securities issuers to accept higher loan-to-value ratios in their deals.

March 5 -

LendingClub, Marlette and others are looking at additional changes to both their securitization and whole-loan-sale programs that could further broaden their investor bases.

March 1 -

Participants at the Structured Finance Industry Group conference in Las Vegas say that future deals could be linked to the performance of jumbo, as well as conforming loans.

February 28 -

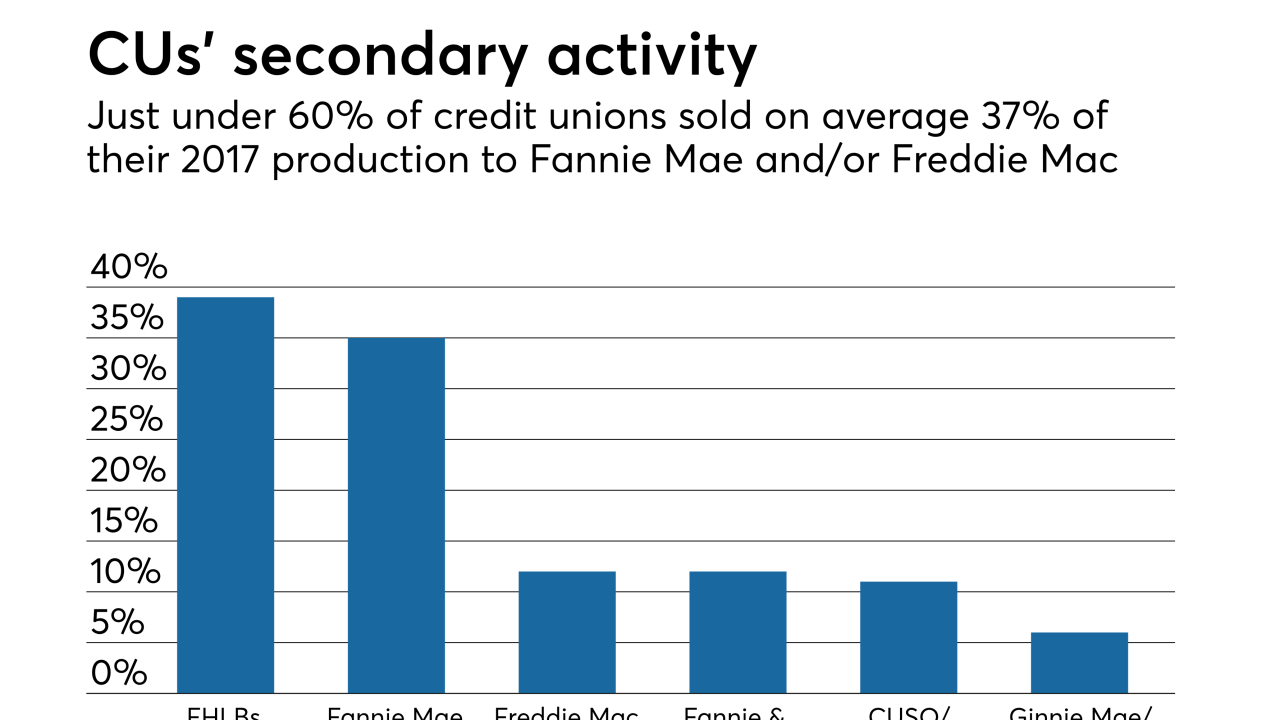

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

Financial services groups are calling for more funding for the Internal Revenue Service that could fix flaws in the agency's system for verifying the income of mortgage applicants.

February 22 -

Lender and servicers are increasingly using nontraditional methods such as "hybrid" appraisals and broker price opinions in an attempt to cut costs, but some are more reliable than others.

February 21 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

Almost two years after settling mortgage securitization allegations with the Department of Justice and a group of states, Goldman Sachs has fulfilled more than half of its consumer relief commitment.

February 16 -

With few foreclosed homes left to pick up on the cheap, the biggest landlords are buying, or building, new single-family homes to pad their portfolios; mortgages on these properties could show up as collateral in rental bonds.

February 14