-

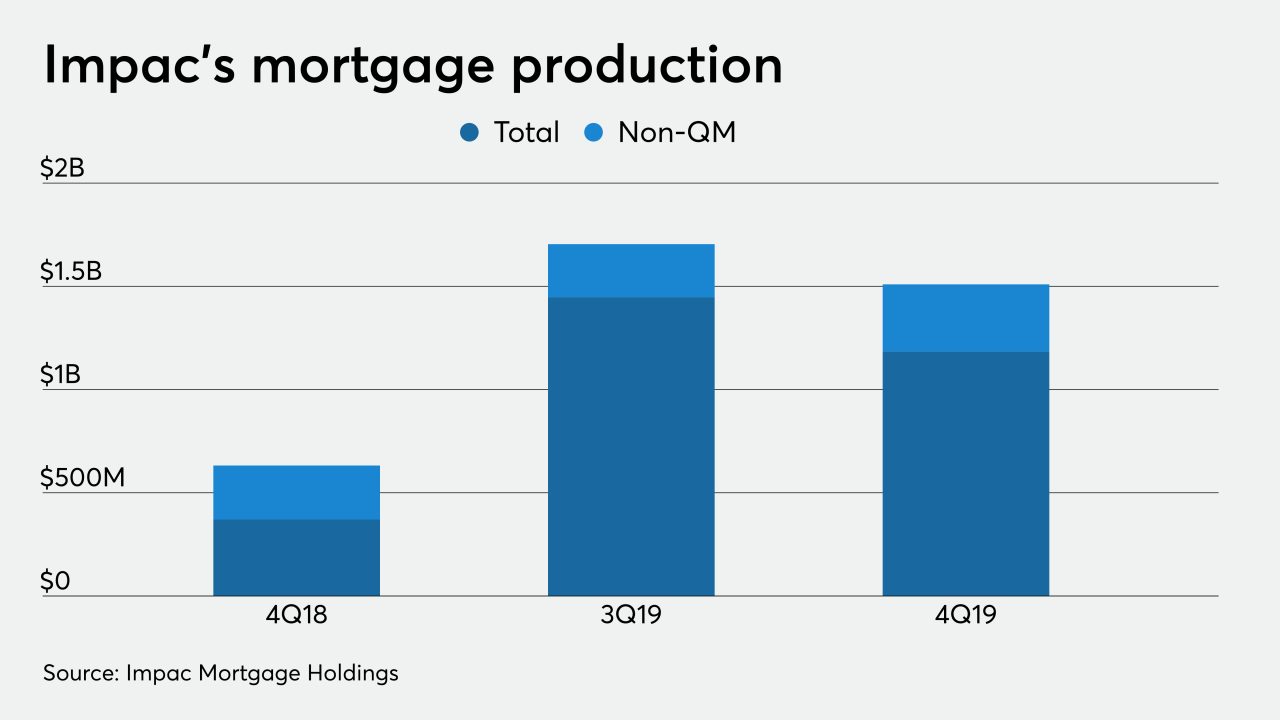

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13 -

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

March 12 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9 -

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

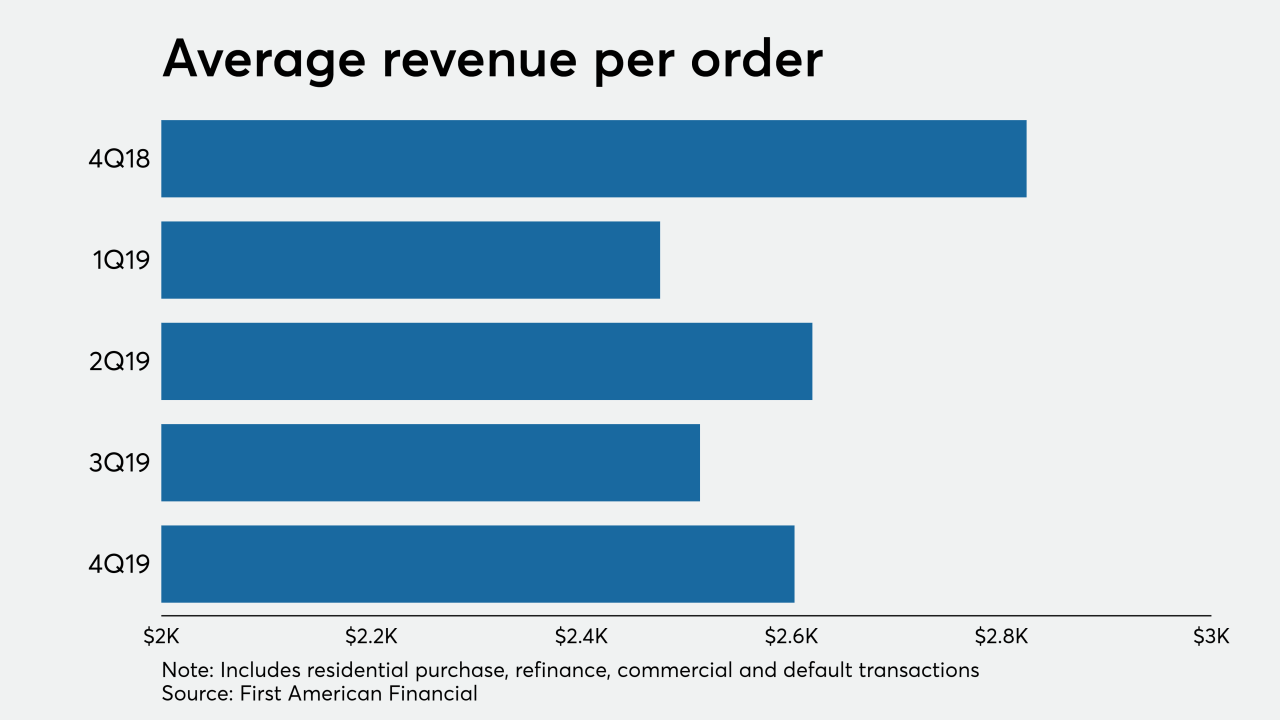

CoreLogic's fourth-quarter earnings reflect the success of the transformation to an appraisal management company business model accelerated in the prior-year period.

February 27 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

February 25 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12 -

Ocwen Financial Corp. is on track to become profitable on a pretax basis by the third quarter without any special items enhancing earnings, according to a preliminary release of its fourth-quarter results.

February 7 -

The strong refinance market in the fourth quarter propelled earnings at three different mortgage-related business that also were dealing with merger and acquisition activity during and after the period.

February 6 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

A booming housing market coupled with low interest rates helped M/I Homes report record results for 2019.

February 5 -

Mortgage refinancings made up slightly under one-third of MGIC Investment Corp.'s new insurance written during the fourth quarter, contributing a significant percentage of its business.

February 4 -

A 10-basis-point year-over-year increase in gross margin on loans sold, along with a nearly 30% increase in origination volume, helped Waterstone Mortgage turn around its fourth-quarter results.

January 31 -

Flasgstar Bancorp's mixed results in its fourth-quarter earnings report are a sign strategic shifts it made to make its earnings less volatile are working.

January 28 -

Bank of America's fourth-quarter mortgage origination volume more than doubled on a year-over-year basis, a faster pace of growth than two of its national banking peers.

January 15 -

Fourth quarter gain on sale margin moved in opposite directions at two of the nation's largest banks, falling 9% quarter-over-quarter at JPMorgan Chase, but increasing 25% at Wells Fargo.

January 14 -

The U.S. Supreme Court may soon decide if it will intervene in a high-stakes fight over the government-sponsored enterprise net worth sweep.

January 10